Crypto Founder Reveals What Will Drive Bitcoin Price To $200,000 In 2026

Alex Smith

2 days ago

BitMEX co-founder Arthur Hayes has predicted that the Bitcoin price could rally to $200,000 next year despite the current crypto market downturn. He also revealed what will spark this parabolic rally, citing recent liquidity measures by the U.S. Federal Reserve.

Arthur Hayes Predicts Bitcoin Price Will Reach $200,000 Next Year

In his latest Substack post, Hayes declared that the Bitcoin price will quickly reclaim $124,000 and rally towards $200,000 next year as the market equates the Fed’s Reserve Management Purchases (RMP) to quantitative easing (QE). The crypto founder expects the Fed’s RMP to inject significant liquidity into the market next year, sparking a parabolic BTC rally.

The Fed had announced, following the FOMC meeting earlier this month, that it would purchase Treasury bills starting December 12 and acquire up to $40 billion in Treasury bills within 30 days. However, the Fed has noted that this move doesn’t qualify, although Hayes and other market experts disagree.

The BitMEX co-founder remarked that the current misguided belief that RMP isn’t QE in terms of credit creation, and the uncertainty about RMP’s existence post-April next year, are the reasons he expects the Bitcoin price to chop between $80,000 and $100,000 until the new year begins.

However, the chop would end as the market equates RMP to QE, sparking the Bitcoin rally to $200,000. Hayes stated that March 2026 will mark the peak in expectations for the RMP’s ability to ramp asset prices, causing BTC to decline and form a local bottom well above $124,000.

Meanwhile, the BitMEX co-founder noted that $40 billion is great, but much less in 2025 than in 2009, based on the percentage of dollars outstanding. As such, he remarked that the market cannot expect its credit impulse at current financial asset prices to be as impactful.

BTC Still At Risk Of Dropping To $56,000

In a report, on-chain analytics platform CryptoQuant predicted that the Bitcoin price could still drop to as low as $56,000 as the market transitions into a bear market. The firm stated that the downside reference points suggest a relatively shallow bear market and that historically, bear market bottoms have aligned with the realized price, which is currently near $56,000.

Meanwhile, CryptoQuant stated that the intermediate support is expected around the $70,000 level. The firm’s bear market thesis for the Bitcoin price is premised on the fact that BTC’s demand growth has “decisively slowed.” They further revealed that the demand growth has fallen below trend since early October 2025, indicating that the bulk of this cycle’s incremental demand has already been realized.

At the time of writing, the Bitcoin price is trading at around $88,400, up almost 2% in the last 24 hours, according to data from CoinMarketCap.

Related Articles

Hong Kong Proposes New Rules To Allow Crypto Investments For Insurers – Report

Hong Kong is reportedly exploring new rules that would allow insurance companies...

Institutional Crypto Trading On JPMorgan’s Radar, Report Suggests

In the midst of a transforming crypto landscape in the US following the return o...

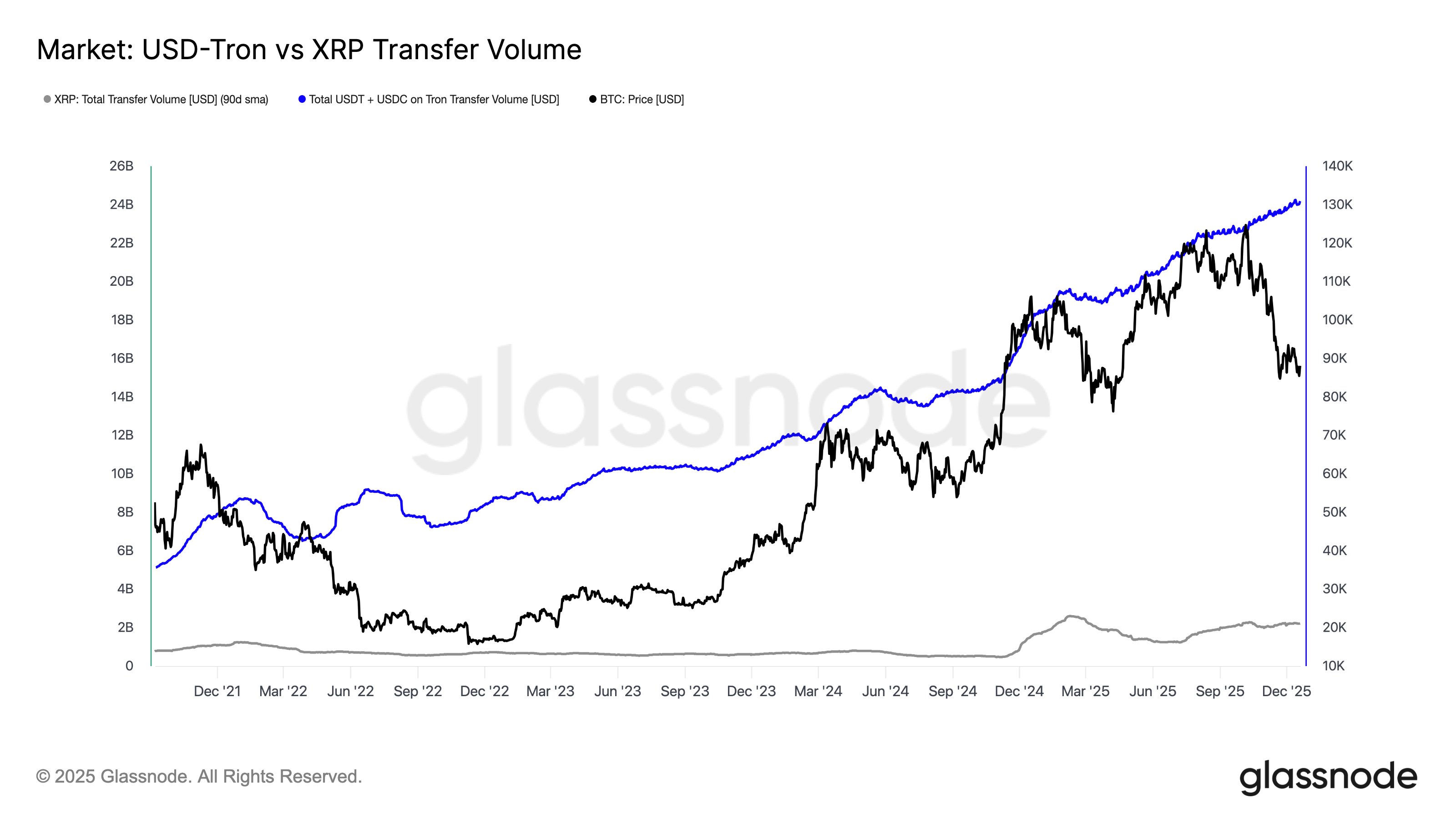

Tron Stablecoin Volume Exceeds XRP Activity By More Than 10 Times: Data

Data shows the transaction volume of USDT and USDC on Tron is now more than 10 t...

Bitcoin Futures Structure Favors Bulls as Short Liquidations Accelerate

Bitcoin is once again attempting to reclaim the $90,000 level, as bulls cautious...