BitMine Goes Shopping As Ethereum Dips: $140M Buy Spotted On-Chain

Alex Smith

1 month ago

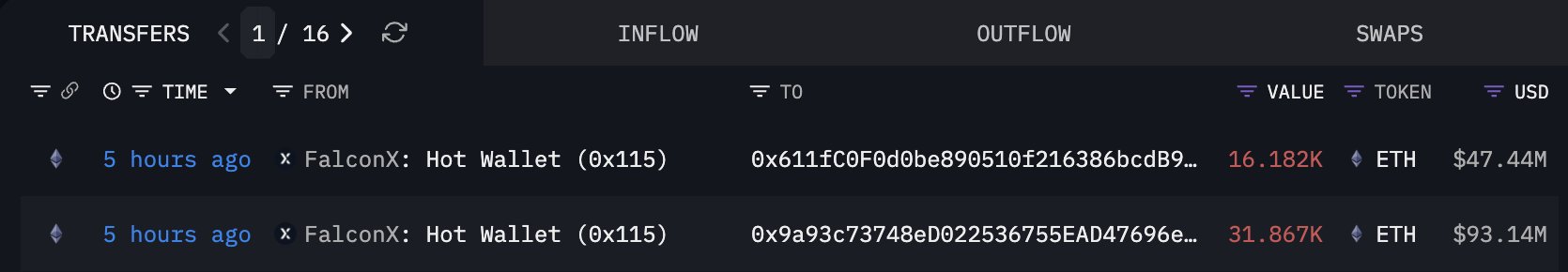

Two massive Ethereum transactions have just flowed out from FalconX, with Lookonchain linking them to ETH treasury company BitMine.

BitMine Has Received 48,049 Ethereum From FalconX

In a new post on X, on-chain sleuth Lookonchain has pointed out how BitMine appears to have acquired 48,049 ETH from a hot wallet connected to FalconX, an institutional digital asset trading platform.

The coins transferred through two transactions to two different wallets. The larger transfer involved 31,867 ETH, while the smaller one 16,182 ETH. In total, the tokens were worth about $140.58 million at the time that they were transacted.

The moves have come as Ethereum has plunged alongside the wider cryptocurrency sector, with its price dropping below the $3,000 level. Thus, it would appear possible that they are a sign of BitMine buying the dip.

Originally a Bitcoin mining-focused company, BitMine transitioned to being an Ethereum treasury vehicle under the leadership of chairman Tom Lee in June of this year. Since then, the firm has rapidly accumulated the cryptocurrency and has established itself as the “Strategy” of ETH.

On Monday, BitMine published a press release announcing that its holdings reached 3,967,210 ETH. So far, the company hasn’t made any official announcement of the latest buy, but if confirmed, it would take the total reserve past the 4 million ETH milestone.

The firm has set a target of 5% of the total circulating Ethereum supply. At present, the company still has some ways to go before this goal is hit, but at about 3.3% of the supply now sitting in its wallets, it has certainly made significant progress.

With holdings valued at more than $11 billion, BitMine is the second-largest cryptocurrency corporate holder in the world, only behind Strategy. Unlike Michael Saylor’s firm, however, the Ethereum hoarder has its treasury sitting in the red right now. Nonetheless, if the two blockchain transactions correspond to purchases, then it’s a sign that BitMine is still committed to accumulating more.

CryptoQuant community analyst Maartunn has talked in an X post about how the Ethereum price has changed since BitMine started its accumulation spree. It’s visible in the chart that during the initial buying period, ETH witnessed some rapid growth.

Clearly, however, despite continued buying from the treasury company, the asset’s price first flatlined and then declined. “Big buys ≠ sustained momentum,” noted the analyst.

ETH Price

Ethereum managed to make a recovery to $3,400 last week, but the coin has once again gone through bearish momentum since then, as its price has returned to the $2,930 level.

Related Articles

Ripple CEO Says XRP Will ‘Always Be Top of Mind’ Ahead of XRP Community Day

Ripple CEO Brad Garlinghouse has reaffirmed that XRP remains a top priority for...

Ethereum On Discount: On-Chain Tracker Flags Massive ETH Buys After Price Crash

Ethereum’s (ETH) latest price crash is triggering aggressive capital rotation fr...

Binance Founder CZ Reveals How Bitcoin Turned Him Into A Billionaire

Changpeng “CZ” Zhao says his path to crypto wealth started far from trading floo...

Bithumb Blames System Flaws For $40 Billion Bitcoin Giveaway

South Korean crypto exchange Bithumb has said that system flaws were the reason...