Bitcoin Miners Face A Harsh December: Rising BTC Difficulty, Falling Hashprice

Alex Smith

3 weeks ago

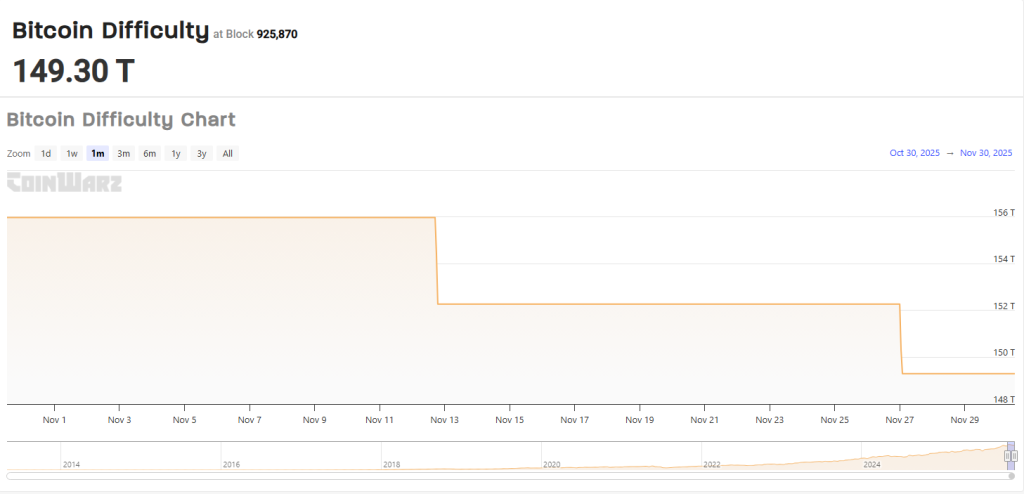

According to CoinWarz, the next difficulty adjustment is expected at block 927,360, moving the target from 149 trillion to close to 150 trillion. That is a modest rise, but it matters because Bitcoin miners are already working with very thin margins. Hashpower is strong enough to push difficulty up even while returns stay near record lows.

Hashprice Sits Near Break-Even

Hashrate Index data shows hashprice is hovering around $38.3 PH/s per day, a touch up from a recent trough below $35 PH/s on November 21. Reports indicate that $40 PH/s is roughly the break-even level for many operations.

When revenue per petahash drifts under that mark, some miners face a hard choice as they usher in December: switch off rigs or keep paying to mine. Average block times have been close to the 10-minute goal, with the network recently averaging about 9.97 minutes, which helped trigger the most recent adjustment that dropped difficulty from 152.2 trillion to 149.3 trillion.

Hardware, Politics And Supply Risks

Reports have disclosed a US Department of Homeland Security probe into Bitmain, the China-based ASIC maker, over concerns its machines could be accessed remotely. Bitmain is reported to control about 80% of the ASIC market, according to the University of Cambridge.

That market concentration leaves the industry vulnerable. If US officials impose restrictions, tariffs, or other limits, miners could face higher hardware costs and slower deliveries. Some equipment orders might be delayed or rerouted, and expansion plans would be tested.

China Unlikely To End Bitcoin Mining Ban Despite UptickMeanwhile, overseas, a mild uptick in China’s bitcoin mining has led some scholars to urge Beijing to relax its ban so miners can use excess energy, but experts say a formal reversal is unlikely.

According to Hashrate Index, China’s share of global hash rate rose from 13.75% in Q1 2025 to 14% in the current quarter, placing it third behind the US and Russia.

Historical data from the Cambridge index shows China’s hash rate fell to zero in July 2021 before unofficial activity pushed it back to 22.29% by September 2021; Cambridge stopped updating its mining map in February 2022.

Beijing has tightened rules on crypto in recent years, arguing such activity disrupts financial order and can enable illegal behavior. Experts believe those political and policy concerns make an official lift of the mining ban unlikely, despite the recent rise in activity.

Featured image from Getty Images, chart from TradingView

Related Articles

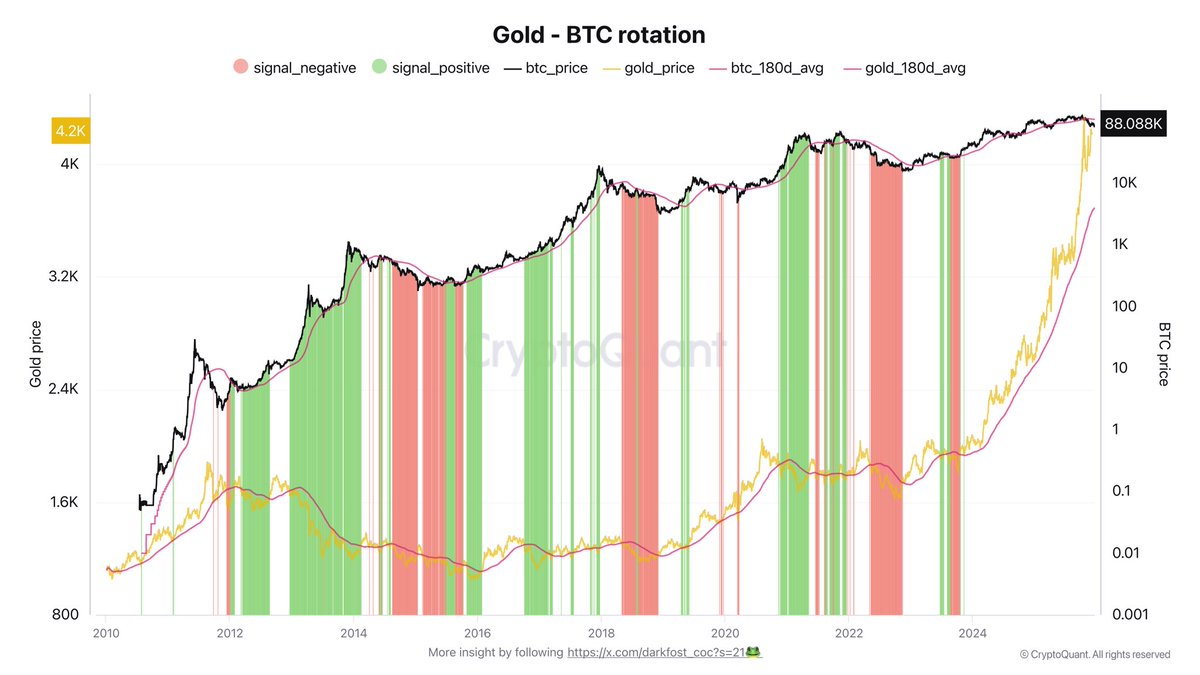

The Gold-to-Bitcoin Rotation Narrative Gains Strength: A Data-Driven Review

Bitcoin is once again attempting to reclaim the $90,000 level, but price action...

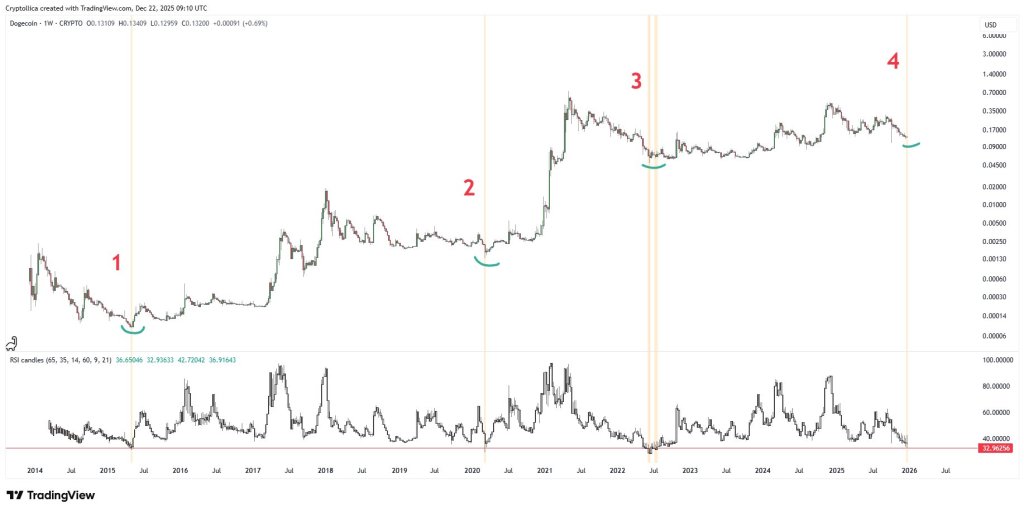

Dogecoin Reclaiming $0.128 Support Could Signal The Perfect Chance For Long Positions

Dogecoin (DOGE) is trading above a price level that could determine whether its...

Ethereum Market Structure Strengthens: Binance Netflows Point to Long-Term Conviction

Ethereum is attempting to reclaim the $3,000 level after showing pockets of bull...

Dogecoin Weekly Fractal Hints At A Bigger Move Brewing

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting...