Bitcoin Rally Reflects Buyer Conviction On Coinbase Spot Markets, Bull Run Back On?

Alex Smith

3 weeks ago

The recent Bitcoin rally may be driven by real spot demand on Coinbase. Data indicating elevated spot activity on Coinbase suggests that this move higher is bolstered by direct purchases rather than leveraged positioning in derivatives markets. This distinction matters because Spot buying reflects a real capital commitment, not a temporary bet.

Why Risk Management When Demand Is Structural

The Bitcoin rally since Sunday’s Powell subpoena news has been largely linked to Coinbase spot buyers. Crypto trader Alex Krüger has highlighted on X that both the Adjusted Coinbase Premium and Cumulative Volume Delta (CVD) show steady spot accumulation, which is exactly why this has been a true hated rally even among bitcoiners. For over a month, the dominant narrative in every crypto chat room has been that BTC is lagging while equities and commodities are moving upward.

However, the fun fact is that equities are not accurate, but 40% of the S&P 500 (Standard & Poor’s 500) stocks have actually closed red in 2025, (39.2% to be precise). Perception is doing a lot of work here, and the United States Department of Justice (DOJ) move on Powell represented a major macro litmus test for BTC. Kruger claims that the BTC long-term value proposition is about protecting against the tail risk of central bank profligacy.

On Monday, BTC surged upward, although the move was just a little surge. According to Krüger, the BTC key battlefield remains the 50-week moving average (WMA), which is currently around $101,420. Meanwhile, the trader is looking to take some profits into short liquidations right above the $100,000 mark.

Why Bitcoin Benefits First From Institutional Flows

The Digital Asset Market Clarity Act is set for markup today, January 15th, 2026, in the Senate Banking Committee. According to the update by BTC_road_to200k on X (Formally Twitter), this is where the lawmakers will debate and shape the final version of the bill before it moves forward.

This matters because the art aims to clear up the ongoing regulatory uncertainty between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), which has been a major source of hesitation for large institutional players looking to move into Bitcoin and other digital assets.

Furthermore, the Clarity Act will be a turning point as it aims to clear rules that will bring more confidence to banks, pension funds, and large investors, which often translates into higher demand and stronger price momentum for BTC. As the regulatory clouds lift, the market might start experiencing a renewed wave of institutional money flowing in, and that’s obviously bullish for BTC.

Related Articles

LayerZero (ZRO) Soars 40% Amid Zero Blockchain Debut, Major Institutional Backing

ZRO, the native token of the omnichain interpretability protocol LayerZero, has...

Bitcoin Social Sentiment Stays Bearish Even As Price Recovers From $60,000 Drop

Data shows the social media sentiment around Bitcoin has remained deeply bearish...

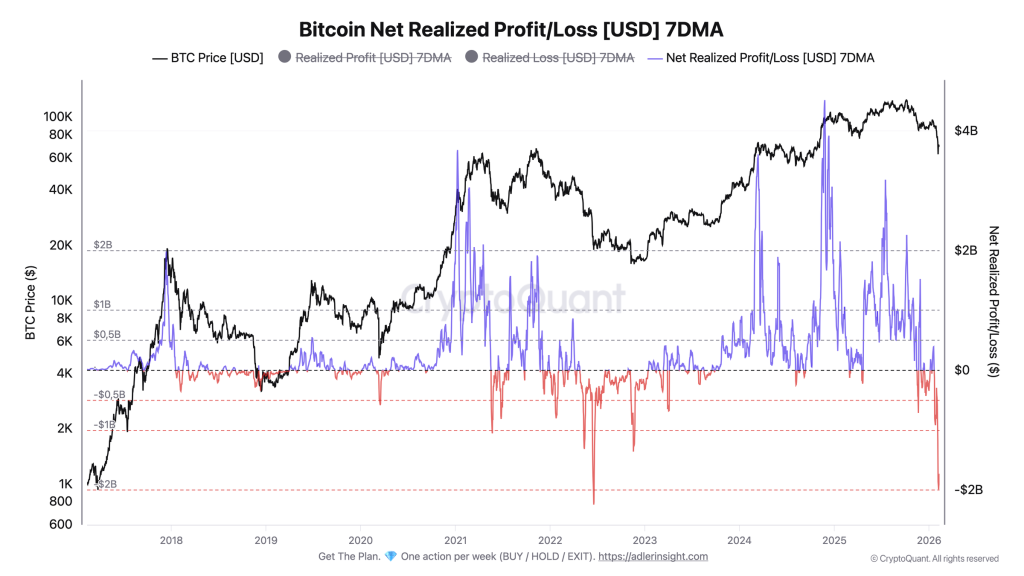

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...

Bitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Bitcoin is facing renewed selling pressure after losing the key $70,000 level, a...