Bitcoin Trapped In Post-Breakdown Compression, A Violent Move Brewing?

Alex Smith

1 month ago

Bitcoin is stuck in a tight consolidation after its sharp rejection from the $100,000 region, with price compressing into a narrow range that reflects growing market tension. As momentum builds beneath the surface, attention is focused on a decisive breakout or breakdown that could define Bitcoin’s next major move.

Bitcoin Trapped In Post-Breakdown Compression

According to analyst CyrilXBT, Bitcoin remains mired in a period of intense price compression following its significant breakdown from the $100,000 threshold. This cooling-off phase reflects the market’s attempt to stabilize after being rejected at a historic milestone, resulting in a loss of immediate upward momentum.

The current technical structure is defined by a series of lower highs, which are effectively squeezing the price into an increasingly narrow corridor. This tightening action is concentrated around the $88,000 to $90,000 range. It creates a high-pressure environment where the asset is searching for its next definitive directional catalyst.

CyrilXBT characterizes this current behavior as “classic post-distribution chop,” a phase typically followed by a period where large holders exit positions, leading to erratic sideways movement. It also serves as a necessary reset before a new trend can be established.

Looking forward, the market is approaching a period of increased volatility that could resolve in two ways. Bitcoin will either stage a bullish breakout through the descending trendline or undergo a final “flush” to the downside, wiping out over-leveraged long positions. Ultimately, this consolidation serves as a strategic battleground to determine which market participants will be shaken out before the next major move.

Price Compression Signals A Bigger Move Ahead

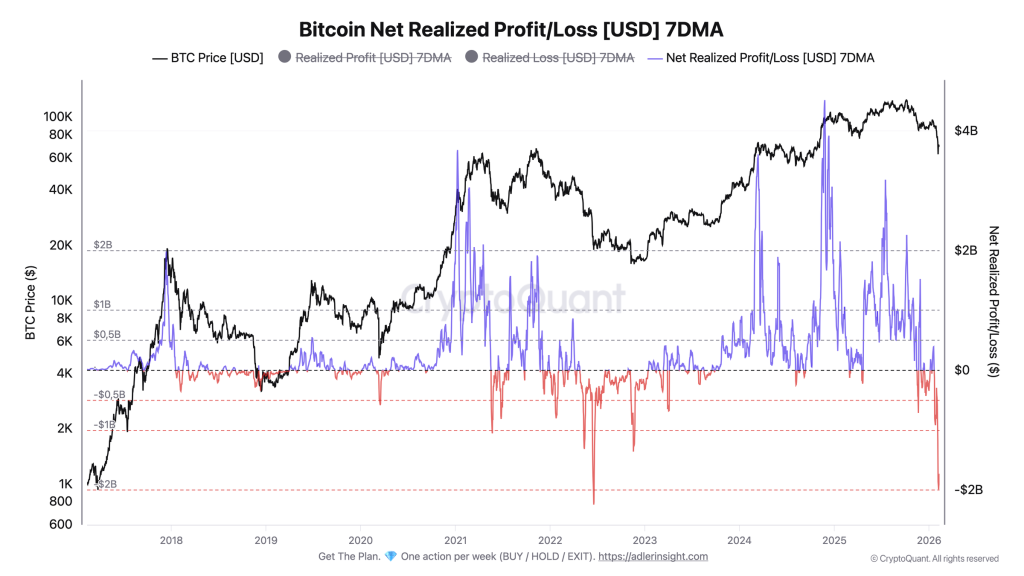

In a market assessment, Daan Crypto Trades observed that despite the ongoing sideways movement, Bitcoin’s underlying market health remains stable. Specifically, both the BTC funding rates and the spot premium have held their ground, suggesting that the current chop hasn’t yet led to the massive de-leveraging or sentiment shifts often seen during volatile corrections.

As Bitcoin remains compressed within this range, a major volatility expansion is highly likely. Based on current trends, a decisive move is expected to materialize within the next one to two weeks as the market reaches a breaking point in its consolidation.

The primary recommendation during this uncertain phase is to exercise patience and wait for a confirmed breakout rather than attempting to trade every minor fluctuation. By avoiding the temptation to over-leverage in the middle of this range, traders can protect their capital and wait for clear confirmation of the next trend.

Related Articles

Bitcoin Social Sentiment Stays Bearish Even As Price Recovers From $60,000 Drop

Data shows the social media sentiment around Bitcoin has remained deeply bearish...

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...

Bitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Bitcoin is facing renewed selling pressure after losing the key $70,000 level, a...

XRP Slips 4% Amid Policy Uncertainty, but Analysts Say a Major Move Is Brewing

XRP’s price has drifted lower this week, slipping roughly 4.5% and trading below...