Cable stock jumps after securing BIS License for manufacturing of power conductors

Alex Smith

1 week ago

SYNOPSIS: The article covers Prime Cable’s newly obtained BIS license for aluminium alloy conductors, its scope and validity, and how this certification supports the company’s participation in regulated power-sector opportunities.

During Tuesday’s trading session, shares of one of the leading manufacturers of low-voltage cables and wires surged nearly 2.5 percent on the NSE, after the company announced securing a Bureau of Indian Standards (BIS) license for power conductors.

At 12:44 p.m., shares of Prime Cable Industries Limited were trading in green at Rs. 101.5 on NSE, up by around 2.5 percent, compared to its previous closing price of Rs. 99, with a market cap of Rs. 186 crores.

What’s the News:

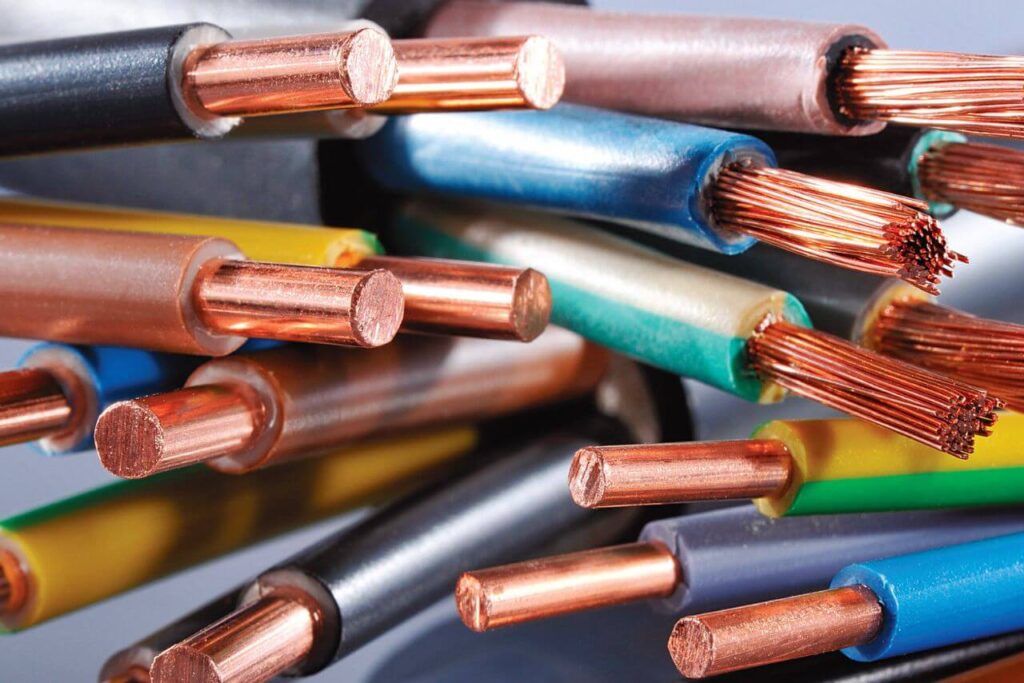

According to recent regulatory filings with the NSE, Prime Cable Industries Limited has received a license from the Bureau of Indian Standards (BIS) for manufacturing High Conductivity Aluminium Alloy Standard Conductors for overhead power transmission.

The approval covers conductor sizes up to 774 sq. mm (actual aluminium conductor area) and applies to the company’s facility located at Ghiloth, Neemrana, Alwar, Rajasthan. Further, the certificate is valid until 27th November 2026.

The BIS certification enables the company to participate in high-value government and utility sector tenders that mandate BIS-compliant products. It also enhances product reliability, as the licensing process involves stringent testing and quality-control requirements. Overall, this certification broadens the company’s eligibility for larger orders and strengthens its competitive positioning.

Financials & More:

Prime Cable reported a significant growth in revenue from operations, experiencing a year-on-year increase of more than 62 percent, from Rs. 56 crores in H1 FY25 to Rs. 91 crores in H1 FY26.

Likewise, the company’s net profit increased during the same period from Rs. 2 crores to Rs. 5 crores, representing an impressive rise of nearly 150 percent YoY.

In H1 FY26, the company reported total revenue from operations of Rs. 91 crore, in which, Control Cables segment contributed the largest share at Rs. 43 crore, accounting for 47.3 percent of revenue.

Power Cables segment generated Rs. 24.4 crore or 27 percent, while Aerial Bunch Cables contributed Rs. 14.6 crore, representing 16 percent. Instrumentation Cables vertical added Rs. 1.09 crore (1.2 percent), and Housing/Building Wires & Conductors accounted for Rs. 3.12 crore (3.5 percent). The remaining product category, classified as Others, contributed Rs. 4.5 crore, making up 5 percent of the revenue mix.

As of H1 FY26, the company has an annual production capacity of 27,000 km of cables and 10,000 km of wires. In FY26, the company expects to achieve an annualised capacity utilisation of around 55 percent for cables and 70 percent for wires. Prime Cable holds vendor approvals across 15 states, reflecting its widespread acceptance in key markets, and currently maintains a pending order book of Rs. 106 crore.

Prime Cable Industries Limited is an indigenous manufacturer of high-quality low-voltage cables and wires, with a comprehensive portfolio including control cables, power cables, aerial bunch cables, instrumentation cables, house/building wires, and conductors.

It supplies mission-critical products to State Electricity Boards, Public Sector Undertakings (PSUs), EPC contractors, and industries like oil & gas, mining, steel, real estate, and electric panel manufacturing.

Written by Shivani Singh

Disclaimer

The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Cable stock jumps after securing BIS License for manufacturing of power conductors appeared first on Trade Brains.

Related Articles

Reliance Retail IPO Strategy: How Reliance Retail is increasing valuation for its 2028 IPO

Synopsis:- The company is preparing for a 2028 IPO by cutting debt from ₹53,546...

FMCG stock to buy now for an upside of 40%; Recommended by Citi

Synopsis: VBL’s shares are in focus following its recent update on plans to acqu...

Dixon Technologies: Why does Morgan Stanley think the company will fail to fulfill its guidance?

Synopsis: Morgan Stanley has doubts about Dixon Technologies, pointing to unclea...

Adani Group stock to buy now for an upside of 31%; Recommended by Morgan Stanley

Synopsis: Adani Power is in focus after Morgan Stanley stated an overweight rati...