Billionaire Entrepreneur Says Bitcoin Price Crash Is A Gift, Here’s Why

Alex Smith

7 hours ago

A sudden drop in the Bitcoin price wiped billions from the crypto market in a matter of hours, triggering panic among traders and forcing many leveraged positions to close. While most investors focused on the losses, a billionaire entrepreneur took a very different view, calling the crash a gift rather than a setback. His reasoning explains why sharp price corrections are sometimes welcomed by experienced market participants.

Why A Violent Bitcoin Price Pullback Can Strengthen The Market

The price decline unfolded at the end of January 2026, when the Bitcoin price dropped from levels near $83,000 to lows around $77,000, marking a decline of more than 5% in a single move. The drawdown triggered over $2.4 billion in liquidations, with long positions accounting for the majority of forced exits. This was not a slow repricing but a leverage-driven flush, visible both in liquidation data and the Bitcoin price chart, which showed a swift breakdown followed by an early-stage rebound toward the $78,500 area.

Barry Silbert, founder of Digital Currency Group, publicly described the crash as a “gift from the gods,” arguing that such events play a functional role in Bitcoin’s market cycle. His view centers on the idea that excessive leverage and speculative positioning create fragility. When price stretches too far, too fast, the market becomes vulnerable to cascading liquidations. The resulting correction resets positioning, removes weak hands, and restores healthier market conditions.

From a structural standpoint, the crash acted as a stress test. It exposed overextended traders, reduced open interest, and recalibrated risk across derivatives markets. Rather than signaling systemic weakness, the move reinforced Bitcoin’s tendency to self-correct after periods of aggressive upside momentum. Bitcoin’s current price action supports this interpretation, showing stabilization after the initial sell-off instead of continued free fall.

Long-Term Conviction Versus Short-Term Pain

The correction also pushed the Bitcoin price below the average cost basis of some of its most visible institutional holders. Strategy founder Michael Saylor briefly saw his firm’s Bitcoin holdings dip below a cost level of approximately $76,037, a situation not seen since October 2023. Instead of signaling concern, Saylor responded symbolically by sharing an AI-generated image of himself running a marathon, reinforcing a long-term mindset rather than reacting to short-term volatility.

This reaction aligns with Silbert’s broader thesis. Both figures frame sharp price declines as part of Bitcoin’s maturation rather than a systemic failure, reinforcing the idea that volatility is a structural feature of an emerging asset still finding fair value. While retail traders faced immediate losses, the market ultimately emerged in a healthier state, with excess risk flushed out, speculative pressure reduced, and price stabilizing instead of spiraling lower. From that standpoint, the move functioned as a necessary reset, not a breakdown.

In that context, calling the drop a “gift” is less about celebrating losses and more about recognizing that sustainable uptrends are built on cleared excess, disciplined positioning, and long-term conviction rather than unchecked momentum.

Related Articles

Trump Crypto Deal Triggers JPMorgan Risk Debate After $500M Abu Dhabi Stake Revelation

A reported $500 million investment by an Abu Dhabi royal into a Trump-linked cry...

Bitcoin Mining Takes New Turn With Tether’s Open-Source Software

Tether, the company behind the dominant stablecoin USDT, has put a full Bitcoin...

UAE Puts Diamonds On The XRP Ledger: $280 Million+ Now On-Chain

Ripple says more than AED 1 billion (over $280 million) of certified polished di...

Bitcoin Holds $78K Amid Signs Of Economic Recovery: Analysts

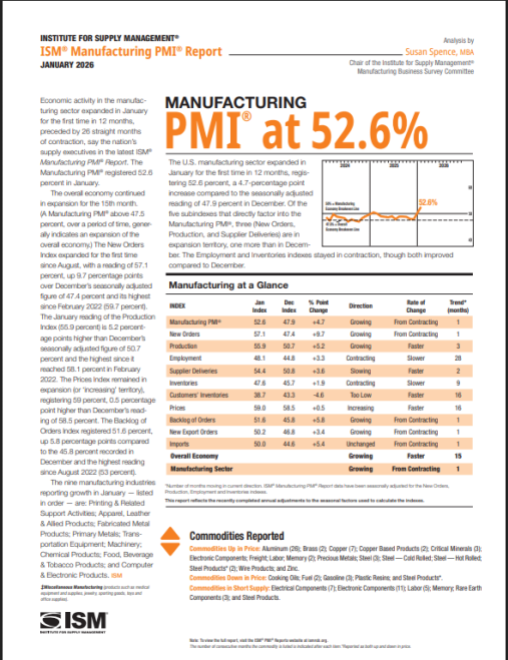

A surprise uptick in a key factory gauge has traders rethinking risk, while cryp...