Ripple’s Climb To A $7 Trillion Valuation: What Would The XRP Price Be?

Alex Smith

2 weeks ago

Crypto pundit Rob Cunningham has outlined a scenario where Ripple could achieve a $7 trillion valuation based on the XRP price. The crypto firm is notably the largest XRP holder, which is why a significant surge in the altcoin’s price could increase the company’s valuation.

Ripple Could Hit A $7 Trillion Valuation With An XRP Price Of $250

In an X post, Cunningham predicted that Ripple could hit a $7 trillion valuation if the XRP price were to rally to $250. Specifically, the pundit outlined a scenario where the company’s XRP position could account for $4.25 trillion of its valuation. He claimed that Ripple owned 17 billion XRP, which would amount to $4.25 trillion at $250 per XRP, the projected price.

Cunningham noted that this trillion-dollar valuation for Ripple, based on an XRP price surge to $250, would make the company 6.6x times more valuable than Visa and 8.6x times more valuable than Mastercard. $4.25 trillion also represents 3.6% of the world’s GDP, which stands at $117 trillion.

Based on an XRP price of $250, the pundit noted that the total XRP market value would be $15 trillion. Ripple’s 17 billion XRP holdings represent 28% of the circulating supply. Meanwhile, Cunningham listed other factors that could drive the firm to a $7 trillion valuation, including the passage of the CLARITY Act.

Other Factors That Would Contribute To A $7 Trillion Valuation

In addition to the XRP price surge to $250 and the CLARITY Act, Cunningham listed the Treasury’s approval of Ripple’s business as another factor. The pundit explained that the Treasury approval would mean that XRP and XRP Ledger (XRPL) would get global regulatory clarity as a core infrastructure layer for the new monetary system.

He also outlined a scenario where RLUSD and XRP become the default U.S. dollar rails globally, which would also contribute to Ripple’s projected $7 trillion valuation. The pundit noted that RLUSD already has a $1 billion market cap with $95 billion in payment volume and is growing. Cunningham also indicated that the XRP price could easily rally to $250, as this scenario positions XRP for a global settlement role rather than just another crypto asset.

The pundit also gave a “conservative” equity value of $1.3 trillion to $2.7 trillion for the payment firm. He noted that markets could apply a 60% to 80% discount to the $4.25 valuation, given an XRP price surge to $250 due to the high concentration in a single asset.

Cunningham also alluded to the political risk, as if Ripple’s payment system becomes the default settlement rail, governments may want a say in their operations. He also outlined possible capital controls, windfall taxes, or forced restructurings as other factors that could reduce Ripple’s projected $7 trillion valuation.

Related Articles

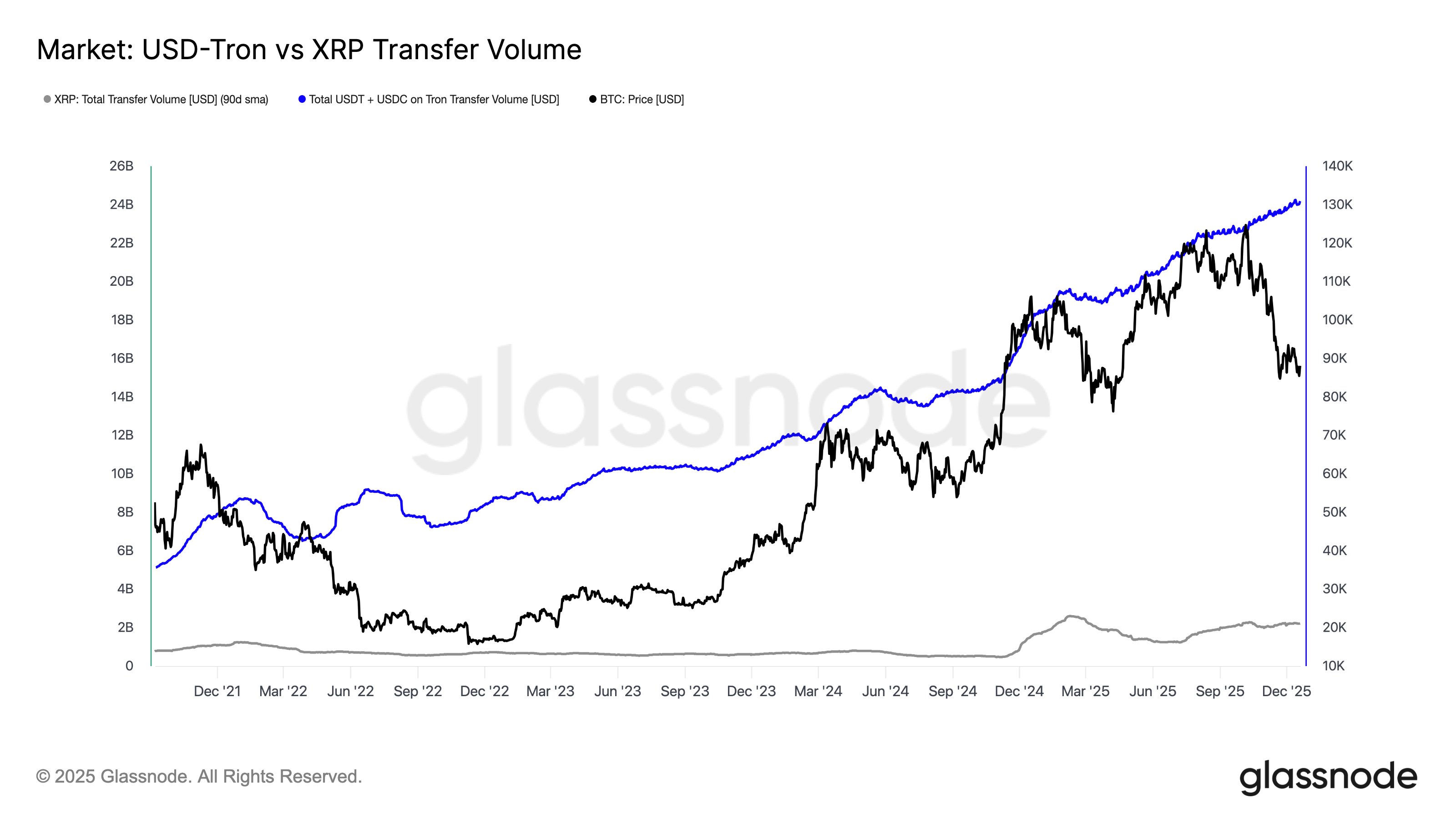

Tron Stablecoin Volume Exceeds XRP Activity By More Than 10 Times: Data

Data shows the transaction volume of USDT and USDC on Tron is now more than 10 t...

Bitcoin Futures Structure Favors Bulls as Short Liquidations Accelerate

Bitcoin is once again attempting to reclaim the $90,000 level, as bulls cautious...

Bitcoin’s Post-Quantum Shift Could Take A Decade, Crypto Exec Says

According to reports, a new round of debate over quantum computers and Bitcoin h...

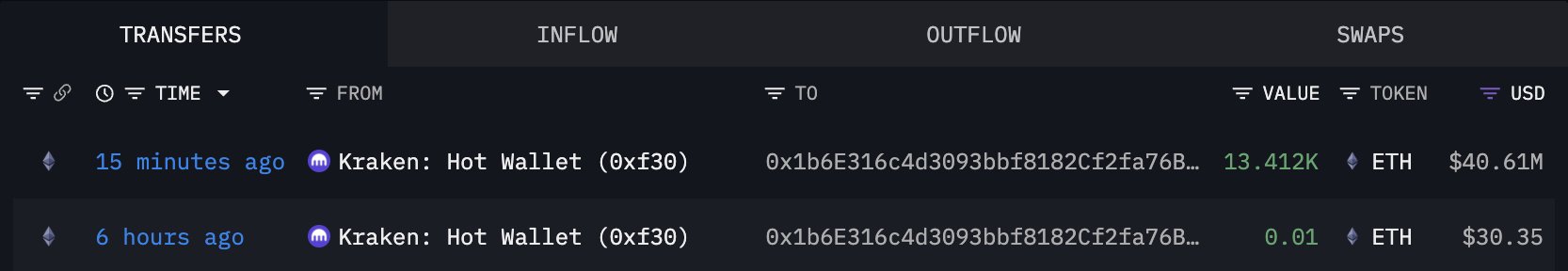

BitMine Doubles Down on Ethereum With $40M Accumulation

Ethereum is currently trading above the $3,000 level, offering a surface-level s...