DraftKings Stock Drops 15% on Earnings Miss, Doubles Down on Prediction Markets

Alex Smith

5 hours ago

DraftKings executives leaned heavily into prediction markets during the company’s fourth-quarter earnings call Friday morning, framing the emerging product as a major long-term growth driver, even as investors reacted cautiously to the near-term financial outlook.

The call came a day after the company released its shareholder letter highlighting what it described as a “massive, incremental opportunity” in DraftKings Predictions and plans to invest heavily in customer acquisition.

The bullish messaging landed alongside softer guidance that fell short of Wall Street expectations. DraftKings shares fell about 15% in premarket trading after its Q4 report came out Thursday, as investors reacted to the conservative outlook and the anticipated costs of expanding prediction markets despite continued revenue growth, according to MarketWatch reporting on the stock reaction.

During the earning call’s analyst Q&A, CEO Jason Robins emphasized growing regulatory clarity, particularly around the Commodity Futures Trading Commission’s role in overseeing event contracts, and pointed to early usage patterns in states without legal sportsbooks, specifically in California and Texas. He also highlighted the upcoming Railbird exchange rollout, for which DraftKings plans to operate its own market maker, positioning liquidity and data infrastructure as competitive advantages in the developing sector.

Robins said DraftKings views prediction markets as a roughly $10 billion long-term market opportunity, citing a mix of analyst estimates, early usage data and internal projections. He noted that some external forecasts run as high as $16 billion.

Railbird rollout highlights shift to in-house prediction markets

One of the more substantive operational details in the Q&A centered on Railbird, the exchange infrastructure DraftKings acquired as part of its push to build a more vertically integrated prediction markets business. Currently, the contracts offered through DraftKings Predictions are sourced from CME Group and Crypto.com, but Railbird is intended to give the company greater control over market creation, pricing and trading economics.

Robins said the Railbird platform is expected to begin rolling out next quarter, with DraftKings planning to operate its own market maker alongside outside trading firms. Market making is central to exchange liquidity, providing continuous buy and sell quotes, tightening spreads and helping keep contracts tradable even when customer activity is limited. Running its own market maker would allow DraftKings to capture more of the revenue from trading activity while supporting liquidity as the market develops.

“On liquidity — virtually every market maker out there is lining up to get set up for Railbird,” Robins said during the call. “The DraftKings market maker will be a differentiator in creating liquidity, especially in new types of markets and combo markets.”

Robins did not identify specific partner firms but suggested DraftKings’ markets may ultimately operate across multiple exchanges rather than relying solely on its own venue.

“We haven’t decided how many exchanges we want to operate on, but we’ll definitely be operating our market maker on Railbird,” he said.

The broader strategy appears to hinge on leveraging DraftKings’ sportsbook infrastructure, including pricing models, trading data, marketing reach and its existing customer base, to accelerate liquidity faster than standalone prediction market platforms.

“One great thing for us is we already have a lot of what we need,” Robins said.

“A real lean-in from the CFTC” is driving confidence

When an analyst asked why the company is leaning more aggressively into prediction markets now vs. the more tentative approach leading up to the DraftKings Predictions launch in December, Robins pointed first to what he described as a meaningful shift at the CFTC.

“There’s been a real lean-in from the CFTC,” Robins said. “What went from a hands-off posture from previous interim chairs is now a full-fledged affirmation that [prediction markets are] firmly under their jurisdiction. They intend to defend it in the courts, and they’re going to issue real guidelines and regulations.”

The comments come as new CFTC chair Mike Selig has signaled a more market-friendly approach to prediction markets, emphasizing principles-based oversight and what he has described as “flexible guardrails” rather than restrictive rulemaking. That evolving stance has been interpreted by industry participants as reducing any regulatory uncertainty that previously hung over event contract platforms, particularly when it comes to sports markets.

Robins framed that regulatory clarity as the biggest barrier that has started to fall away for DraftKings.

“The biggest thing holding us back before was regulatory uncertainty, and that’s been cleared up,” he said. “Anything that creates a stable regulatory environment that allows us to operate more freely is a big upside for us.”

DraftKings’ measured rollout also reflects ongoing state-level legal battles over prediction markets. Some states, including Massachusetts and Nevada, are actively challenging certain platforms over sports event contracts, putting sportsbook operators like DraftKings in a delicate position as they try to expand predictions offerings without creating friction with the same regulators who oversee their core sports betting licenses.

No DK Predictions revenue assumed, but spending is real

DraftKings’ FY2026 guidance ranges assume continued investment in DK Predictions, even as Robins told analysts it did not bake that revenue into the outlook.

“Predictions is all upside,” Robins said. “There’s no revenue in the guide. We’re assuming this is a year we spend a lot on customer acquisition, like new user offers. There probably will be some revenue, but it’s too early to quantify, so we didn’t put any in the guide.”

In the Q4 earnings press release, DraftKings set 2026 revenue guidance at $6.5 billion-$6.9 billion and adjusted EBITDA guidance at $700 million-$900 million, and said those ranges “reflect expected investment in DraftKings Predictions.” Analysts had been expecting closer to $7.3 billion in 2026 revenue and roughly $981 million in adjusted EBITDA, meaning DraftKings’ outlook landed well below Wall Street forecasts, a gap that contributed to the stock selloff as investors weighed the costs of its prediction markets push.

DraftKings says it is not seeing OSB cannibalization

Investors have questioned whether prediction markets could siphon activity from DraftKings’ sportsbook, particularly given the similarities between event contracts and traditional sports wagering. Robins downplayed that risk during both his prepared comments and the analyst Q&A, framing Predictions as more of an expansion opportunity than a substitute.

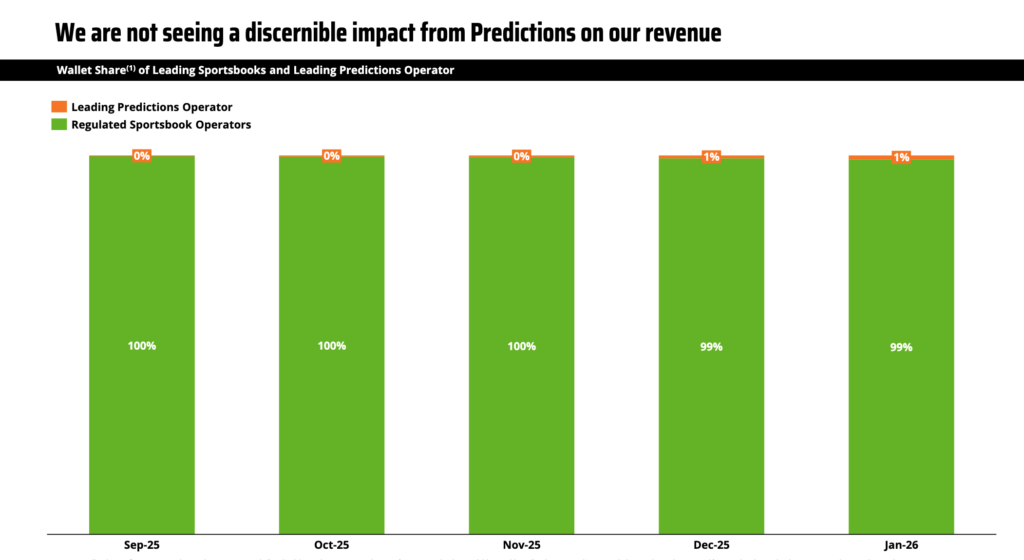

“We are not seeing a discernible impact from Predictions on our revenue,” the company said in its earnings presentation, pointing to internal data suggesting limited overlap so far between prediction markets activity and its core betting business.

A chart included in the earnings presentation shows sportsbook operators continuing to capture nearly all customer wagering activity, with prediction markets accounting for roughly 1% or less of wallet share in recent months based on the company’s analysis.

During the Q&A, Robins said the DraftKings Predictions is not primarily an add-on for existing sportsbook users.

“Because the product is so similar, it’s not something we see as largely incremental to our existing customers, and that’s why we don’t see much cannibalization from prediction operators in states we’ve been in,” he said, adding that the bigger opportunity lies in attracting new customers in states where DraftKings does not yet offer online sports betting.

Early DK Predictions users are concentrated in Texas and California

Asked who is using DraftKings’ prediction markets product so far, Robins pointed to geography, calling it a defining early pattern.

“The most common theme is prediction players tend to be Californians and Texans,” he said, adding that otherwise they look “a lot like our existing customers.”

That matters strategically because California and Texas remain the largest U.S. states without legal online sports betting, making prediction markets a path to acquire and engage users in jurisdictions where sportsbooks cannot operate today.

Robins leaned into that comparison explicitly. “About half the country, population-wise, was available for us to launch predictions in,” he said. “In some ways it’s like if you told me we opened up the rest of the U.S. overnight to a strong version of a sports product.”

What comes next for DraftKings’ prediction markets push

Robins repeatedly pointed listeners and analysts to DraftKings’ March 2 virtual “Investor Day” event for a more detailed prediction market playbook, especially in regards to product design, marketing strategy, and how DraftKings expects to translate sportsbook advantages like pricing models, data, and trading infrastructure into the event contracts market.

The bigger picture is that DraftKings appears to be shifting from cautiously testing prediction markets to more actively building around them. Whether that pays off will depend not just on product execution, but on regulatory clarity, investor patience and whether the industry can sustain deep, liquid markets at scale.

The post DraftKings Stock Drops 15% on Earnings Miss, Doubles Down on Prediction Markets appeared first on DeFi Rate.

Related Articles

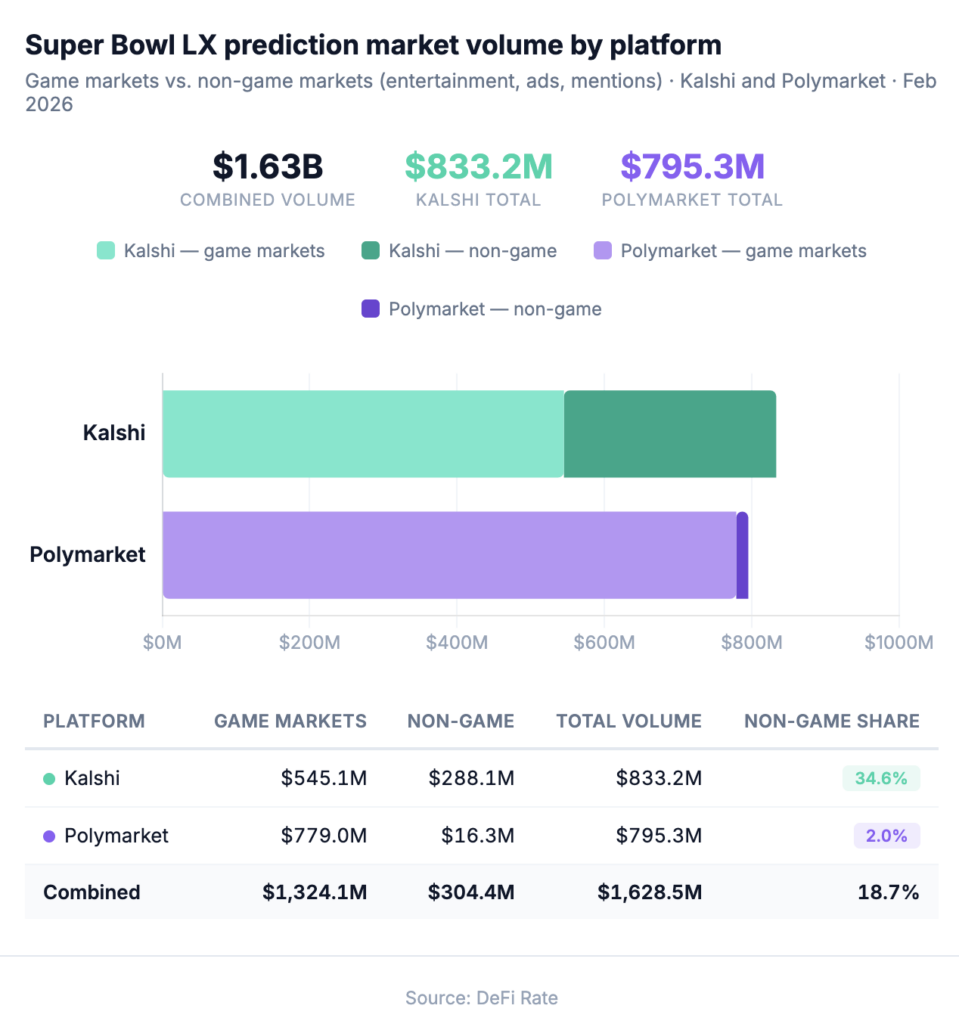

$1.63B in Super Bowl Prediction Market Volume, $304M on Culture: Full Data Breakdown

We tracked $1.63B in Super Bowl prediction market volume across 68+ markets and...

Rebuilding sUSD

A new path for Synthetix's stablecoinsUSD is the synthetic asset that power...

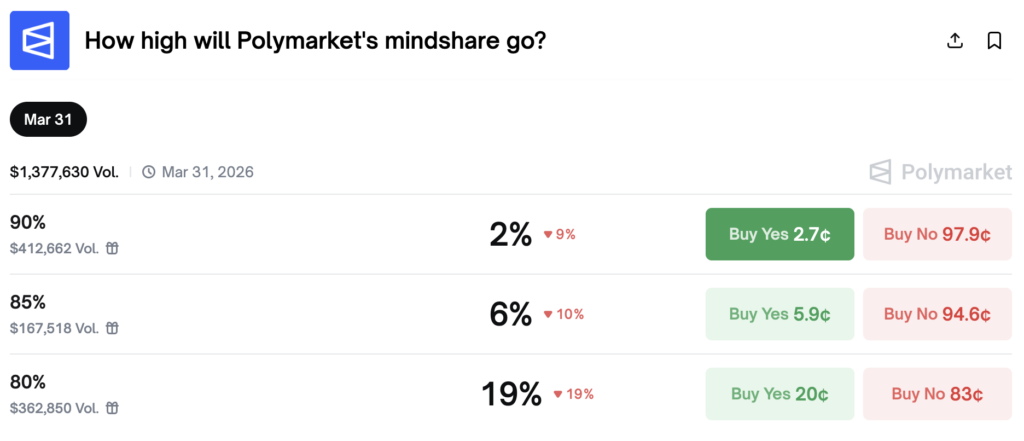

Polymarket and Kaito Roll Out Attention Markets for ‘Mindshare’ Trading: What It Means

Polymarket has two live attention markets on where public sentiment or "mindshar...

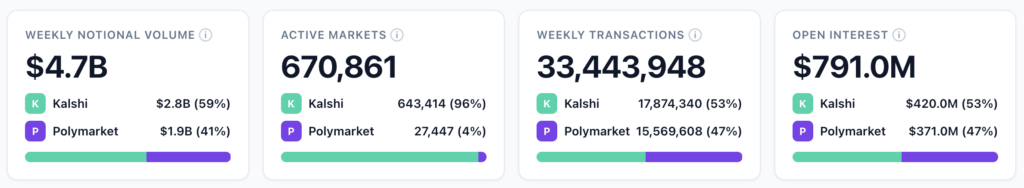

Super Bowl Fuels Kalshi to Record $2.8B Week as Prediction Markets Hold Near $6.3B

Kalshi hit a record $2.80B week with the Super Bowl surge as Polymarket slipped...