Bitcoin Shark Accumulation Overstated: Glassnode Researcher Debunks Narrative

Alex Smith

3 days ago

Senior researcher at on-chain analytics firm Glassnode has explained how the recent Bitcoin shark “accumulation” is not a sign of organic buying.

Bitcoin Shark-Sized Entities Have Been Growing Recently

In a new post on X, Glassnode senior researcher CryptoVizArt.₿ has talked about the recent growth in the supply attached to the Bitcoin sharks. “Sharks” are defined as the entities carrying between 100 and 1,000 BTC.

At the current exchange rate, the range of this cohort converts to $8.7 million at the lower end and $87 million at the upper one. Due to the significant size involved, sharks are considered as a investor group, although they are less influential than the whales (1,000+ BTC).

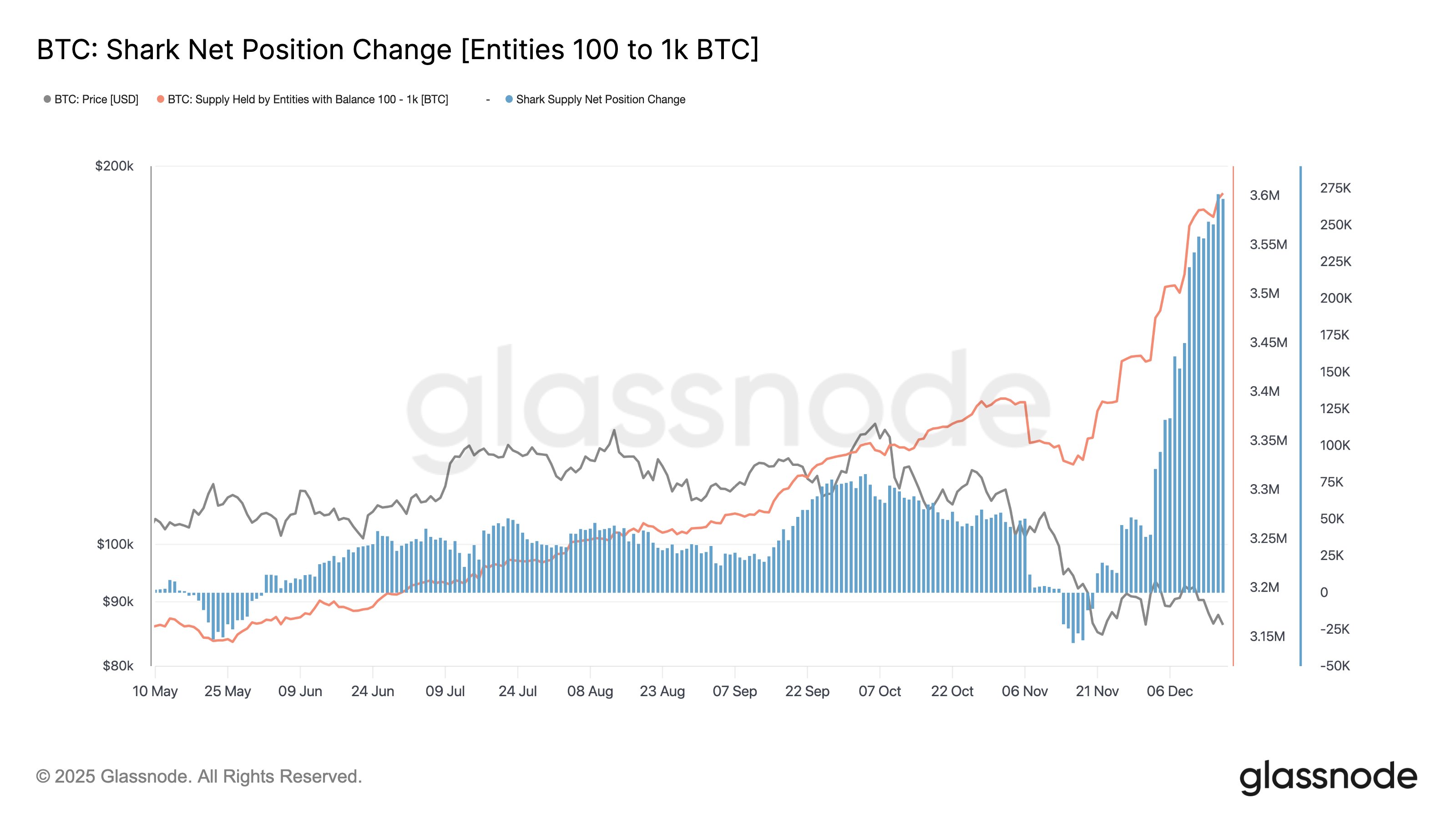

Lately, the supply of the sharks has been following a rapid upward trajectory, as the chart shared by CryptoVizArt.₿ shows.

Since November 16th, the Bitcoin sharks have seen their combined balance change from 3.33 million BTC to 3.60 million BTC, reflecting a significant rise of 270,000 tokens. “The key question, however, is whether this reflects genuine net accumulation, or merely internal reshuffling across cohorts, a distinction only deeper on-chain analysis can resolve,” said the Glassnode researcher.

By “reshuffling,” CryptoVizArt.₿ is referring to the merging or splitting of holdings that investors sometimes take part in. For example, a whale deciding to break their balance across multiple wallets can register as a decrease in the whale supply, and an increase in the supply of whatever bracket the smaller holdings fall inside.

Signs point to something similar being a factor behind the recent Bitcoin shark supply increase. Below is another chart shared by the analyst, this one comparing the trend in the supply of the 100,000+ BTC entities against that of the sharks.

The 100,000+ BTC cohort corresponds to the largest of entities on the blockchain, including exchanges, exchange-traded funds (ETFs), and custodial services. From the graph, it’s apparent that the holdings of this group have been declining recently.

Interestingly, the amount distributed by the cohort in this drawdown is 300,000 BTC, which is roughly equal to that accumulated by the sharks (270,000 BTC). “This pattern strongly points to wallet reshuffling, not organic accumulation,” noted CryptoVizArt.₿.

Since the 100,000+ BTC bracket also includes exchanges, reshuffling out of these platforms (that is, withdrawals) can still point toward positive accumulation. It turns out, however, that the nature of the reshuffling is truly likely to be internal, as Coinbase made internal wallet transfers amounting to a massive 640,000 BTC alongside this trend.

Based on the data, the analyst has concluded:

The key takeaway is that >90% of the apparent “shark accumulation” is likely driven by internal reshuffling by large custodial entities, rather than net buying by new 100–1K BTC holders.

BTC Price

At the time of writing, Bitcoin is floating around $87,300, down over 3% in the last seven days.

Related Articles

Bitcoin Is Entering A Window For A Santa Rally, Analyst Says

Bitcoin might be stumbling into a very seasonal setup, not because Santa is real...

This Double Bottom Formation Could Send XRP Soaring To $2.5

XRP may be setting up for a major breakout as technical indicators flash a famil...

Ripple Vs. SEC Lawsuit: What XRP Investors Should Know As The Year Draws To An End

As the year draws to a rapid close, the lawsuit between Ripple Labs and the Unit...

Bitcoin Long-Term Holders Stay Resilient, But Profits Haven’t Fully Arrived – Here’s What To Know

Despite several attempts at an upward move, the price of Bitcoin has continued t...