Bitcoin’s Network Growth Just Reached Extreme Levels Last Seen Before The 2021 Surge

Alex Smith

6 hours ago

Bitcoin’s on-chain fundamentals are flashing a powerful signal that hasn’t appeared since the last major bull run. Network Growth has surged to extreme levels, mirroring the same conditions seen in early 2021, just before BTC launched its historic rally toward new all-time highs. At the same time, liquidity is rapidly expanding across the market, suggesting fresh capital is flowing in.

Rising Network Adoption Strengthens Long-Term Bull Thesis

The last time Bitcoin’s network growth and liquidity reached comparable extreme levels was in 2021, just ahead of BTC’s final surge to a new all-time high. Swissblock revealed on X that these metrics are now showing signs of recovery, signaling that a final bullish phase may be forming.

However, the current divergence and rising metrics alongside the declining price action suggest that investors are re-entering the market primarily to sell. The critical question is whether this renewed participation can persist long enough to allow the market to stabilize. If Network Growth and Liquidity continue to expand sustainably, they could provide the fundamental catalyst for one last upside push before the cycle concludes.

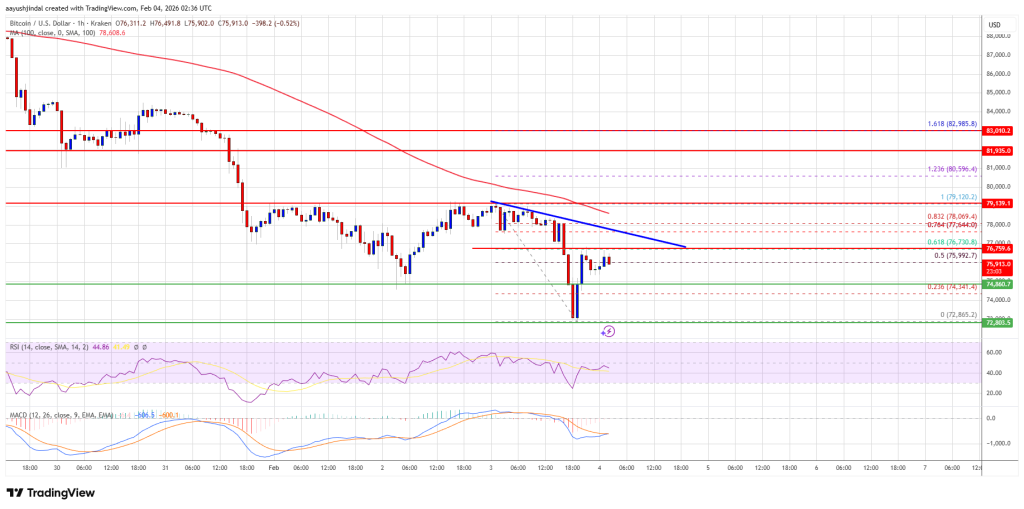

FUD has intensified across social media following Bitcoin’s roughly 16% decline since January 28. Santiment has highlighted that after briefly dipping to around $74,600, BTC has rebounded toward $78,300, a move largely attributed to retail selling assets. This behavior is proof that markets move in the opposite direction of the crowd’s narrative.

Social sentiment has turned sharply negative, with social data indicating this is the most bearish that retail has seen since the November 21st crash. Historically, periods of extreme negativity like this have been followed by a short-term relief rally, and early price action suggests this bounce is beginning to resemble the previous two post-FUD recoveries.

How Next Cycle Leg Could Push Bitcoin To $104,000

Market expert and investor, The Milk Road, who previously nailed Bitcoin’s drop from its all-time highs, is now predicting a potential 40% gain starting immediately. According to Milk Road, BTC could still experience a correction ranging from -20% to -77% before the next major pivot, which is projected between November 19 and February 2. A shallow 20 to 34% drop seems unlikely. Locally, it should be more than that but smaller than 77%.

Furthermore, BTC fell roughly -40% between its October 6, 2025, ATH and February 2, a move consistent with prior cycle behavior. Milk Road’s yearly cycle analysis signals a key pivot around February 2, after which BTC could stage a +40% rally, potentially reaching $104,000 between now and September.

Related Articles

Bitcoin Price Bounce Looks Hollow, Downtrend May Resume

Bitcoin price extended its decline below $75,000. BTC is now attempting to recov...

Bitcoin LTH Profit-Taking Collapses: Is Smart Money Done Selling?

Bitcoin continues to trade below the $80,000 level as the market remains under s...

Is Dogecoin Still Worth Investing In? DOGE Rally Sparks Debate Over Long-Term Value

Triggered by market performance, Dogecoin (DOGE) is once again at the center of...

Solana Returns To A Critical Demand Zone — Trend Reload Or Breakdown Risk?

Solana has pulled back into a key demand zone, a level that could determine whet...