Diamond Power stock jumps after securing ₹52 Cr supply order from Enrich Energy

Alex Smith

3 weeks ago

Synopsis: Diamond Power Infrastructure is in focus, as it has secured a Letter of Intent (LOI) from Enrich Energy Pvt Ltd to supply power cables worth Rs 52.48 crore and is expected to execute the project by May 2026.

The shares of this company, engaged in the business of manufacturing and transmission & distribution of power products & services in India, are in focus after the company secured a significant order worth Rs 52.48 crore. In this article, we will dive more into the details of it.

With a market capitalisation of Rs 6,830 crore, the shares of Diamond Power Infrastructure Ltd are currently trading at Rs 131.25 per share, up 0.57 percent from its previous day’s closing price of Rs 130.50 per share. In the last one year, the stock has delivered a muted return of 2 percent, underperforming NIFTY 50’s return of 9 percent.

Order

c, through a stock exchange filing, announced that it has secured a Letter of Intent (LOI) from Enrich Energy Pvt Ltd, a domestic client, to supply power cables worth Rs 52.48 crore (including GST).

The company further added that the contract has been awarded as a per-kilometre rate, and the order has to be executed by May 2026. Diamond Power also pointed out that the deal isn’t a related party transaction, and the promoter group isn’t involved with the awarding company.

Per-km basis means the customer will pay Diamond Power based on how many kilometres of cable it supplies (price = rate per km × total km). On the other hand, the PV (Price Variation) formula means the final billing can increase or decrease depending on changes in raw material prices like copper/aluminium, so the company is protected if metal prices rise during execution.

Financials

The consolidated revenue from operations for Diamond Power stands at Rs 438 crores in Q2 FY26 compared to Q2 FY25 revenue of Rs 250 crores, up by 75 per cent YoY. Additionally, on a QoQ basis, it reported a growth of 45 percent from Rs 302 crore.

Coming down to its profitability, the company’s net profit stood at Rs 28 crore in Q2 FY26, up from just Rs 4 crore in Q2 FY25, which is a staggering growth of 600 percent YoY. Additionally, on a QoQ basis, it reported a net profit of Rs 20 crore, which is a growth of 40 percent.

As of the latest disclosures, the company communicated a firm overall order position. They have confirmed orders for a total of Rs 2,555 crore, of which Rs 1,405 crore is the subject of finalisation. Besides that, there is a large potential of Rs 7,491 crore in pending bids.

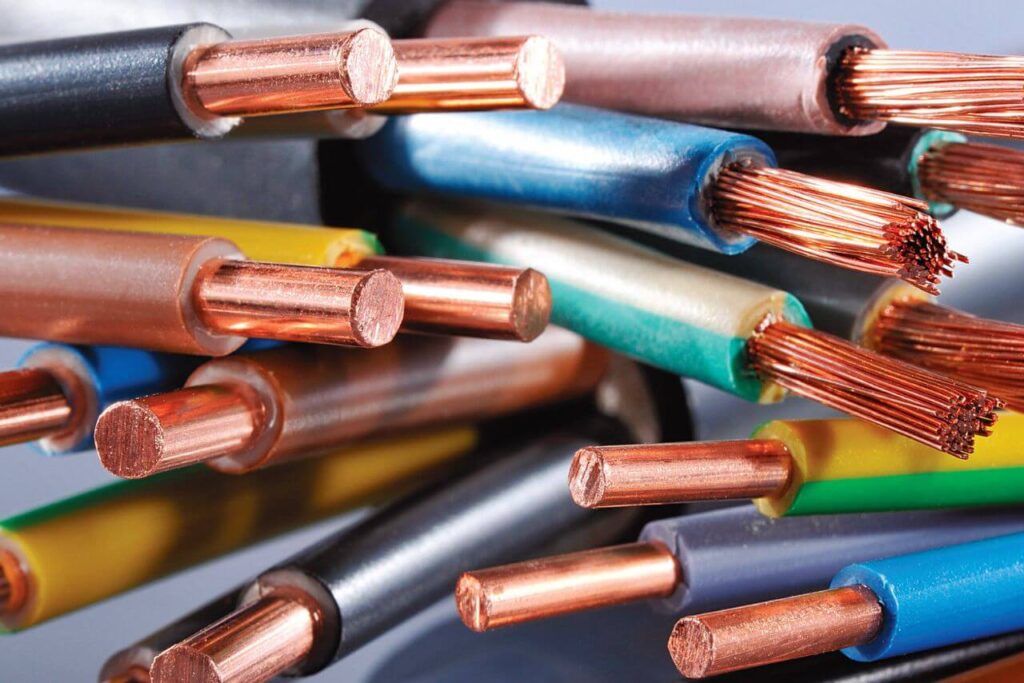

Diamond Power focuses on making conductors, cables, and transmission towers. They handle everything, from manufacturing to providing full turnkey services in transmission and distribution. The company builds power cables up to 550KV, power and distribution transformers up to 220KV, transmission and distribution conductors up to 765KV, plus transmission towers. Their lineup includes EHV cables, medium voltage cables, and AL 59 conductors.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Diamond Power stock jumps after securing ₹52 Cr supply order from Enrich Energy appeared first on Trade Brains.

Related Articles

Why did KPIT Technologies share crash up to 29% in one month?

Synopsis: KPIT Technologies Limited shares fell nearly 29% in a month amid Europ...

Solar Industries, Caplin Point and 6 other stocks delivering back-to-back EPS growth

Synopsis: Stocks like Solar Industries, Waaree Energies, and Navin Fluorine and...

Will Max Financial share price cross ₹2,000 after announcing robust Q3 results?

Synopsis: Max Financial gains after robust Q3 performance; Jefferies reiterates...

Angel One Vs Groww: Which stockbroker performed better in Q3?

Synopsis: Angel One and Groww delivered contrasting performances in Q3 FY26. Ang...