Crypto Exchange Binance To Assist Pakistan In Tokenizing $2 Billion In Government Bonds

Alex Smith

1 month ago

As Pakistan continues to deepen its involvement in the digital asset landscape, the country has signed a memorandum of understanding (MoU) with crypto exchange Binance, aiming to explore the tokenization of up to $2 billion in sovereign bonds, treasury bills, and commodity reserves to enhance liquidity and attract foreign investors.

$2 Billion Asset Tokenization Initiative

According to Reuters, the agreement sets the stage for a potential collaboration focused on allowing the tokenization and blockchain-based distribution of various real-world assets (RWAs) held by the Pakistani government.

These assets may include sovereign bonds, treasury bills, and a range of commodity reserves such as oil, gas, metals, and other raw materials.

The country’s finance ministry, Muhammad Aurangzeb, indicated that while the initiative could involve assets valued at up to $2 billion, final approval is still pending. The goal is to improve liquidity, transparency, and access to international markets for these assets.

Aurangzeb remarked that the memorandum of understanding signifies Pakistan’s commitment to a reform-oriented economic trajectory and establishes a long-term partnership with Binance.

Binance founder Changpeng Zhao expressed optimism about the agreement, calling it “a great signal for the global blockchain industry and for Pakistan.” He suggested that this partnership marks the beginning of a significant shift toward fully implementing the tokenisation initiative.

PVARA Provides Initial Clearance For Binance And HTX

In addition to this MoU, Pakistan has granted initial clearance for Binance and cryptocurrency exchange HTX, to register with local regulators as part of their efforts to establish domestic subsidiaries. This step allows both companies to prepare applications for full exchange licenses.

The Pakistan Virtual Assets Regulatory Authority (PVARA) provided these early approvals after assessing the governance and compliance frameworks of both platforms.

Chairman Bilal bin Saqib indicated that these clearances initiate Pakistan’s phased licensing process, emphasizing that the strength of compliance will play a crucial role in determining which exchanges will proceed.

This move comes as Pakistan accelerates its digital finance overhaul, which has included the formation of the Pakistan Crypto Council and the establishment of the PVARA, alongside the drafting of a formal licensing regime.

As Bitcoinist reported at the time, Pakistan’s growing involvement in digital assets drew the attention of industry leaders such as Michael Saylor, co-founder of the Bitcoin proxy firm Strategy, who praised the country’s efforts and described it as a sign that the country understands how to handle this new market.

Notably, Pakistan ranks as the world’s third-largest cryptocurrency market by retail activity, according to Saqib. The government is also planning a pilot program for a central bank digital currency (CBDC) and a comprehensive Virtual Assets Act.

At the time of writing, the exchange’s native cryptocurrency, Binance Coin (BNB), is trading at $878, down 35% from all-time highs just above $1,369.

Featured image from DALL-E, chart from TradingView.com

Related Articles

Here’s Why The XRP Price Has Been In A Consistent Downtrend Since 2025

On-chain data from Glassnode has unveiled the reason why the XRP price has been...

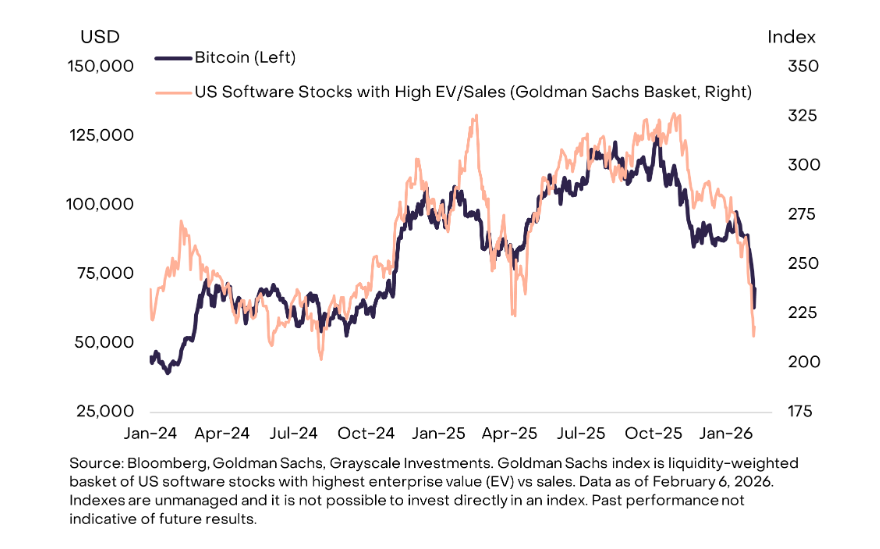

Bitcoin Moves With Tech, Not Precious Metals, Analysts Find

Bitcoin’s image as a steady store of value is being tested. What once was talked...

XRP ‘Looks Different’ This Cycle, Targets No. 2 Spot: Crypto Analyst

Crypto Insight UK director Will Taylor argued in a new video that XRP is “tradin...

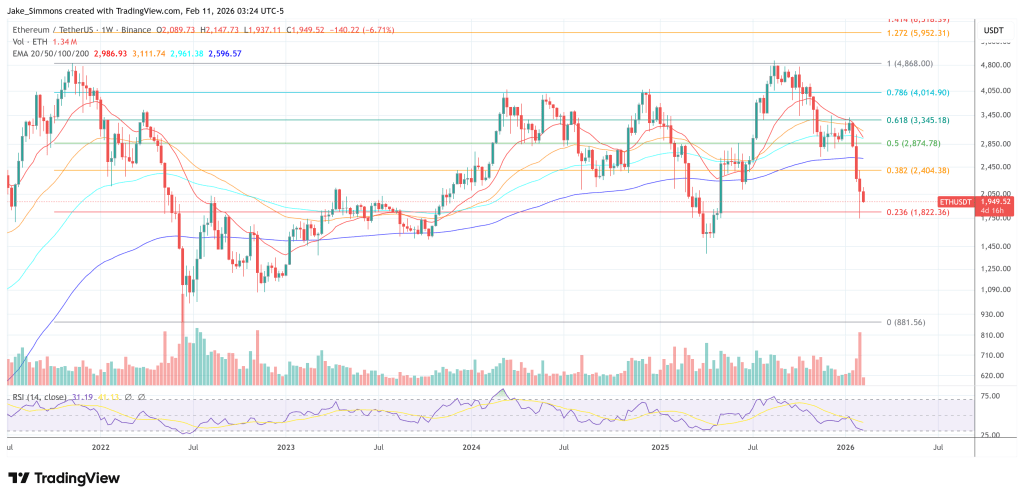

Ethereum ETF ‘Diamond Hands’ Face Their Harshest Test At $2,000

Ethereum ETF investors are sitting on a far uglier entry point than their bitcoi...