XRP ETFs Attract $756M as Price Slides Toward $2, Meme Traders Rotate Into Maxi Doge

Alex Smith

2 weeks ago

What to Know:

- XRP ETFs, attracting hundreds of millions, while the token drifts toward $2, signal a quiet transfer of supply from retail to institutions.

- Divergences between ETF inflows and spot price often push smaller traders toward higher‑beta meme plays in search of asymmetric upside.

- Meme tokens are evolving into trading-centric communities with games, leaderboards, and incentives, rather than just static dog logos and passive holders.

- Maxi Doge targets leverage‑obsessed retail with a 240‑lb gym‑bro mascot, 1000x energy culture, and competitive, community‑driven trading tournaments.

Sometimes crypto sends mixed signals, and this is one of those moments.

XRP spot ETFs have quietly absorbed about $756M in cumulative inflows even as the token drifts toward the $2 range. On the surface, it seems contradictory: prices are sliding, while regulated products steadily absorb the supply.

But for allocators, the divergence is perfectly rational. ETFs let funds scale exposure without touching exchanges, pulling liquidity from long-suffering retail holders eager to derisk after a punishing multi-year grind.

What retail reads as ‘weakness’ is often just order flow transferring from impatient sellers to institutional balance sheets.

And we’ve seen this dynamic before. When institutions buy dips through compliant wrappers, degen capital almost never follows them into KYC funnels. Instead, it rotates into pure upside, hunting spots where a few thousand dollars can still shift the entire market cap.

That’s where meme-beta comes back into play. As capital migrates out of direct XRP and into ETFs, traders are scanning for narrative-charged microcaps with real volatility potential.

Meme contenders like Maxi Doge ($MAXI) are increasingly popping up on watchlists, not because they’re ‘safe,’ but because they offer what ETFs never will: the chance at 10x, not 10%.

How ETF Accumulation Rewires Retail Risk Appetite

The XRP structure is a textbook case of institutional-retail divergence. ETF inflows signal long-horizon conviction, yet the spot chart grinds lower, pushing smaller holders toward capitulation. For many retail wallets, that exit liquidity becomes fresh ammo for the next speculation cycle.

Historically, that rotation never returns to sleepy large caps. It flows into the highest-beta corners of the market, meme tokens, trading tribes, and micro-caps, where a five-figure punt can actually move the needle. Dogecoin, Shiba Inu, and Pepe all surged on earlier waves of capital fleeing blue-chip boredom for volatility.

But meme markets aren’t the wild west they used to be. Competition is fierce. New entrants lean into trading culture, on-chain games, real utility, and social leaderboards, not just another dog mascot.

Turbo, Floki, and similar projects now fight for attention by building communities around distinct identities: degenerates, gamers, options addicts, stat-nerds.

Inside that landscape, Maxi Doge is carving out its lane as the meme avatar for hyper-aggressive traders, a gym-bro, 240-lb canine built around 1000x-leverage energy and ruthless PnL flexing.

For traders rotating out of slow-bleeding majors, it slots neatly onto the high-risk, high-reward menu, right alongside other meme ecosystems competing for the next cycle’s volatility flow.

Why Maxi Doge Targets the Leverage-Obsessed Retail Gap

Under the memes, Maxi Doge is tapping into a very specific retail pain point: most traders don’t have whale-level capital or discipline, but they still want whale-sized returns.

Instead of pretending that the average user will suddenly become a methodical swing trader, $MAXI leans directly into the reality of leverage and builds its entire culture around it.

The project presents itself as a 240-lb, gym-bro canine built on 1000x mentality, the same mindset traders chase when hunting for the next 1000x crypto, and then hardwires that persona into on-chain incentives.

Holder-only trading competitions, seasonal ROI leaderboards, and public PnL flexing turn degen behavior into a structured game, where bragging rights, prizes, and social pressure reinforce the ‘never skip leg day, never skip a pump’ ethos.

However, unlike memes that stop at a logo and Discord, Maxi Doge incorporates yield mechanics and treasury strategy. Stakers currently access a 72% APY via daily auto-distributions from a dedicated 5% staking pool for up to a year.

Meanwhile, the Maxi Fund treasury focuses on liquidity, partnerships, and futures integrations, designed to fuel these competitions and keep the ecosystem active.

Early metrics show that positioning is resonating. The presale has raised over $4.2M so far, with tokens priced at $0.000271. Smart money isn’t ignoring it either: two high-net-worth wallets accumulated $503K in recent weeks, including a single $251K buy.

For traders looking to get involved early, the process is straightforward. Our full guide on how to buy $MAXI walks through wallet setup, network selection, and how to join the presale before allocations increase.

Always DYOR, understand the risks, and never allocate more than you can afford to lose when speculating on $MAXI or any meme asset.

Related Articles

Ethereum Market Structure Strengthens: Binance Netflows Point to Long-Term Conviction

Ethereum is attempting to reclaim the $3,000 level after showing pockets of bull...

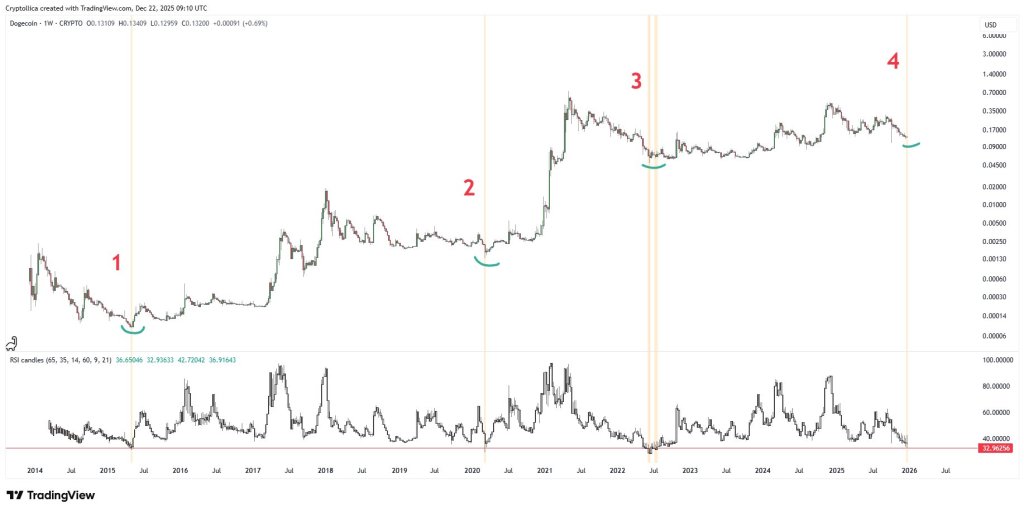

Dogecoin Weekly Fractal Hints At A Bigger Move Brewing

Dogecoin is doing that thing again, not pumping, not capitulating, just sitting...

Bitcoin Price Remains Stuck Inside This Range, But A Breakout Could Follow

Bitcoin’s price action in recent days has been characterized by tight consolidat...

Saylor Sparks Bitcoin Speculation With ‘Green Dots’ Signal

Michael Saylor’s brief post on X that showed “green dots” ahead of orange dots h...