100 Million TRX Leaves Binance — Justin Sun Behind The Move

Alex Smith

2 weeks ago

According to on-chain monitors, a wallet linked to TRON founder Justin Sun pulled 100 million TRX from Binance on December 3, 2025. Reports say the same address also moved $5 million USDT around the same time. These large transfers were flagged publicly by Onchain Lens and picked up by multiple crypto news outlets.

Transaction Values And Timing

Onchain tracking shows the 100 million TRX was worth close to $28 million at the time of the move. The USDT transfer of $5 million happened within a minute of the TRX withdrawal, which has led observers to call the action coordinated rather than routine.

Based on reports, the close timing and mixed asset types — token plus stablecoin — drew extra attention from traders and on-chain sleuths.

Data also shows the Justin Sun-linked wallet now holds a much larger TRX balance than just this single transfer. Tracking services report the address sits at about 492 million TRX, a holding with a notional value near $138 million based on market rates at the time. That swelling balance has prompted talk that accumulation of TRX has been steady in recent days.

A wallet linked to Justin Sun (@justinsuntron) withdrew 100M $TRX worth $27.96M from #Binance and also withdrew $5M $USDT.https://t.co/4d2utqwsv0 pic.twitter.com/k40pMUj15d

— Onchain Lens (@OnchainLens) December 3, 2025

Market Reaction And Liquidity

Initial market moves were muted. Some exchange data and commentaries noted a mild uptick in TRX price after the news, suggesting traders saw the outflow as removing sell pressure from exchange order books.

Analysts who track exchange liquidity say large withdrawals like this can shrink available sell-side supply and can support price stability if demand holds. Still, any clear price trend will depend on what happens next with the withdrawn tokens.

No Official Word YetThere has been no public statement from Justin Sun or TRON explaining the transfers. Without confirmation, motives remain speculative. Observers are weighing a few common possibilities: long-term cold storage, staking or protocol use, or internal treasury moves. All of those ideas are possible, but none are confirmed by the team.

What Could Happen NextIf the tokens stay offline, some traders may view the move as bullish since it cuts the floating supply held on big exchanges. If the funds are later sold or used to provide liquidity, the effect could swing the other way.

Reports point out that similar moves by major holders have sometimes been followed by quiet accumulation and other times by large transfers into trading venues — timing and intent matter.

Featured image from Unsplash, chart from TradingView

Related Articles

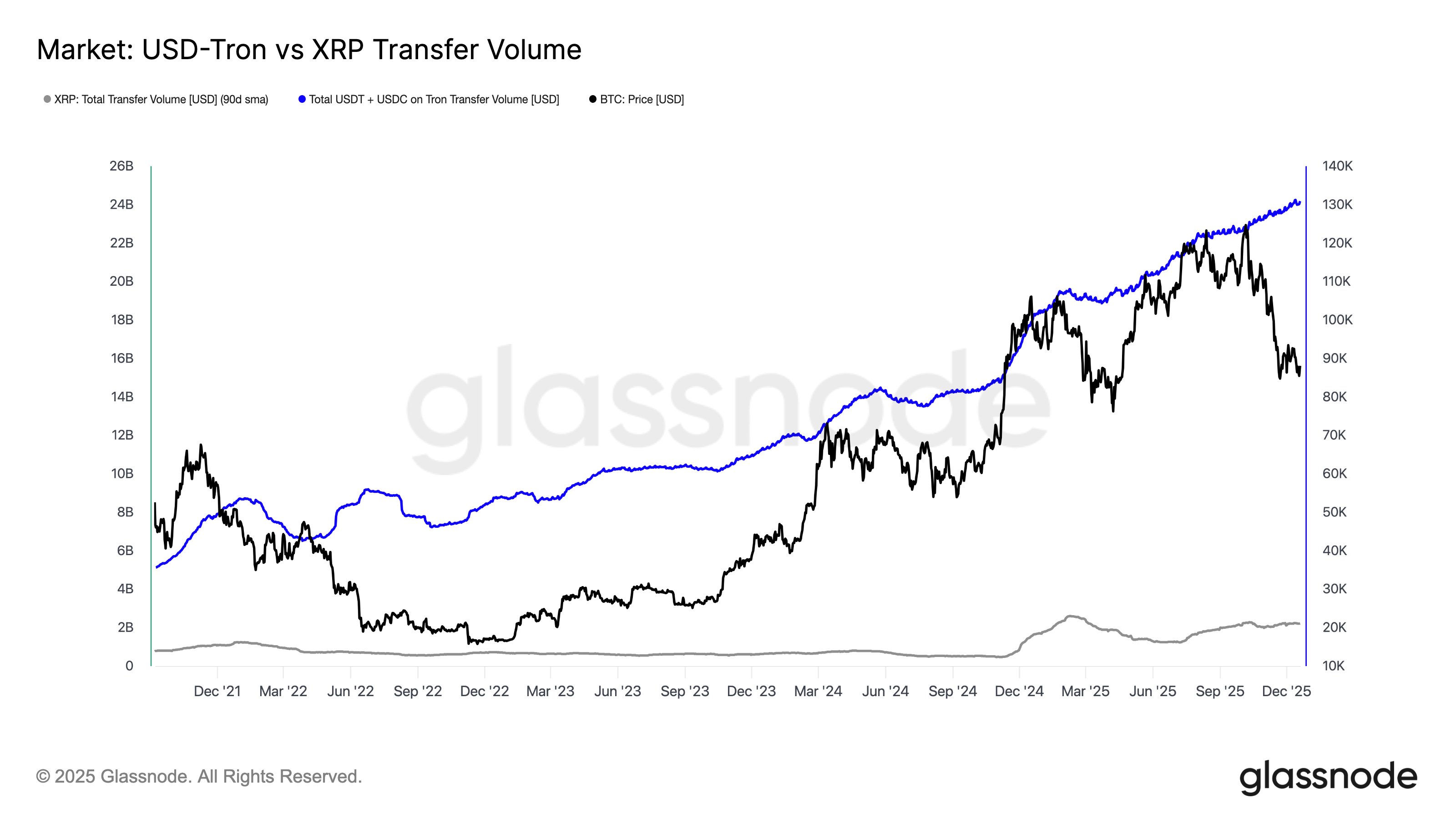

Tron Stablecoin Volume Exceeds XRP Activity By More Than 10 Times: Data

Data shows the transaction volume of USDT and USDC on Tron is now more than 10 t...

Bitcoin Futures Structure Favors Bulls as Short Liquidations Accelerate

Bitcoin is once again attempting to reclaim the $90,000 level, as bulls cautious...

Bitcoin’s Post-Quantum Shift Could Take A Decade, Crypto Exec Says

According to reports, a new round of debate over quantum computers and Bitcoin h...

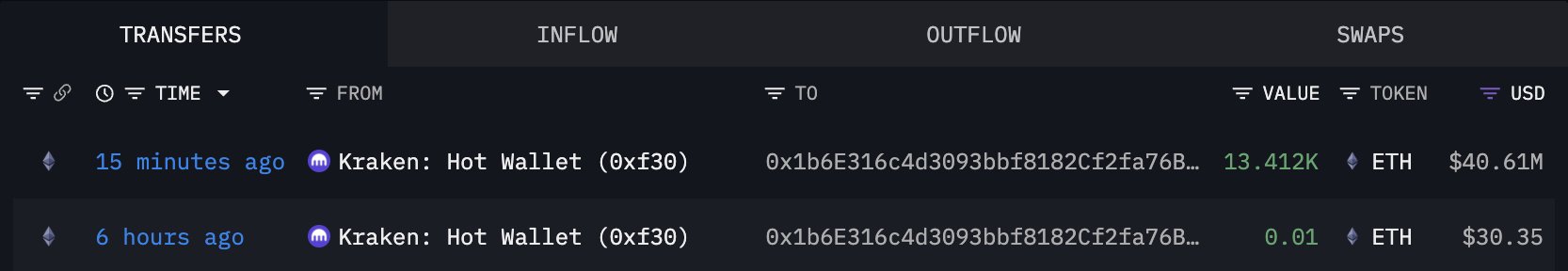

BitMine Doubles Down on Ethereum With $40M Accumulation

Ethereum is currently trading above the $3,000 level, offering a surface-level s...