Crypto Payments Firm MoonPay Set For $5 Billion Valuation With NYSE Owner’s Backing

Alex Smith

3 days ago

Crypto payment platform MoonPay is poised to receive a significant fundraising boost as recent reports suggest that Intercontinental Exchange (ICE), the owner of the New York Stock Exchange (NYSE), is exploring an investment in the company.

According to a Bloomberg report, which cited sources familiar with the discussions, MoonPay is close to finalizing this fundraising round and is targeting a valuation around $5 billion.

New Regulatory Approval And Investment Talks

Based in New York, MoonPay specializes in simplifying the trading of cryptocurrencies through various payment methods, including PayPal, Apple Pay, and Venmo. The platform also offers tools for users to send, receive, and manage stablecoins.

Notably, MoonPay recently obtained a Limited Purpose Trust Charter from the New York Department of Financial Services (NYDFS), a significant regulatory approval that complements its existing BitLicense.

This charter enables MoonPay to expand its custody and other crypto services within New York, placing the company in league with established players like Coinbase (COIN) and PayPal, which also operate under the state’s strict digital asset regulations.

The momentum for MoonPay continues to build, particularly with news that Caroline Pham, the acting chair of the Commodity Futures Trading Commission (CFTC), plans to join the firm as its chief legal and administrative officer.

CFTC Chair Caroline Pham to Join MoonPay

Pham has been a notable figure in the regulatory landscape, having served on the CFTC’s board since April 2022 and becoming acting chair in January 2025.

She announced her intention to return to the private sector once a permanent chair was confirmed, which is expected to happen this week with Mike Selig’s anticipated confirmation.

Under Pham’s leadership, the CFTC expedited several initiatives focused on cryptocurrencies, including the allowance for spot crypto trading on futures exchanges and the launch of a digital assets pilot program permitting the use of assets like Bitcoin (BTC) and Ethereum (ETH) in derivatives markets.

Additionally, Pham implemented various operational changes within the CFTC, reportedly leading to nearly $50 million in annual savings by enhancing governance and accountability.

Pham articulated that her agenda as acting chair concentrated on executing a range of presidential executive orders aimed at promoting regulatory clarity and efficiency across government agencies.

Reflecting on her decision to join MoonPay, she emphasized the importance of people in her career choices, stating that meaningful connections guide her decisions.

Her connection to MoonPay began through a dinner hosted by Christie’s Art + Tech in 2023, where she met MoonPay’s president, Keith Grossman. A conversation that started at the dinner evolved into a friendship and later professional discussions as Pham considered her options post-government.

Grossman expressed confidence in Pham’s capabilities, stating, “MoonPay has really matured, and Caroline is the exact type of leader with the exact type of big bank and regulatory experience that’s needed for us to be able to move to the next level.”

Featured image from DALL-E, chart from TradingView.com

Related Articles

Ethereum Price Presses Resistance, but Can The Recovery Survive?

Ethereum price started a recovery wave above $2,980. ETH is now consolidating an...

XRP Price Holds Key Support While Traders Weigh Breakout Odds and Downside Risk

XRP enters the final days of 2025 trading in a narrow and tense range, with mark...

Bitcoin Price Holds Firm, Upside Extension Now in Trader Focus

Bitcoin price started a decent recovery wave above $88,000. BTC is now consolida...

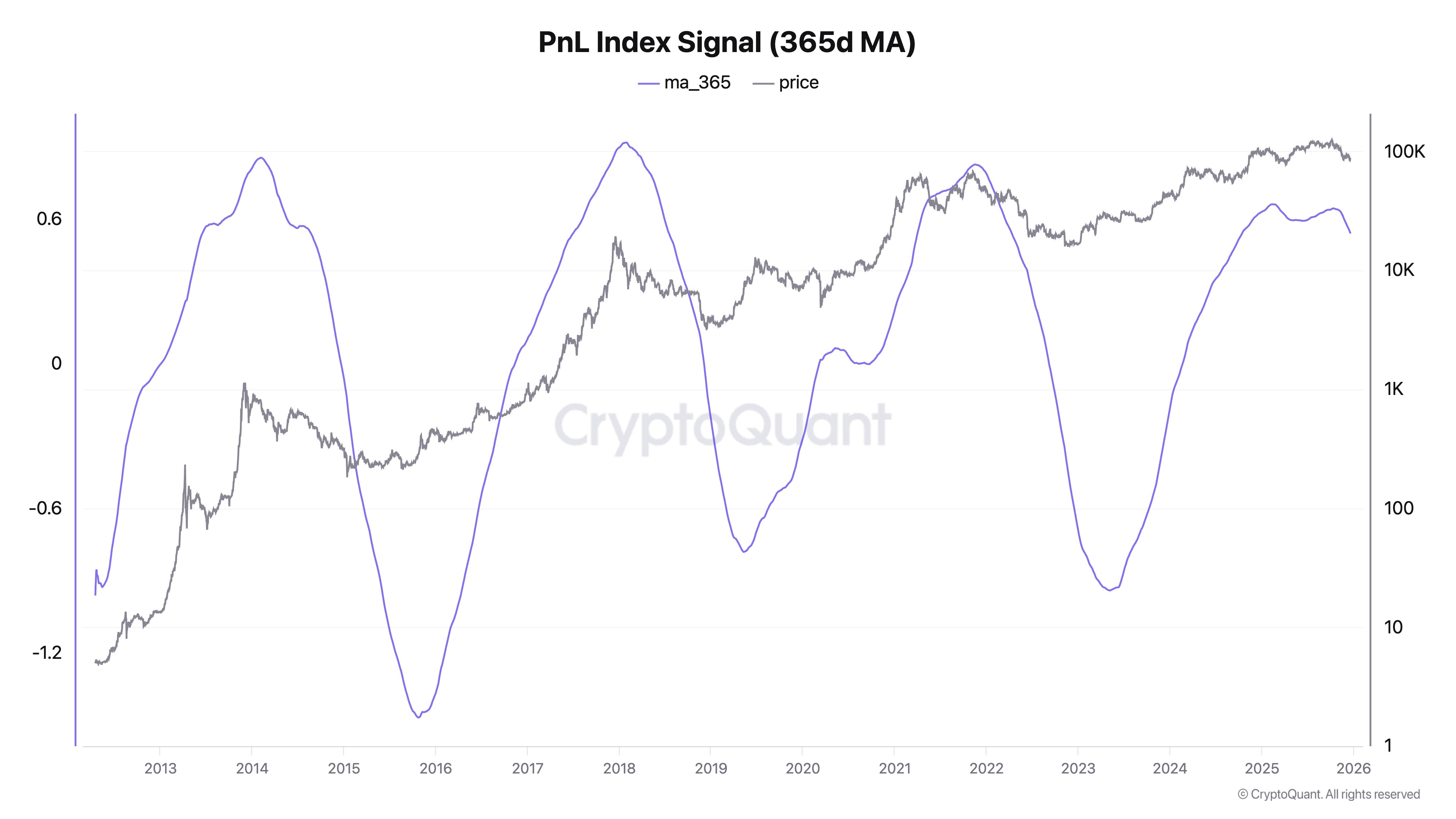

Bitcoin Inflow Slowdown: CryptoQuant Founder Says Sentiment Could Take Months To Recover

The founder and CEO of on-chain analytics firm CryptoQuant has revealed how Bitc...