Bitcoin Cycle Defined by Demand, Not Price: CryptoQuant Head Says

Alex Smith

1 month ago

Head of research at on-chain analytics firm CryptoQuant has explained how demand makes the basis of a Bitcoin cycle, rather than price performance.

Bitcoin Apparent Demand Has Been Declining Recently

In a new post on X, CryptoQuant head of research Julio Moreno has talked about Bitcoin cycles from a different lens. “Most are focusing on price performance to define a cycle, when it is demand what they should be looking to,” noted Moreno.

The analyst has gauged the “demand” for the cryptocurrency using the Apparent Demand indicator, which compares the daily miner issuance against the changes in the 1-year dormant supply.

The first of these, the miner issuance, is the amount that miners are “minting” on the network every day by receiving block rewards. This metric essentially reflects the “production” of the asset. The 1-year inactive supply, on the other hand, can be thought of as the cryptocurrency’s “inventory.”

Thus, the Apparent Demand basically compares the production of Bitcoin against changes taking place in its inventory. Below is the chart shared by Moreno that shows the trends in the 30-day and 1-year versions of the Apparent Demand over the past decade.

As is visible in the graph, the last few Bitcoin cycles have all transitioned into a bear market when the Apparent Demand has plunged into the negative region on both the monthly and yearly timeframes.

In the current cycle, the 30-day Apparent Demand has plunged into the red zone recently, suggesting that the monthly demand for the asset has been negative.

On the annual scale, the metric is still at a positive level, but its value has been following a downtrend. If this decline keeps up, it won’t be long before the indicator has dipped into the negative territory.

Considering the pattern from the previous cycles, the current structure in the Apparent Demand is certainly looking bearish. It only remains to be seen, though, whether the yearly version of the metric will cross into the red zone or if it will rebound, signaling the return of demand.

Spot demand isn’t the only way to measure Bitcoin demand these days. With the advent of exchange-traded funds (ETFs), there has been some fresh off-chain demand coming into the cryptocurrency this cycle.

As on-chain analytics firm Glassnode has talked about in an X post, the 30-day netflow related to the US BTC spot ETFs has remained in the negative zone recently, indicating demand has been muted in this side of the market as well.

BTC Price

Bitcoin has taken to consolidation recently as its price is still floating around the $88,000 level.

Related Articles

Bitcoin Social Sentiment Stays Bearish Even As Price Recovers From $60,000 Drop

Data shows the social media sentiment around Bitcoin has remained deeply bearish...

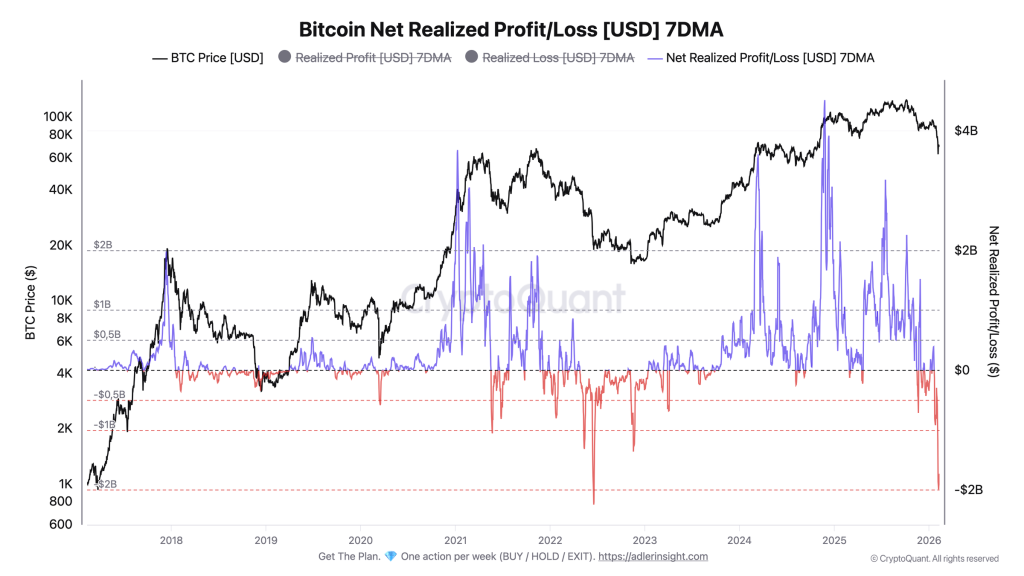

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...

Bitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Bitcoin is facing renewed selling pressure after losing the key $70,000 level, a...

XRP Slips 4% Amid Policy Uncertainty, but Analysts Say a Major Move Is Brewing

XRP’s price has drifted lower this week, slipping roughly 4.5% and trading below...