Bitcoin Value Days Destroyed Reaches Lowest Point Of The Current Cycle, A Structural Calm?

Alex Smith

1 month ago

With bullish sentiment returning to the market, Bitcoin is demonstrating renewed upward momentum, allowing it to retest the $94,000 price level last seen in early December 2025. Despite the recent rebound in BTC’s price, several key metrics are down, showing that on-chain activity is trending in a different direction.

Cycle-Low Bitcoin VDD Hints At Minimal Coin Movement

Bitcoin’s price is gradually undergoing a recovery, but its on-chain action is moving into an unusually subtle phase. This divergence is observed in the recent performance of the Bitcoin Value Days Destroyed (VDD) metric, which has fallen sharply.

It is worth noting that the BTC VDD is a method of measuring long-term holders’ activity similar to the BTC Coin Days Destroyed (CDD) metric, but including a valuation component. In other words, it allocates a value based on the price of Bitcoin at the time the UTXO is spent, in addition to the number of holding days lost.

In this case, VDD is expressed as a ratio to evaluate its velocity in relation to its annual average. Furthermore, the ratio between the annual average and the monthly average helps to position current activity in relation to the annual norm.

After examining the BTC VDD metric, Darkfost, a market expert and CryptoQuant author, noted that the metric has fallen to historical low levels for this market cycle. According to the expert, this shift comes following a period of heavy long-term holder distribution that has now significantly declined.

As seen in the chart, the market is now entering a period in which the VDD has dropped sharply and is now at extremely low levels relative to its annual average. This trend indicates a huge decline in selling pressure from long-term BTC holders.

With the metric at 0.55, the current VDD is roughly twice the annual average. Such levels have repeatedly been observed following significant corrections in the ongoing cycle. Interestingly, this suggests that long-term holders are presently choosing to hold onto their coins at current price levels.

BTC’s Upward Trend Is Still Intact

The price of Bitcoin experienced a brief pullback as Tuesday drew to a close, which raised questions about its price stability. Amid this discussion, Milk Road, a crypto and macro researcher, has offered insights into BTC’s current price action, highlighting that the market is still bullish.

Milk Road’s objective is based on a multi-year Ascending Channel pattern. According to the expert, BTC has been moving inside the upward channel since 2022, making higher highs and higher lows.

While the recent drop pushed BTC’s price toward the bottom of the upward channel, the support line held strong, leading to a bounce. Following the bounce, Bitcoin formed another higher low, which is the line that is keeping the upward trend intact. Therefore, unless BTC goes below that range, the larger pattern is still heading higher despite the fact that the price has been sideways for months.

Related Articles

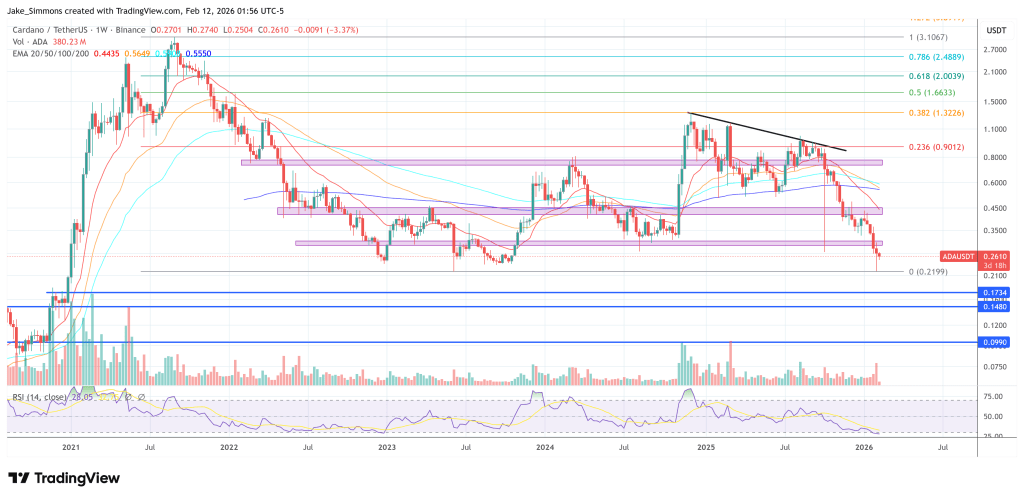

3 Major Cardano Announcements Just Landed: The Breakdown

Three Cardano ecosystem announcements landed onstage at Consensus Hong Kong yest...

Denmark’s Largest Bank Adds Bitcoin, Ethereum ETPs, But Warns Of ‘High Risk’

Danske Bank has started offering Bitcoin and Ethereum ETPs to customers for the...

BlockFills Freezes Client Funds — Is Another Crypto Crisis Unfolding?

BlockFills, a Chicago‑based cryptocurrency trading and lending firm that caters...

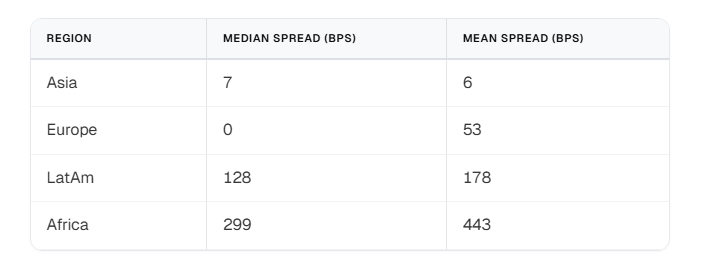

Stablecoins See Largest Conversion Spreads In Africa, Research Shows

Africa’s promise of cheaper remittances via stablecoins is clashing with reality...