Bitcoin Price Slides From Peak Levels—Is a Bigger Correction on Deck?

Alex Smith

1 week ago

Bitcoin price failed to continue higher above $94,000. BTC is now gaining bearish pace and might decline further below $89,500.

- Bitcoin started a downside correction from the $94,500 zone.

- The price is trading below $92,000 and the 100 hourly Simple moving average.

- There was a break below a bullish trend line with support at $91,600 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair might continue to move down if it settles below the $89,500 zone.

Bitcoin Price Dips Again

Bitcoin price failed to gain strength for a move above the $94,000 and $94,500 levels. BTC started a downside correction and traded below the $92,000 support.

There was a clear move below the 50% Fib retracement level of the upward move from the $87,777 swing low to the $94,583 high. Besides, there was a break below a bullish trend line with support at $91,600 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading below $91,200 and the 100 hourly Simple moving average. The price is now approaching the $89,500 support, and the 76.4% Fib retracement level of the upward move from the $87,777 swing low to the $94,583 high.

If the bulls remain in action, the price could attempt another increase. Immediate resistance is near the $91,200 level. The first key resistance is near the $91,500 level. The next resistance could be $92,000. A close above the $92,000 resistance might send the price further higher. In the stated case, the price could rise and test the $92,850 resistance. Any more gains might send the price toward the $93,500 level. The next barrier for the bulls could be $94,000 and $94,500.

More Losses In BTC?

If Bitcoin fails to rise above the $92,000 resistance zone, it could start another decline. Immediate support is near the $89,500 level. The first major support is near the $88,800 level.

The next support is now near the $87,750 zone. Any more losses might send the price toward the $86,500 support in the near term. The main support sits at $85,000, below which BTC might accelerate lower in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $89,500, followed by $88,800.

Major Resistance Levels – $91,200 and $92,000.

Related Articles

Ethereum Market Structure Strengthens: Binance Netflows Point to Long-Term Conviction

Ethereum is attempting to reclaim the $3,000 level after showing pockets of bull...

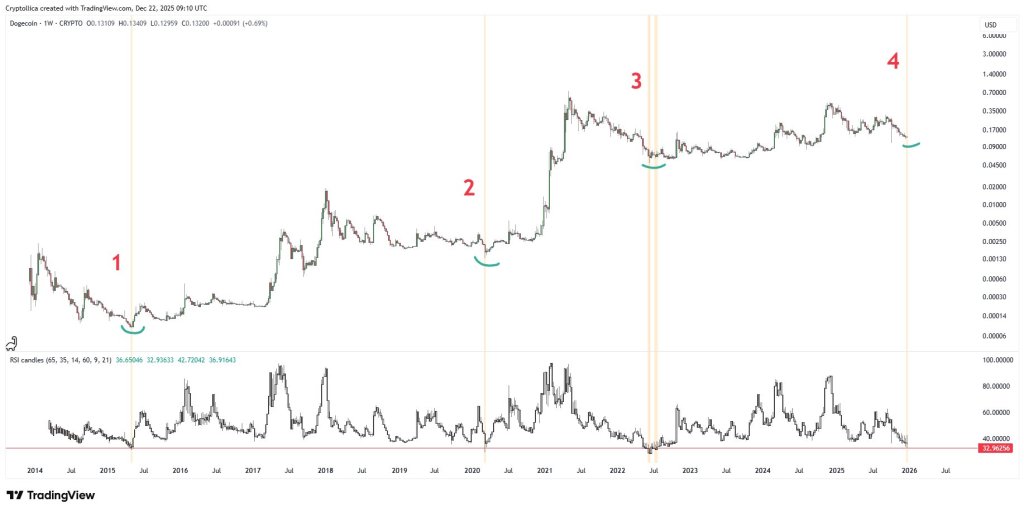

Dogecoin Weekly Fractal Hints At A Bigger Move Brewing

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting...

Bitcoin Price Remains Stuck Inside This Range, But A Breakout Could Follow

Bitcoin’s price action in recent days has been characterized by tight consolidat...

Saylor Sparks Bitcoin Speculation With ‘Green Dots’ Signal

Michael Saylor’s brief post on X that showed “green dots” ahead of orange dots h...