Bitcoin Long-Term Holders Stay Resilient, But Profits Haven’t Fully Arrived – Here’s What To Know

Alex Smith

8 hours ago

Despite several attempts at an upward move, the price of Bitcoin has continued to fluctuate below the $90,000 pivotal level over the past week. With the ongoing bearish price performance extending, a significant portion of long-term BTC investors have yet to witness a profit condition that would be considered truly compelling.

Long-Term Bitcoin Holders Still Waiting for Stronger Gains

Bitcoin’s waning price action appears to be testing the resolve of long-term BTC holders, who are usually classified as the market’s most patient and conviction-driven investors. CW, a market expert and data analyst, reports that these key investors are still struggling to record substantial profits from their positions, which is likely to affect supply dynamics and mold on-chain behavior.

The lingering profit gap indicates that conviction among long-term investors remains strong, but the next decisive stage is still to come. Long-term BTC holders failing to see satisfactory profit yet is due to the flagship asset’s price being confined beneath the $100,000 price mark after falling from its all-time high. Such a situation raises significant concerns about whether the market has already reached a mature bullish phase or if a more crucial surge is still required to reward those who have persevered over several cycles.

According to the data analyst, the cohort still holds a whopping 13.6 million BTC valued at a jaw-dropping $1.2 trillion at the current price of the asset. CW stated that the current holding level of the group is comparable to the maximum holding level from the last Bitcoin market cycle.

These investors may be resilient during bearish price action, but a rebound will flip their behavior. CW noted that the cohort will transfer their holdings to short-term BTC holders when the asset shifts toward an upside direction again.

During such a scenario, the analyst claims that the peak of the ongoing market cycle will probably coincide with the peak of greed. Looking at the chart from CW, it seems like there has not been a real rally in this cycle.

On-Chain Activity Slows Down, Creating A Calm Situation

Presently, the Bitcoin market has entered a critical phase as the BTC Cumulative Volume Delta (CVD) Indicator reveals a calm situation. BTC’s CVD indicator is a key metric that measures the aggressive purchasing versus selling pressure, which currently tells that neither side is dominating.

This calm situation is mainly driven by BTC whale investors or large holders, who are taking a break. The flatlining CVD indicator points to a period of consolidation during which liquidity is stabilizing, traders are pulling back, and the next big move is subtly developing beneath the surface.

BTC’s price is likely to continue its downward trend unless the activity of the cohort shifts, because only when they start moving again will something happen. In the meantime, CW highlighted that a selling wall is forming at the $94,000 price mark, which also represents the next crucial resistance level.

Related Articles

Bitcoin’s Post-Quantum Shift Could Take A Decade, Crypto Exec Says

According to reports, a new round of debate over quantum computers and Bitcoin h...

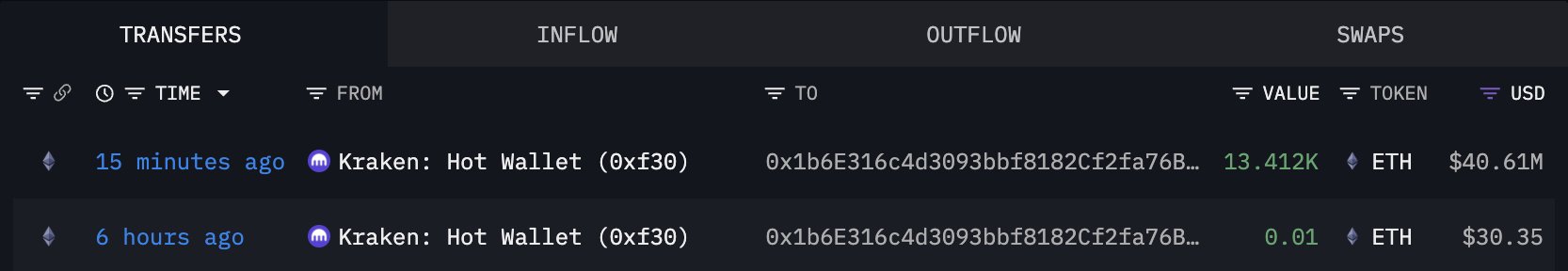

BitMine Doubles Down on Ethereum With $40M Accumulation

Ethereum is currently trading above the $3,000 level, offering a surface-level s...

Crypto Theft Hides In Plain Sight Inside Popular Game Mods—Kaspersky

Kaspersky has warned that a new infostealer called “Stealka” is bein...

Here’s Why The XRP Price Will Shine In The New Year

XRP has spent the past few weeks on a downtrend after a bullish cycle earlier in...