Ethereum Takes The Lead In DeFi Lending Revenue, Leaving Rivals Behind – See How

Alex Smith

3 days ago

Ethereum’s price may be hampered by selling pressure, but the leading network continues to experience heavy utilization from developers and users. After robust interaction from the participants, the blockchain giant emerged once again as the leader in Decentralized Finance (DeFi) lending.

DeFi Lending Still Pays Best On The Ethereum Network

A recent report has underscored Ethereum’s growing dominance within the blockchain sector. The network is solidifying its position as the financial foundation for decentralized finance lending, and the data is starting to present a convincing picture.

A look at the data shared by Leon Waidmann, a market expert and the head of research at On-Chain Foundation, shows that ETH is now the revenue center of DeFi lending. This implies that most of the revenue flowed through the ETH ecosystem, outpacing other major chains like Base, Plasma, and Arbitrum.

From borrowing fees to interest paid by active users, the ETH network continues to be the key settlement layer where value is persistently created. ETH is at the center of the revenue outlines the network’s usage in addition to its ongoing dominance as the fundamental infrastructure driving DeFi’s most lucrative lending activity.

As seen on the chart, Ethereum mainnet steadily secured over 80% to 90% of all DeFi lending revenue and activity, reinforcing its increasing role in the financial landscape. Interestingly, this share has remained a dominant force even with the vigorous expansion of the Layer 2 and alt-Layer 1 chains.

Data shows that usage may be fragmented, but fees do not. Meanwhile, at the protocol layer, Waidmann highlighted that concentration is quite stronger. Amid this rising DeFi revenue lending, Aave is the core revenue engine on the Ethereum mainnet, attracting more than 50% of the total lending funds.

This part of the network was also responsible for over 60% of all active loans on ETH. In the end, the project generated approximately $885 million in fees in 2025 alone, reflecting the significant usage of the network.

While Ethereum mainnet secures balance sheets and profits, layer 2s are optimizing execution and User Experience (UX). Waidmann noted that where confidence and liquidity are greatest, DeFi credit markets converge. “Ethereum Mainnet is not being disrupted, but is being reinforced,” the expert added.

Active ETH Addresses Targeting Its Peak

Another instance of robust engagement across the Ethereum network is a spike in active wallet addresses. Joseph Young, a crypto enthusiast, previously highlighted that the active users on the network are drawing close to its all-time high. Such a rise in active addresses suggests a resurgence of interest and conviction among larger and retail investors.

At the time of the post, about 2.4 million wallet addresses were actively interacting with the network every week. This is an indication that tokenization, stablecoins, and privacy infrastructure are all converging on Ethereum. Currently, Young stated ETH is dominating the big three metas, while expressing his conviction in the network’s prospects.

Related Articles

No Bitcoin Buy This Monday—Strategy Adds $748M To USD Reserve Instead

Bitcoin treasury company Strategy hasn’t announced any new BTC buy this we...

Hong Kong Proposes New Rules To Allow Crypto Investments For Insurers – Report

Hong Kong is reportedly exploring new rules that would allow insurance companies...

Institutional Crypto Trading On JPMorgan’s Radar, Report Suggests

In the midst of a transforming crypto landscape in the US following the return o...

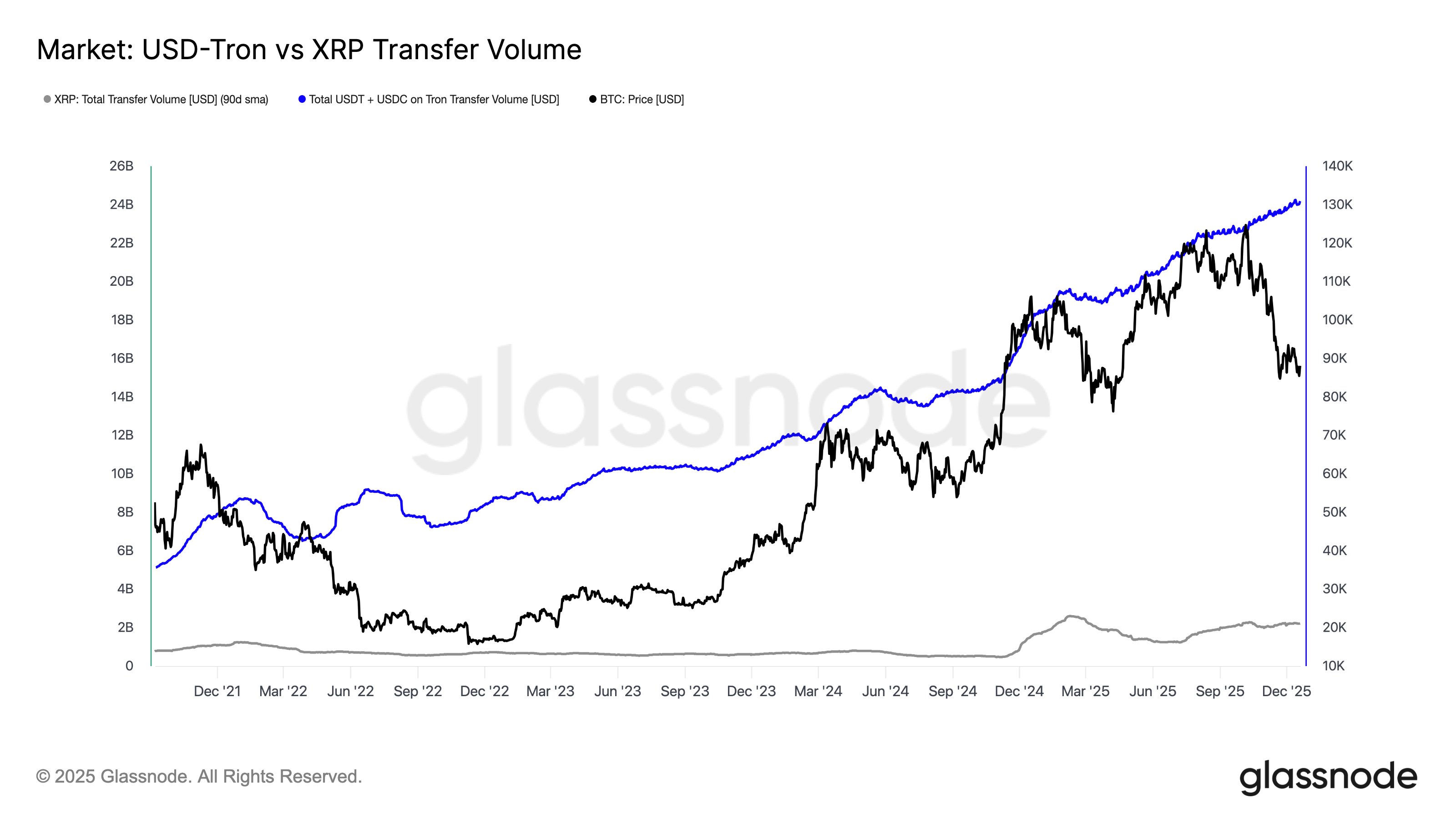

Tron Stablecoin Volume Exceeds XRP Activity By More Than 10 Times: Data

Data shows the transaction volume of USDT and USDC on Tron is now more than 10 t...