Ripple Marks Another Milestone In Bid To Dominate Global Payments With XRP

Alex Smith

2 weeks ago

On December 1, 2025, Ripple announced a major regulatory upgrade in Singapore, reinforcing its ambition to make XRP a central instrument for global payments. The expanded license allows the company to streamline cross-border money transfers, expand its payments infrastructure, and provide faster, more transparent settlements to financial institutions worldwide.

Ripple Intensifies Its Global Payments Playbook

The Singapore regulatory upgrade extends the scope of Ripple’s Major Payment Institution (MPI) license, giving its subsidiary, Ripple Markets APAC Pte. Ltd., authority to operate a fully regulated, end-to-end payments platform. The license enables Ripple to handle fund collection, secure custody, token conversion, and final payouts within a single operational framework. XRP and Ripple’s stablecoin RLUSD are embedded into the system, consolidating complex cross-border processes into a fast, compliant, and transparent environment.

This upgrade positions Ripple as a turnkey solution for banks, corporates, and fintechs. By managing both regulatory compliance and the technology infrastructure, Ripple removes the fragmentation that slows legacy systems. These institutions now have a single point of contact, reducing complexity and making operations more efficient.

Ripple is also expanding its geographic reach through strategic partnerships. Its collaboration with Bahrain Fintech Bay allows the company to run pilot programs, real-world payment trials, and early deployment of token-driven services in the Gulf region. These initiatives help Ripple establish liquidity corridors, embed its infrastructure into local financial ecosystems, and build familiarity with regional regulators.

Financially, Ripple strengthened its position with a $500 million funding round in November 2025, which valued the company at roughly $40 billion. The capital is being directed toward scaling payment infrastructure, enhancing enterprise tools, and expanding its stablecoin program. With these resources, Ripple can roll out its technology faster, integrate with new partners more efficiently, and advance its dominance in the institutional payments market.

XRP’s Expanding Utility In Ripple’s Global Framework

XRP remains the settlement engine of Ripple’s infrastructure, providing instant liquidity, rapid transaction settlement, and multi-currency interoperability. This functionality allows Ripple to address high-friction payment corridors, such as those in Africa, where it works with regional providers to replace slow correspondent banking chains with XRP-enabled settlements. In the Asia-Pacific region, growing on-chain activity and rising institutional demand create favorable conditions for token-based cross-border payments. The Singapore MPI upgrade now offers a regulated launchpad to deliver XRP-powered rails across these high-growth regions.

Building on this foundation, Ripple is creating a vertically integrated ecosystem where fiat, stablecoins, and digital assets operate through a unified platform. Within this framework, XRP bridges currencies, provides deep liquidity, and executes transactions faster than traditional systems. Each regulatory approval, partnership, and infrastructure deployment further embeds XRP into the backbone of global financial infrastructure.

Together, these milestones illustrate Ripple’s multi-market strategy: expanding regulatory clarity, deploying robust infrastructure, and demonstrating real-world XRP utility. The Singapore upgrade is a decisive step in this progression, reinforcing Ripple’s steady movement toward making XRP a central tool for cross-border payment systems.

Related Articles

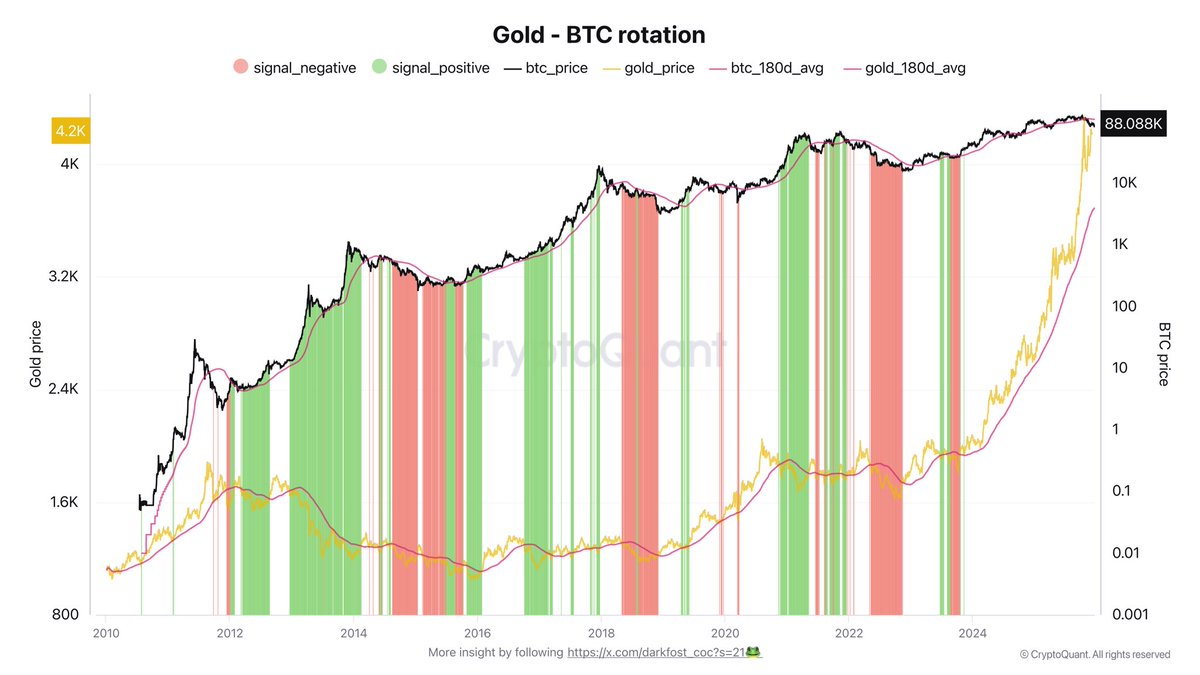

The Gold-to-Bitcoin Rotation Narrative Gains Strength: A Data-Driven Review

Bitcoin is once again attempting to reclaim the $90,000 level, but price action...

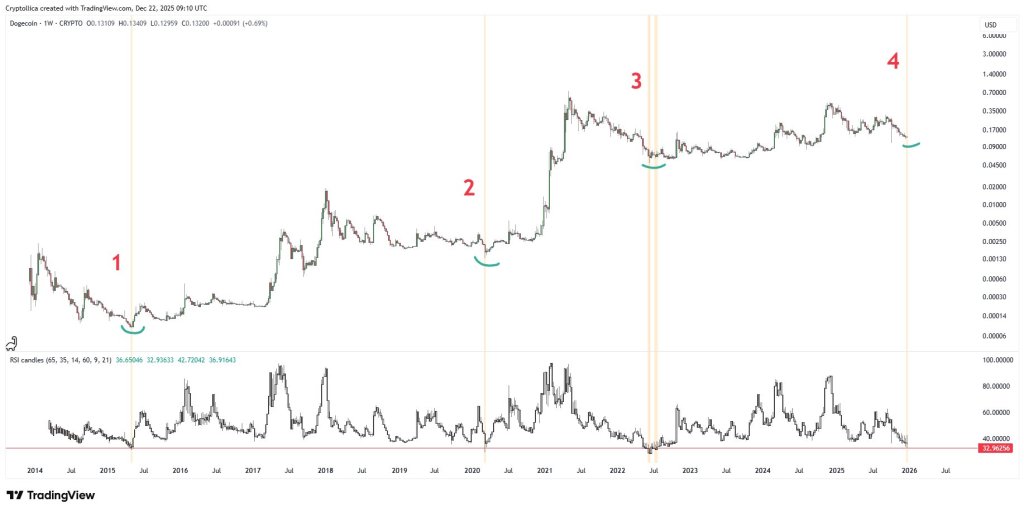

Dogecoin Reclaiming $0.128 Support Could Signal The Perfect Chance For Long Positions

Dogecoin (DOGE) is trading above a price level that could determine whether its...

Ethereum Market Structure Strengthens: Binance Netflows Point to Long-Term Conviction

Ethereum is attempting to reclaim the $3,000 level after showing pockets of bull...

Dogecoin Weekly Fractal Hints At A Bigger Move Brewing

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting...