Data Centre stock jumps 14% after 1:10 bonus issue: How many shares will investors receive?

Alex Smith

1 month ago

Synopsis: The shares of this small-cap IT stock jumped 14% following the shareholder approval of a 1:10 bonus issue, which will be provided from a securities premium account amounting to Rs 4.16 crore. The bonus issue showcased a confidence of the company in itself and towards its future, initiating the share price jump of 14%.

The shares of this company, which is a rapidly expanding IT solutions provider based in Mumbai with deep expertise in creating specialised products and solutions within the IT business verticals, had its shares in momentum following the announcement of shareholder approval of the 1:10 bonus issue.

With the market cap of Rs 1,552 crore, the shares of Orient Technologies Ltd had hit their intraday high at Rs 380, gaining more than 14 per cent compared to their previous day’s closing price of Rs 330.40. The shares are trading at a PE of 31, whereas their industry PE is at 31.6.

About the bonus issue.

Orient Technologies has declared a bonus issue approved by its shareholders in the ratio of 1:10. For every 10 equity shares you currently own in Orient Technologies, you will receive 1 additional bonus share, increasing your total holding proportionately after the bonus issue, which is a major capital operation that indicates the company’s confidence in its financial resilience and growth plans.

Financially, the bonus issue will be effectuated through the capitalisation of the securities premium account of the company of Rs 4.16 crore. Even though the company’s intrinsic value as well as the earnings of the company remain unaffected through the bonus issue, the total number of outstanding shares of the company will increase. The bonus shares will carry the same rights as the existing shares of the company.

The bonus issue serves as a signal of the company’s strength in terms of balance sheet position. By improving the liquidity of the equity and attracting more investors through the retail route, Orient Technologies brings the bonus issue in line with the company’s focus on creating long-term shareholder value.

The company’s focus on developing scalable and future-proof competencies in the area of enterprise IT will see the positive impact of the bonus issue on the company’s ability to create shareholder value over the long term.

The revenue from operations for the company stands at Rs 273 crores in Q2 FY26 compared to Q2 FY25 revenue of Rs 223 crores, up by about 23 per cent YoY. However, the net profit stood at Rs 14 crore in Q2 FY26, down from Rs 15 crore in Q2 FY25.

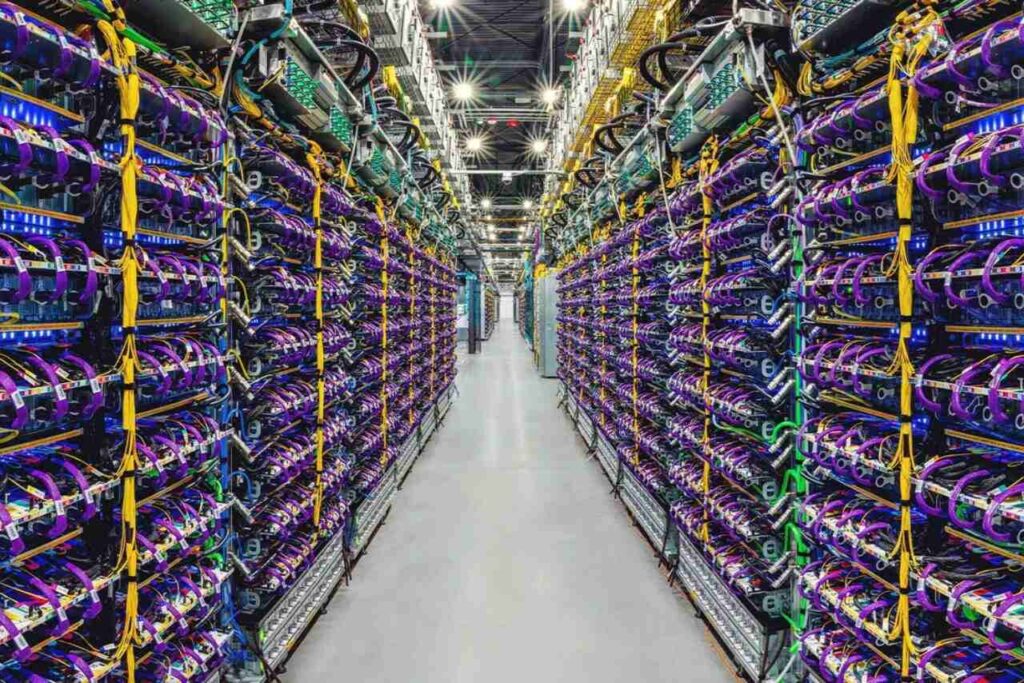

Orient Tech serves through three verticals that are complementary and cross-sell driven, making it a complete enterprise technology solutions-delivering company. Its IT infrastructure vertical provides the backbone and is involved in providing data centre solutions, network solutions, security, collaboration services, and end-user computing solutions. This provides a solid foundation for its enterprise relationships.

Its IT Enabled Services (ITeS) business provides managed services, multi-vendor services, facility management services, and security operations to its existing and new clientele. Its Cloud and Data Management vertical provides data centre migration to the cloud to its enterprises transitioning to a more robust and dynamic cloud-centric architecture.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Data Centre stock jumps 14% after 1:10 bonus issue: How many shares will investors receive? appeared first on Trade Brains.

Related Articles

Why did KPIT Technologies share crash up to 29% in one month?

Synopsis: KPIT Technologies Limited shares fell nearly 29% in a month amid Europ...

Solar Industries, Caplin Point and 6 other stocks delivering back-to-back EPS growth

Synopsis: Stocks like Solar Industries, Waaree Energies, and Navin Fluorine and...

Will Max Financial share price cross ₹2,000 after announcing robust Q3 results?

Synopsis: Max Financial gains after robust Q3 performance; Jefferies reiterates...

Angel One Vs Groww: Which stockbroker performed better in Q3?

Synopsis: Angel One and Groww delivered contrasting performances in Q3 FY26. Ang...