Jake Claver Doubles Down On $100 XRP Target After 2025 Miss

Alex Smith

1 month ago

Jake Claver, a renowned XRP promoter and CEO of Digital Ascension Group, is again leaning into a familiar XRP thesis: behind-the-scenes institutional adoption, NDAs, and “domino” catalysts, only days after analyst Zach Rector publicly criticized Claver’s failed “$100 XRP by end of 2025” prediction as misleading.

$100 XRP Only Delayed, Says Claver

In a post on Jan.1, Claver responded: “Timelines always get extended,” and added: “I should know this by now from all that we’ve built in the past 3 years, working with partners and regulators. I’m sure Ripple and many others have felt and still feel the same way after 13.5 years. The Domino Theory still stands, Real world events will play out, and XRP will become the backbone of markets in the future.”

In a series of posts spanning Dec. 27 through Jan. 1, Claver argued that “real world events will play out, and XRP will become the backbone of markets in the future.” A Jan. 1 post focused on Ripple’s non-disclosure agreements, which Claver described as a signal that large counterparties are already preparing to build with XRP.

“Ripple signing over 1,700 non-disclosure agreements probably isn’t random,” he wrote. “These most likely cover talks with major players—governments, global banks, payment networks, big universities, and Fortune 500 firms—all laying the groundwork to use XRP. The pieces for mass adoption have been falling into place behind the scenes for quite a while.”

Earlier posts pressed the same point with higher conviction. On Dec. 28, Claver claimed: “Major institutions are stacking up XRP behind the scenes while keeping the public in the dark. The current price is merely a shadow of what’s coming. When XRP transforms into the foundation of international finance, today’s hesitation will become tomorrow’s regret. In my opinion, nothing in crypto space offers this level of certainty and potential for massive returns.”

On Dec. 31, he described XRP “as built to upgrade the existing financial system,” while adding that “blockchain isn’t just for storing value, it can power a faster, more open financial system. For that, you need high-performance infrastructure like XRP.”

As reported on Bitcoinist yesterday, Rector’s criticism has been less about making bold forecasts than about the way they are delivered. Rector argued there was “no plausible scenario” for a roughly 5,000% move in the time window implied by the $100 call, and that the messaging leaned on suggestions of privileged insight rather than probabilistic framing.

Rector’s allegations also extended beyond price talk into claims about XRP-focused funds associated with Claver’s orbit. “Jake and his scheme, his business has grown so big they’ve taken in so much XRP from our community,” Rector said. “There’s a massive discrepancy from what he’s saying publicly and what investors are telling me privately.”

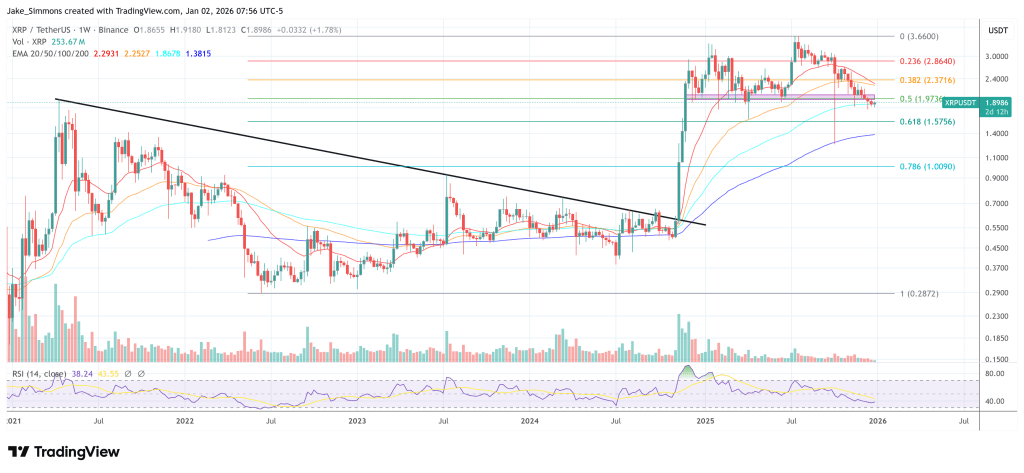

At press time, XRP traded at $1.89.

Related Articles

Is Bitcoin Already Pricing A US Recession? Analyst Sees Major Risk‑Reward Setup

Bitcoin’s (BTC) recent pullback may be less about crypto‑specific weakness and m...

LayerZero (ZRO) Soars 40% Amid Zero Blockchain Debut, Major Institutional Backing

ZRO, the native token of the omnichain interpretability protocol LayerZero, has...

Bitcoin Social Sentiment Stays Bearish Even As Price Recovers From $60,000 Drop

Data shows the social media sentiment around Bitcoin has remained deeply bearish...

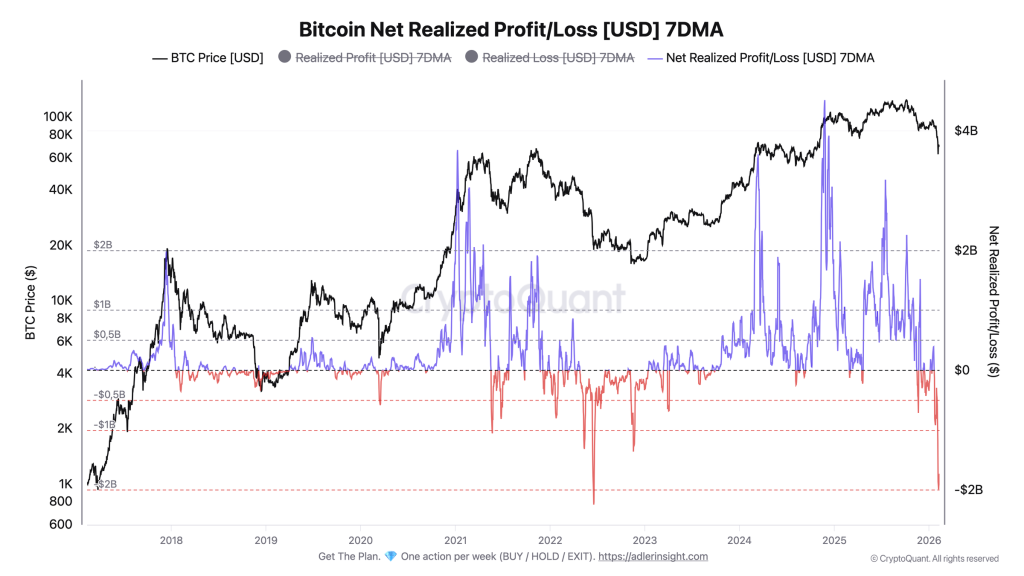

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...