Tether Eyes Stock Tokenization Option In Ambitious $20 Billion Raise

Alex Smith

1 week ago

As Tether (USDT), the issuer of the world’s largest stablecoin, USDT, prepares for a significant fundraising effort aimed at entering the US market, the company is actively seeking ways to bolster liquidity for its investors.

This initiative comes in the wake of Tether’s intervention to prevent some existing shareholders from offloading their stakes at a substantial discount.

Tether In Talks With Major Firms

According to Bloomberg, Tether is contemplating various strategies, including share buybacks and the tokenization of the company’s shares on a blockchain once the fundraising deal is complete.

These discussions have been prompted by concerns that the sale of shares by certain investors could jeopardize Tether’s ambitious fundraising goals.

In response to inquiries from Bloomberg News, Tether confirmed that it has successfully halted plans from at least one shareholder seeking to divest their stock, emphasizing that it would be “imprudent” for any investor to attempt to bypass the established processes managed by top-tier global investment banks.

Tether’s management is actively managing these situations to ensure that the forthcoming fundraising effort remains robust. Reports indicate that the company aims to attract “strategic” investors as part of its capital raise and has held discussions with firms such as SoftBank Group Corp. and Ark Investment Management LLC.

However, Tether has not provided a timeline for a potential initial public offering (IPO), suggesting that both new and existing investors may face delays before any liquidity events occur.

Juventus Acquisition Proposal

Tether also announced on Friday a binding cash proposal to acquire Exor’s entire stake in the Italian Football giant, Juventus Football Club. This proposal aims to secure Exor’s shareholding, which represents 65.4 percent of Juventus’ total issued share capital.

The completion of this acquisition is contingent upon Exor’s acceptance, the signing of final agreements, and the receipt of necessary regulatory approvals.

Tether intends to make a public tender offer for any remaining shares at the same price, fully backed by its own capital, reflecting a long-term commitment to Juventus.

Paolo Ardoino, CEO of Tether, expressed a deep personal connection to the club, emphasizing that his experiences with Juventus have instilled values of commitment, resilience, and responsibility in him.

With plans to invest €1 billion in the club’s development and support, the firm’s proposal extends beyond mere ownership; it aims to forge a meaningful partnership that reinforces Juventus’ legacy and enhances its global brand, the firm disclosed.

Ardoino articulated his belief in the club’s importance, stating that Juventus is more than just a football team; it represents a cultural and sporting identity that has inspired loyalty among fans worldwide.

Featured image from DALL-E, chart from TradingView.com

Related Articles

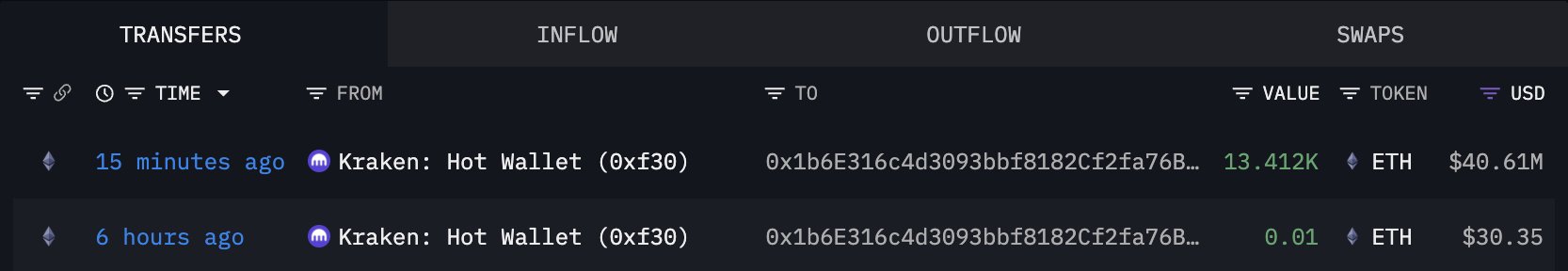

BitMine Doubles Down on Ethereum With $40M Accumulation

Ethereum is currently trading above the $3,000 level, offering a surface-level s...

Crypto Theft Hides In Plain Sight Inside Popular Game Mods—Kaspersky

Kaspersky has warned that a new infostealer called “Stealka” is bein...

Here’s Why The XRP Price Will Shine In The New Year

XRP has spent the past few weeks on a downtrend after a bullish cycle earlier in...

Bitcoin Is Entering A Window For A Santa Rally, Analyst Says

Bitcoin might be stumbling into a very seasonal setup, not because Santa is real...