Did 2025 Mark A Bear Market For Bitcoin? Predictions Point To A $150,000 Rally In 2026

Alex Smith

1 week ago

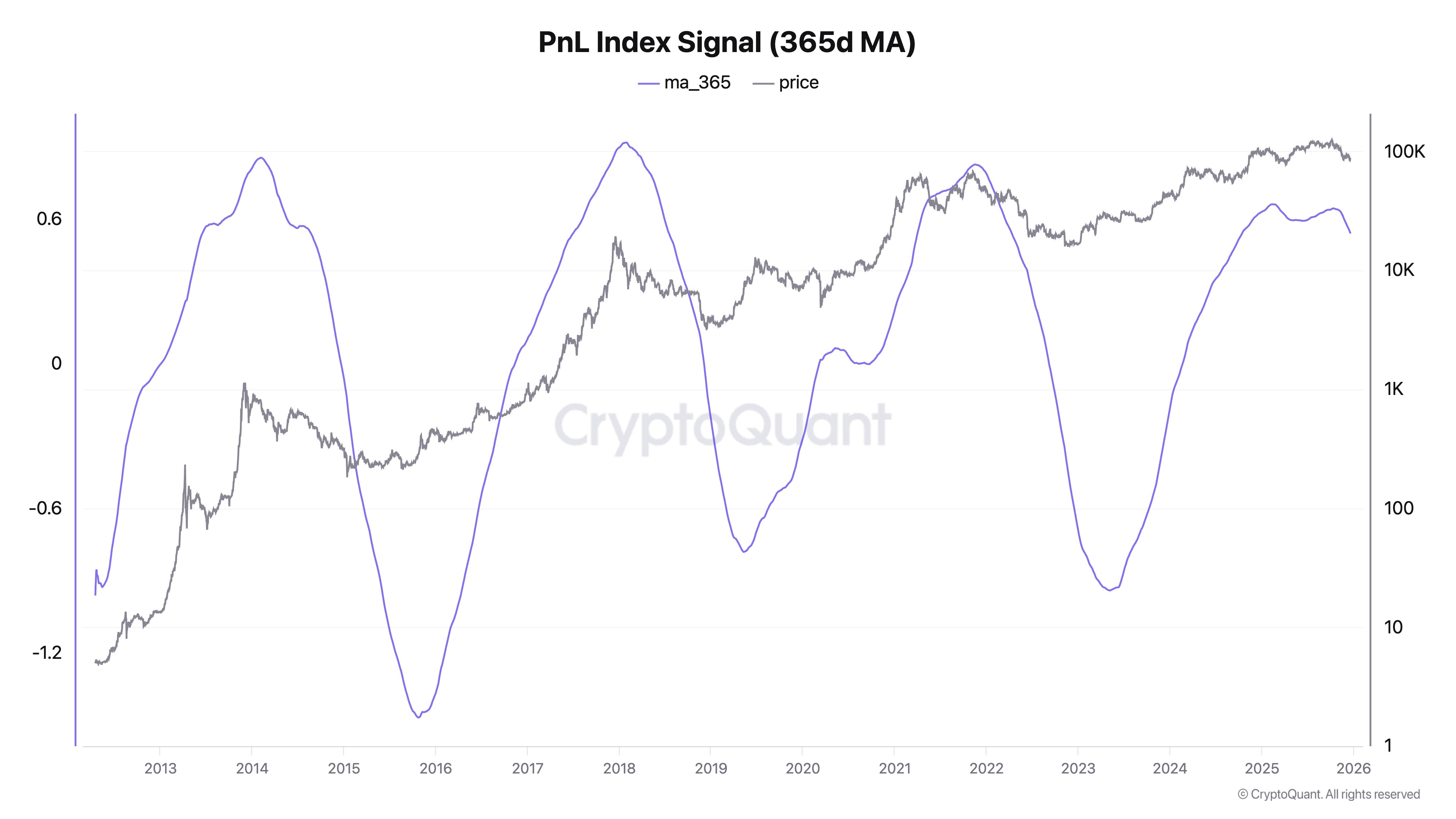

As Bitcoin (BTC) experienced significant volatility throughout the year, reaching new all-time highs (ATHs) before enduring sharp corrections of up to 30%, the cryptocurrency community has become increasingly polarized regarding its future direction.

Many analysts are raising concerns about a potential bear market emerging in 2026; however, market expert Shanaka Anslem has offered a different perspective on social media platform X (formerly Twitter), questioning whether 2025 has already represented the real bear market.

A Sign Of Cycle Change

In his analysis, Anslem highlights key evidence. For the first time in history, Bitcoin breached its all-time high prior to the Halving event in April of this year, which he argues isn’t a bullish signal but rather an indication of the cycle inverting.

According to him, 2024 should not be viewed as the beginning of a new bull run; instead, it was a period of what he calls “political repricing” as the market factored in a pro-crypto administration with President Donald Trump’s reelection.

The characteristics of a bear market have been evident in 2025, according to Anslem. Bitcoin’s dominance has reached multi-year highs while altcoins continue to struggle, leading to quarter-after-quarter declines in their values.

Additionally, a massive $3.5 billion in exchange-traded fund (ETF) outflows occurred within just one month. This year saw a significant 29% drawdown from its October highs, paired with extreme fear readings on various sentiment indices.

Anslem insists that while the four-year Halving cycle remains relevant, its impact has evolved. With $120 billion in ETF interconnected with the Federal Reserve’s (Fed) liquidity, the Halving continues to dictate BTC’s supply, but demand now aligns with broader economic narratives rather than the more crypto-specific factors.

Major Bitcoin Rally Ahead?

What does Anslem’s “cycle inversion” theory implies for 2026? If the bear market has already transpired, masked by nominal highs, the next logical phase might be a genuine blow-off top.

His predictions suggest Bitcoin’s price could soar to between $150,000 and $200,000, particularly as global liquidity continues to expand and directs capital toward hard assets. Anslem believes that many in the market are currently positioned for a downturn that has already occurred.

However, dissenting opinions exist. Analyst Mr. Wall Street argues that the bottom for Bitcoin has not yet arrived and won’t be realized in the coming weeks or months.

He highlights that the critical support level has been breached, indicated by the weekly exponential moving-average (EMA50) closing below the threshold.

He asserts that the market has entered the early stages of a substantial bear market, predicting that it will only abate once Bitcoin reaches the $54,000 to $60,000 range, which he expects might occur in the fourth quarter of 2026.

Despite this bearish outlook, he remains cautiously optimistic about Bitcoin in the short term. He expects a potential upward movement to retest the EMA50 Weekly, which currently stands at approximately $100,000, while maintaining that mid-term targets are much lower.

At the time of writing, BTC was trading at $90,352, which represents a 28% difference between current valuations and ATH levels.

Featured image from DALL-E, chart from TradingView.com

Related Articles

Bitcoin Price Holds Firm, Upside Extension Now in Trader Focus

Bitcoin price started a decent recovery wave above $88,000. BTC is now consolida...

Bitcoin Inflow Slowdown: CryptoQuant Founder Says Sentiment Could Take Months To Recover

The founder and CEO of on-chain analytics firm CryptoQuant has revealed how Bitc...

XRP Enters The Quiet Accumulation Phase For Institutional Players

As the broader crypto markets remain fixated on volatility and short-term narrat...

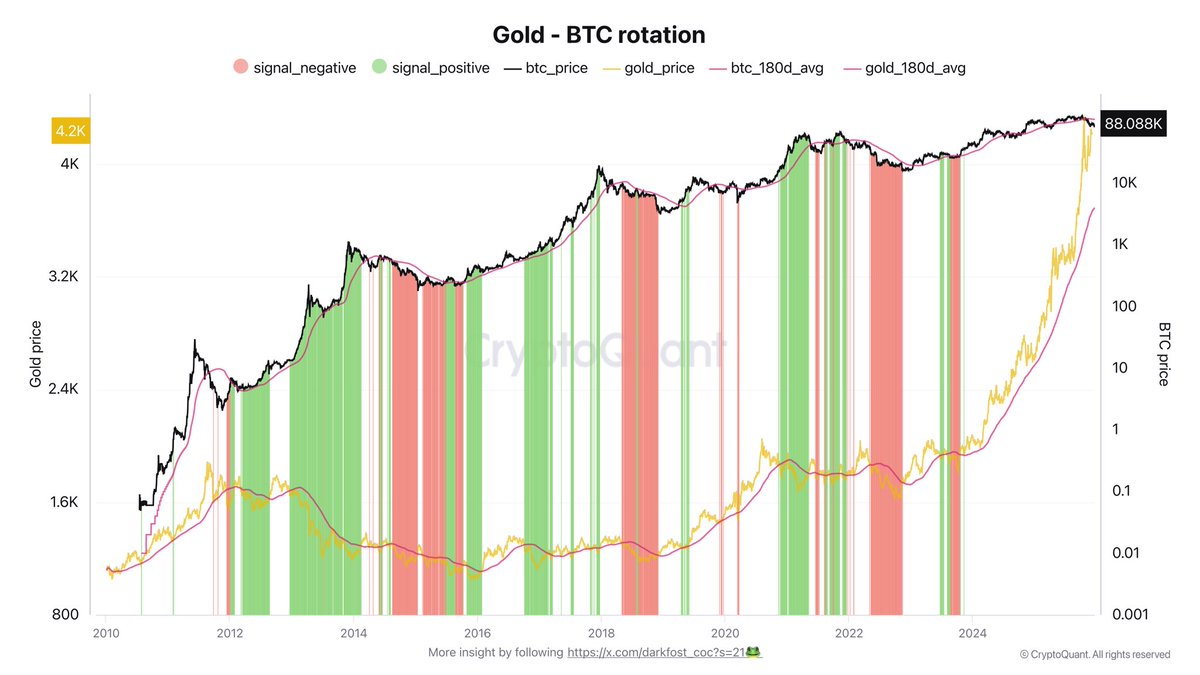

The Gold-to-Bitcoin Rotation Narrative Gains Strength: A Data-Driven Review

Bitcoin is once again attempting to reclaim the $90,000 level, but price action...