Bitcoin Enters Decision Phase, But What Does It Mean For The Crypto Market?

Alex Smith

1 month ago

Bitcoin (BTC) is showing early signs of hesitation after a strong upward move, positioning the market at a critical decision phase. A crypto analyst has shared details on whether the current pause reflects healthy consolidation or a shift in momentum that could influence the broader crypto market.

A recent analysis by crypto analyst Tony Severino shows that Bitcoin is entering a critical decision phase, with price action indicating a maturing trend. His chart highlights a robust upward structure that has begun to slow, signaling a shift in market behavior rather than an immediate price reversal. Notably, this moment is significant not just for Bitcoin but for the broader crypto market, which often follows its lead.

Crypto Market Next Move As Bitcoin Hits Key Phase

Severino’s chart illustrates a steady climb in Bitcoin’s price, marked by higher highs and measured pullbacks, indicating that buyers have largely been in control. However, recent candles show slower momentum and smaller bodies, suggesting that BTC’s bullish strength is starting to waver. The analyst has stated that the market is currently testing whether buyers still have the strength to push prices to upper levels or if Bitcoin’s upward move has run its course.

Related Reading: Economist Blasts Strategy’s Bitcoin Bet, Despite $8 Billion Profits, Here’s Why

Another key feature of the chart is the Doji candle forming near the top of the trend. Severino notes that this candle should not be interpreted as a sell signal, but rather an acknowledgement by the market that Bitcoin’s upside certainty has ended. The candle is also viewed as an early sign of hesitation, with multiple market outcomes possible.

Severino explained that the market could enter a period of digestion, where Bitcoin’s price consolidates while maintaining a larger uptrend. Alternatively, the pause could signal distribution, with stronger hands beginning to transfer risk as BTC’s momentum fades.

Another possibility is a final push higher driven by renewed conviction and late-cycle momentum. In that scenario, Bitcoin could break out of its current slowdown and extend gains before any new correction. Notably, Severino’s chart analysis does not confirm which path the market could ultimately take, only that the next sequence is expected to be decisive.

Bitcoin Price Faces Potential Decline To $35,000

In a separate post, crypto market expert Lofty warned that Bitcoin could extend its downtrend, potentially triggering a deeper price crash. He pointed out striking similarities between the current BTC cycle and the 2021 bull run, highlighting a Double Top pattern that has preceded a significant price drop in the past cycle.

According to Lofty, if Bitcoin follows its historical four-year trend, its price could collapse to $35,000 within the next two weeks. Notably, the cryptocurrency has already completed its Double Top formation and is showing early signs of a prolonged downtrend. If the price declines to $35,000, it would represent a more than 60% drop from its current value of over $88,500.

Related Articles

Bitcoin Social Sentiment Stays Bearish Even As Price Recovers From $60,000 Drop

Data shows the social media sentiment around Bitcoin has remained deeply bearish...

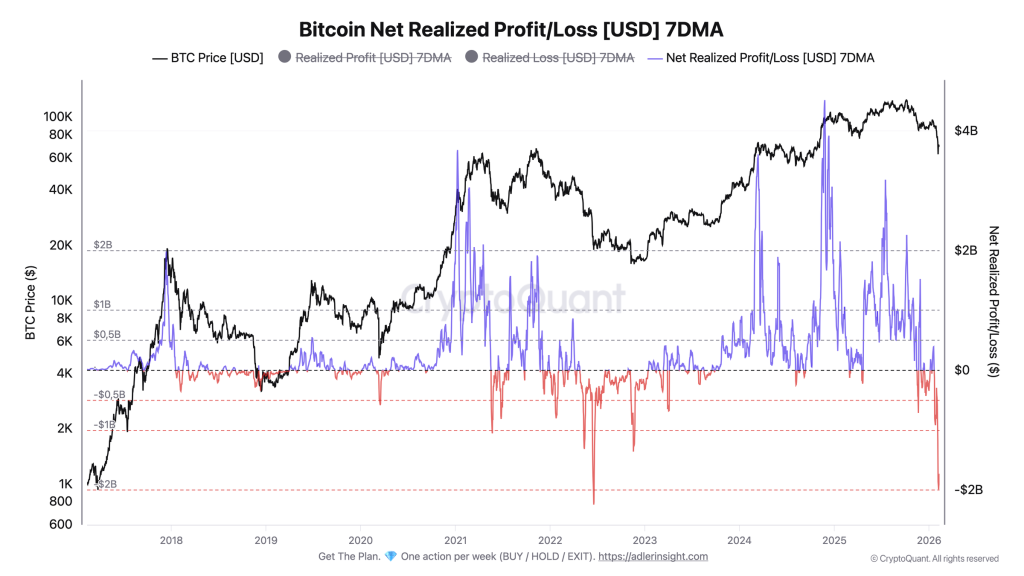

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...

Bitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Bitcoin is facing renewed selling pressure after losing the key $70,000 level, a...

XRP Slips 4% Amid Policy Uncertainty, but Analysts Say a Major Move Is Brewing

XRP’s price has drifted lower this week, slipping roughly 4.5% and trading below...