Flight To Metals? Gold And Silver Hit Records While Bitcoin Drops

Alex Smith

3 days ago

Gold and silver hit fresh highs on Tuesday while Bitcoin slid back under $89,000, sending a clear message that some investors are favoring metal over riskier bets.

According to Reuters and market data, gold traded above $4,330 an ounce and silver pushed past $66 an ounce in what market participants called a strong run for bullion. Reports have disclosed that silver’s rally has lifted local prices in India to about ₹2.06 lakh per kilogram.

Metals Rally, Hit New Highs

Silver’s advance has been dramatic. It is up roughly 120-130% year-to-date, a jump that outpaces gold by a wide margin.

Traders point to a mix of stronger industrial demand from solar and electronics, tighter supplies, and flows into safe assets as reasons behind the move.

Gold buyers have also been encouraged by signs that US inflation may cool and by shifting expectations for central bank policy, which tends to support non-yielding assets when real yields fall.

JUST IN : Silver soars to $66 for the first time in history pic.twitter.com/YGCrB5VDPH

— Barchart (@Barchart) December 17, 2025

Safe Haven Demand And Industrial Use

Some investors are treating metals as a hedge. Others want exposure linked to real economy needs. Both forces are at work. Analysts say silver’s dual role — as an industrial metal and as a store of value — is amplifying moves.

Energy prices and supply reports have added pressure on markets, and that has upped demand for physical metal in several trading hubs.

Bitcoin Slips Under Key LevelBitcoin fell below $89,000 and was trading nearer to $88,450 in mid-session, giving back gains from earlier months. Based on reports and market feeds, BTC is about 7% lower year-to-date and roughly 30% below its October 2025 peak above $126,000.

Some crypto funds recorded outflows recently, and several traders described market tone as risk-off, which has weighed on digital assets this week.

Liquidity, ETF Flows And SentimentETF flows played a role. Where money leaves ETFs, prices can feel the impact quickly. Margin calls, profit taking after a volatile run, and investors moving to what they see as safer stores of value have all been cited by sources watching the tape.

Technical levels near $84,000 to $85,000 are now being watched for support, while resistance sits close to $90,000 to $92,000.

Markets Eye Data And Policy MovesEconomic reports and central bank signals are next on traders’ calendars. US inflation prints and comments from global central banks have been flagged as possible triggers for fresh moves in both metals and crypto.

Investors also noted that equity weakness, especially in some large tech names, has nudged money toward hard assets and away from riskier positions.

Several market strategists said that policy shifts overseas, including from the Bank of Japan, could further change global liquidity and investor choices.

Featured image from Unsplash, chart from TradingView

Related Articles

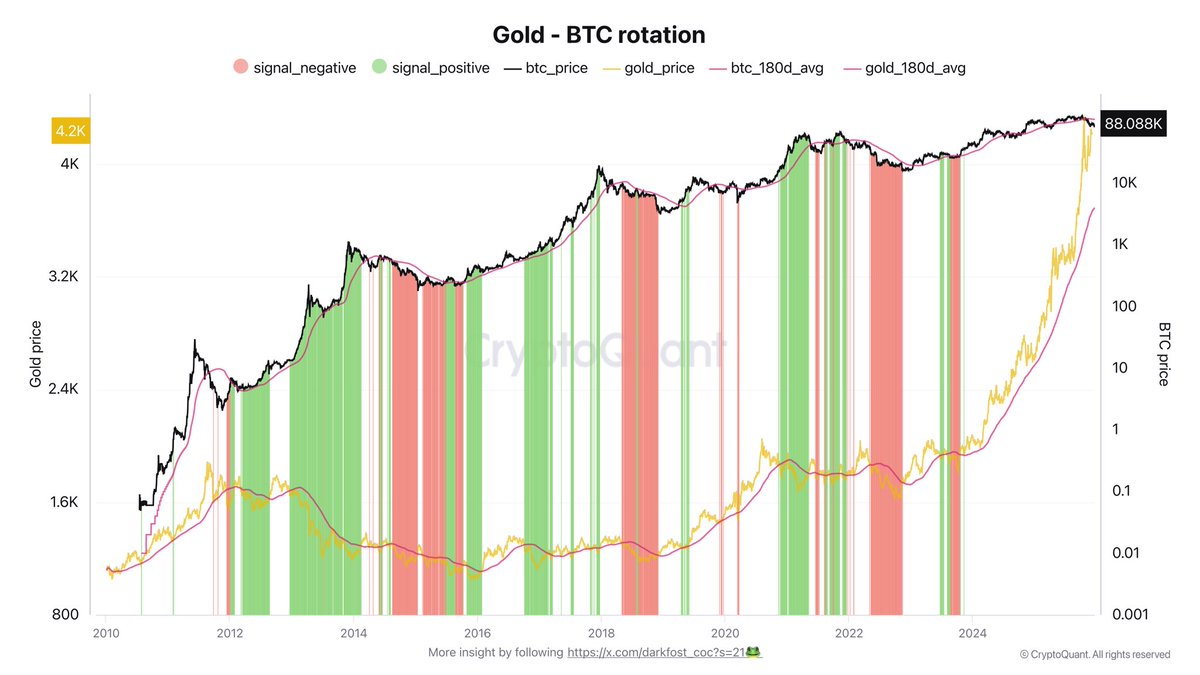

The Gold-to-Bitcoin Rotation Narrative Gains Strength: A Data-Driven Review

Bitcoin is once again attempting to reclaim the $90,000 level, but price action...

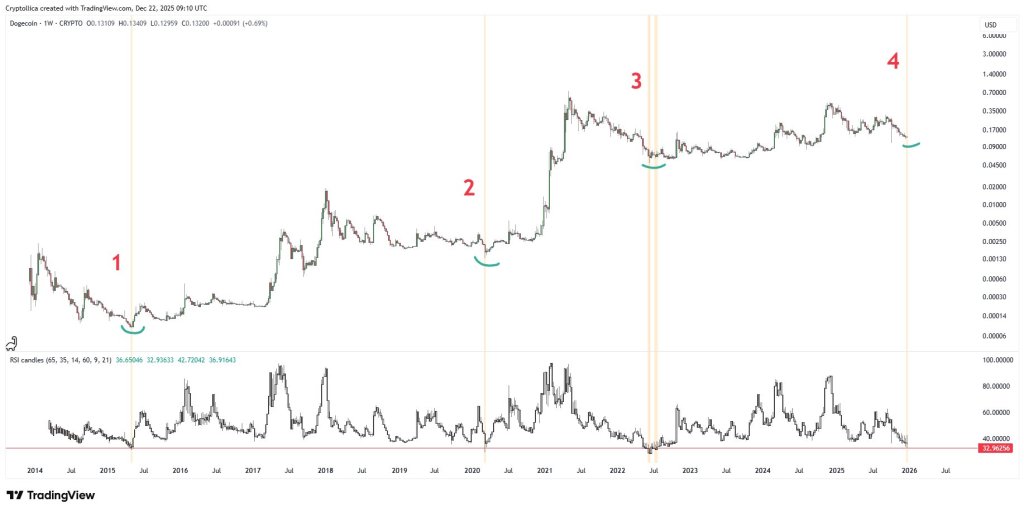

Dogecoin Reclaiming $0.128 Support Could Signal The Perfect Chance For Long Positions

Dogecoin (DOGE) is trading above a price level that could determine whether its...

Ethereum Market Structure Strengthens: Binance Netflows Point to Long-Term Conviction

Ethereum is attempting to reclaim the $3,000 level after showing pockets of bull...

Dogecoin Weekly Fractal Hints At A Bigger Move Brewing

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting...