Crypto Market Dips: The Reasons Behind Bitcoin Plunge Below $90,000 Despite FOMC Optimism

Alex Smith

1 month ago

On Thursday, Bitcoin (BTC) once again fell below the critical $90,000 mark, even after what many had anticipated to be a bullish event stemming from the US Federal Reserve’s (Fed) decision to cut rates by a quarter point. Analysts from Bull Theory note several factors contributing to this unexpected downturn.

Bitcoin Sell-Off Amid Market Unease

The analysts pointed out that the rate cut itself was largely anticipated by investors weeks prior, with a 95% probability already priced into the market.

Ahead of the announcement, they identified that many positioned themselves in expectation of some form of liquidity support from the Fed, leading to a rally in Bitcoin prices.

However, when the actual cut and the accompanying plan for $40 billion in monthly T-bill purchases were confirmed, many of these “whales”—large investors in the market—began to take profits.

Adding to the market’s unease was Fed Chair Jerome Powell’s post-announcement press conference, where he highlighted persistent weaknesses in the labor market and ongoing inflation concerns. Furthermore, the Fed’s dot plot projections indicated the likelihood of only one additional rate cut in 2026.

The situation was compounded by disappointing earnings results from Oracle, which reported its second quarter’s financials after the market’s close. The tech giant missed its adjusted revenue estimates, and higher capital expenditure projections led the stock to plunge by more than 11% in after-hours trading.

This drop also negatively impacted US stock futures, as concerns grew that the artificial intelligence (AI) boom may be peaking. The widespread fear from Oracle’s results quickly spread from equities into the cryptocurrency space.

Ultimately, all three factors converged to create a significant sell-off: the rate cut was already factored into the market, liquidity trades had been preemptively enacted, and Powell’s remarks did not provide the strong easing signal that some traders had hoped for.

Positive Liquidity Conditions Expected In 2026

Interestingly, Bull Theory analysts assert that the crypto market’s recent decline is not indicative of a fundamental shift towards bearish conditions but rather an overreaction based on high expectations leading up to the Fed’s announcement.

The Fed has now enacted rate cuts three times in as many meetings, and their plans to purchase $40 billion in T-bills over the next month are designed to inject liquidity into the markets.

Moreover, Powell indicated that further rate hikes are not on the horizon as a base case, and forecasts for solid economic growth next year remain intact.

Although job gains may have been overstated, suggesting a softer labor market, this could afford the Fed greater flexibility to ease monetary conditions in the future if necessary.

The current market movements illustrate that the dumping of assets was largely driven by overly optimistic expectations rather than any deterioration in underlying fundamentals.

Looking ahead, the analysts believe that next year is expected to be more favorable for Bitcoin and broader crypto prices in terms of liquidity, contrasting sharply with the conditions projected for 2025.

Bitcoin recovered above $91,100 as of this writing, amid rising volatility. This puts the top cryptocurrency 26% behind its all-time high of $126,000, set in October of this year.

Featured image from DALL-E, chart from TradingView.com

Related Articles

XRP ‘Looks Different’ This Cycle, Targets No. 2 Spot: Crypto Analyst

Crypto Insight UK director Will Taylor argued in a new video that XRP is “tradin...

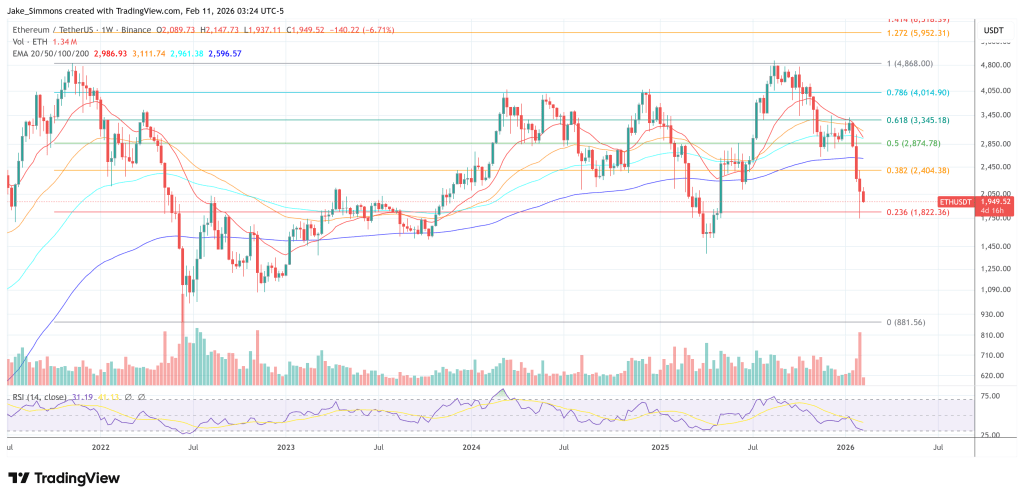

Ethereum ETF ‘Diamond Hands’ Face Their Harshest Test At $2,000

Ethereum ETF investors are sitting on a far uglier entry point than their bitcoi...

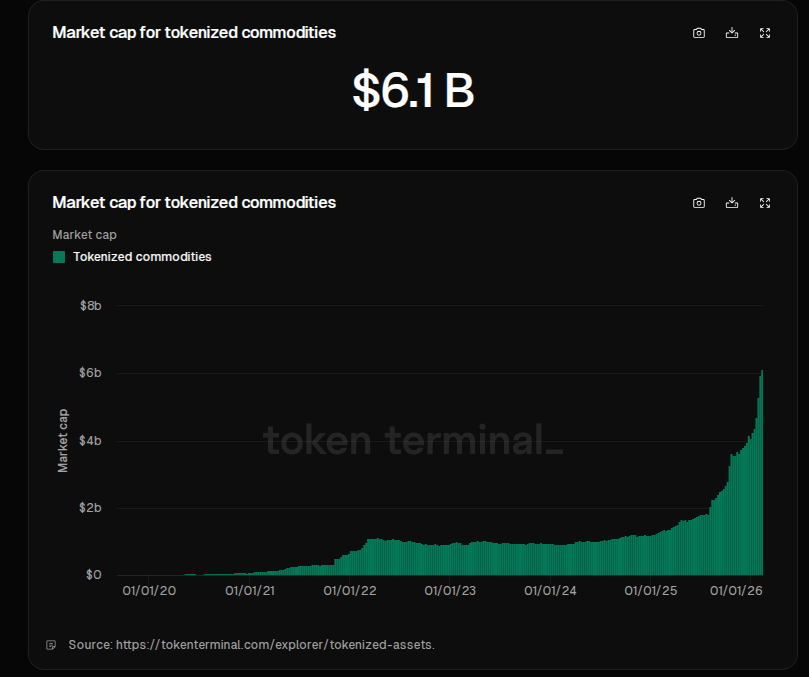

Blockchain Meets Gold: Tokenized Commodities Hit $6 Billion

Markets have put more gold on blockchains, And the shift has been rapid. Reports...

XRP Positioned For Major Structure Shift As Price Tests Critical Level

After recovering from last week’s lows, XRP has been moving sideways, hovering b...