Crypto Unrealized Losses Hit $350 Billion, With $85 Billion From Bitcoin Alone

Alex Smith

1 week ago

On-chain data shows the Unrealized Loss in the crypto market recently ballooned to $350 billion, with Bitcoin accounting for a significant part of it.

Unrealized Loss Has Spiked In The Crypto Sector After Bearish Price Action

In a new post on X, on-chain analytics firm Glassnode has shared the data related to the Unrealized Loss in the crypto sector. This indicator measures, as its name suggests, the total amount of loss that investors are holding on their tokens right now.

The metric works by going through the transaction history of each token on a given network to find what price it was last moved at. If this last selling price of a token was less than the current spot price of the asset, then that particular coin is assumed to be underwater.

The exact amount of the loss involved with the token is equal to the difference between the two prices. The Unrealized Loss sums up this value for all coins being held at a loss.

Like the Unrealized Loss, there also exists the Unrealized Profit, keeping track of the supply of the opposite type. That is, it accounts for the coins with a cost basis lower than the latest spot price.

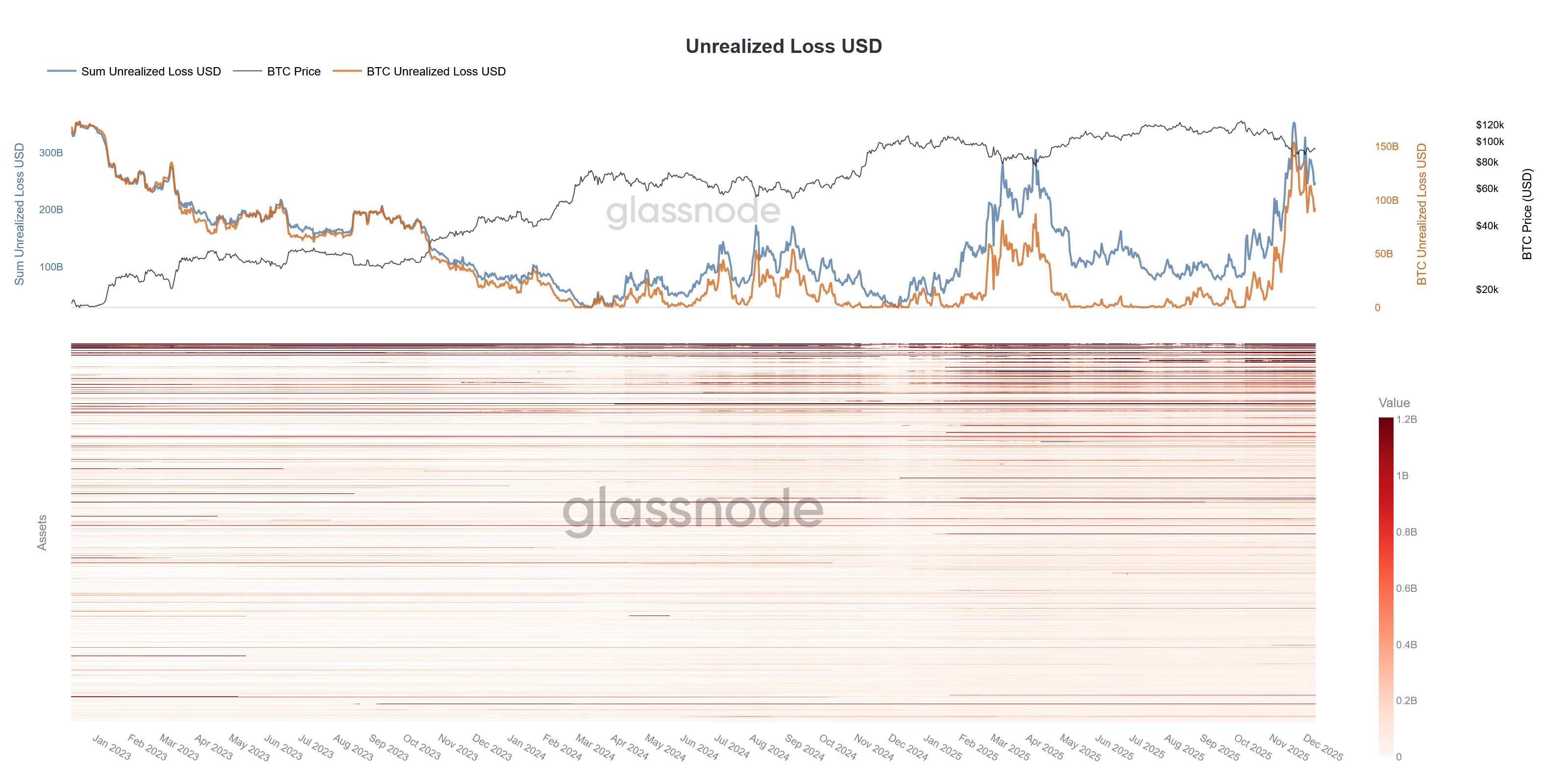

Now, here is a chart that shows the trend in the Unrealized Loss for the combined crypto market and Bitcoin over the last few years:

As displayed in the above graph, the Unrealized Loss across the crypto market has surged following the downturn that the sector has gone through since October.

At its peak, the indicator hit a value of $350 billion for the entire market, with Bitcoin alone contributing about $85 billion. These are both elevated levels and showcase the degree of pain among the investors.

Glassnode explained:

With multiple on-chain indicators signalling shrinking liquidity across the board, the market is likely entering a high-volatility regime in the weeks ahead.

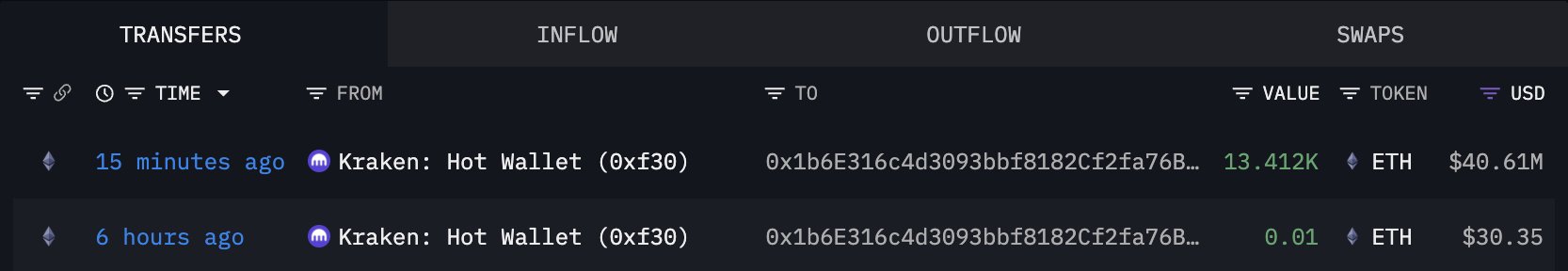

In some other news, Bitcoin and Ethereum have shown strong divergence in the Exchange Netflow trend this week, as institutional DeFi solutions provider Sentora has pointed out in an X post.

As is visible above, the Bitcoin Exchange Netflow registered a significant value of -$1.34 billion over the past week. The value being negative implies centralized exchanges faced net withdrawals.

In contrast, the same indicator has witnessed a sharp positive value of $1.03 billion for Ethereum instead. Usually, investors deposit to exchanges when they want to participate in one of the services that they provide, which can include selling. As such, large exchange net inflows can be bearish for the asset’s price.

BTC Price

Bitcoin has again failed to maintain its recovery above $92,000 as its price is back to $90,000.

Related Articles

Bitcoin’s Post-Quantum Shift Could Take A Decade, Crypto Exec Says

According to reports, a new round of debate over quantum computers and Bitcoin h...

BitMine Doubles Down on Ethereum With $40M Accumulation

Ethereum is currently trading above the $3,000 level, offering a surface-level s...

Crypto Theft Hides In Plain Sight Inside Popular Game Mods—Kaspersky

Kaspersky has warned that a new infostealer called “Stealka” is bein...

Here’s Why The XRP Price Will Shine In The New Year

XRP has spent the past few weeks on a downtrend after a bullish cycle earlier in...