Breakdown Or Bear Trap? BNB Loses Trendline But Flashes Strong Rebound Signals

Alex Smith

4 days ago

BNB has slipped below its long-standing bullish trendline, raising fresh concerns about a deeper pullback. However, the selloff is unfolding right into a key support zone, where multiple technical signals hint that buyers may be preparing for a counter-move. With breakdown risk clashing against early rebound signs, BNB now sits at a pivotal moment that could define the next major move.

Bullish Trendline Break Signals A Change In BNB Market Character

According to crypto analyst Marcus Corvinus, BNB has just experienced a significant structural shift by losing its long-held bullish trendline. This technical break is a critical development that is rapidly changing the market mood from optimism to caution, as a primary support trendline has been invalidated.

The analyst noted that while the price had been respecting this upward trend for a considerable period, this decisive break indicates that buyers are finally losing control. Momentum is visibly cooling off, providing sellers with the necessary opening to press and take command of the short-term price action.

Corvinus warned that if the price fails to reclaim the broken trendline, the path will likely open for a much deeper move to the downside. He emphasized that this current behavior appears to be a fundamental shift in market structure rather than just a typical small pullback, suggesting a more prolonged period of weakness.

Thus, the market has now entered a caution zone, with the analyst noting that bears are knocking on the door of lower support levels. The next major reaction from the market will be the deciding factor in whether BNB can recover its uptrend or embark on a new, sustained bearish trajectory.

Confluence Emerges At Key Support Zone

In a recent update shared on X, analyst Batman revealed that BNB is currently carving out a highly attractive long setup. The asset is exhibiting a rare alignment of multiple technical indicators, suggesting that the current price level may serve as a powerful launchpad for the next leg up.

This setup is rooted in a confluence of support levels. Specifically, BNB is resting within a strong bullish Fair Value Gap (FVG). This high-interest zone has seen a positive reaction from the market, as the price tapped the 0.618 Fibonacci retracement level.

To further bolster the bullish conviction, the momentum oscillators have aligned with the price action. Batman pointed out that the Stochastic indicator has officially formed a bullish divergence followed by a golden cross. Significantly, this combination signals that selling exhaustion has been reached and that buyers may be regaining control, thereby paving the way for a potential sustained price recovery.

Related Articles

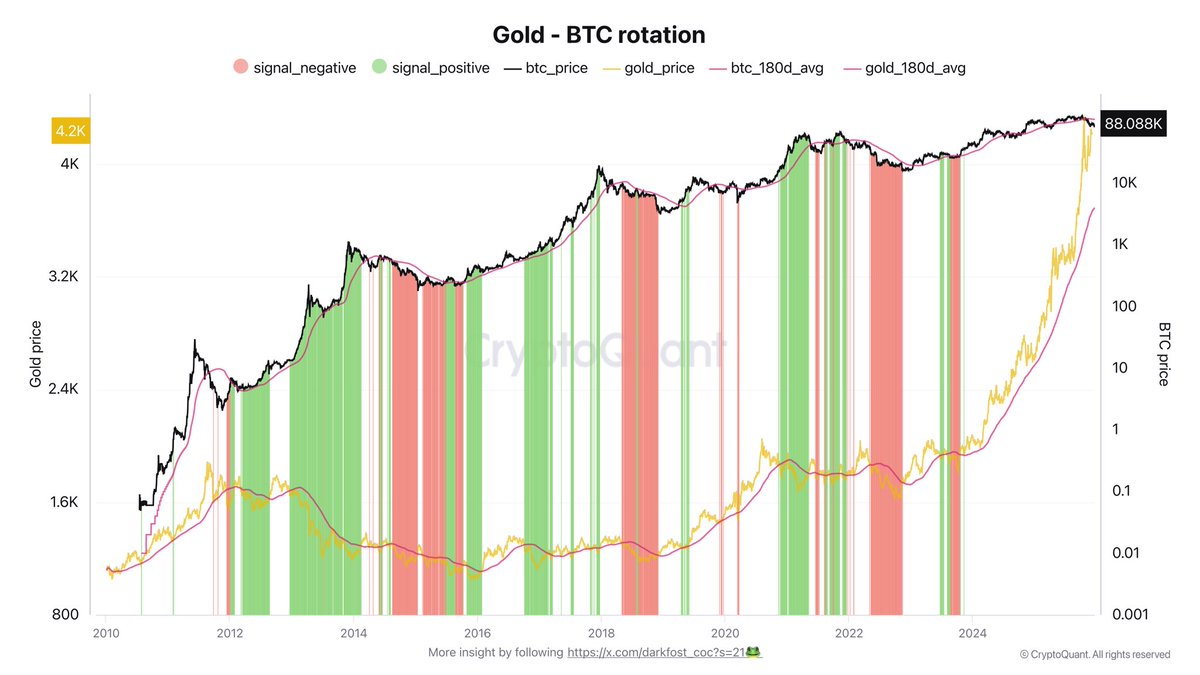

The Gold-to-Bitcoin Rotation Narrative Gains Strength: A Data-Driven Review

Bitcoin is once again attempting to reclaim the $90,000 level, but price action...

Dogecoin Reclaiming $0.128 Support Could Signal The Perfect Chance For Long Positions

Dogecoin (DOGE) is trading above a price level that could determine whether its...

Ethereum Market Structure Strengthens: Binance Netflows Point to Long-Term Conviction

Ethereum is attempting to reclaim the $3,000 level after showing pockets of bull...

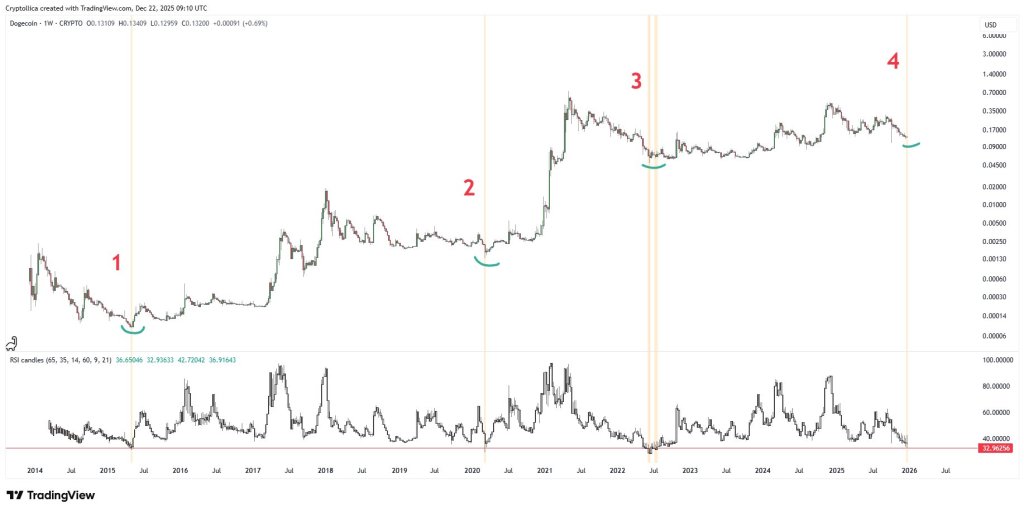

Dogecoin Weekly Fractal Hints At A Bigger Move Brewing

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting...