JPMorgan Keeps Bitcoin Bull Case: $266,000 Remains The Target

Alex Smith

4 hours ago

JPMorgan is sticking with its long-run bitcoin upside framework, including a $266,000 per-coin target, even as the bank flags near-term stress signals around mining economics and still-chilly risk sentiment heading into 2026.

The bank’s latest read hinges on two pillars: a “soft” floor around bitcoin’s production cost, and a valuation model that maps bitcoin’s potential market cap against private-sector gold investment on a volatility-adjusted basis. In the near term, JPMorgan frames the current drawdown as a familiar stress test for miners. The bank estimates the cost to produce a bitcoin at roughly $77,000, while bitcoin was trading around the mid-$60,000s in the same analysis window, putting spot below breakeven for less efficient operators.

JP Morgan Remains Bullish On Bitcoin

Historically, JPMorgan argues, production cost tends to behave like “soft” support rather than a hard line. The mechanism is reflexive: if prices stay below profitability for long enough, weaker miners shut down, difficulty adjusts lower, and the average cost of production falls, effectively tightening the band that previously sat above spot.

The bank also keeps its broader market tone constructive for 2026, leaning on the idea that institutional capital (not retail or corporate treasuries) is the marginal buyer that can restart flows when the macro backdrop stabilizes. As JPMorgan put it: “We are positive on the outlook for 2026 and expect increased inflows into digital assets, driven by institutional investors.”

JPMorgan’s $266,000 target is not pitched as a 2026 “call,” but as the mathematical end point of a gold-parity thought experiment. In the bank’s model, matching the scale of private gold investment (roughly $8 trillion, excluding central banks) implies a bitcoin price around $266,000, a level the analysts themselves described as “unrealistic” in the near term.

The bridge between “unrealistic now” and “possible later,” in JPMorgan’s framing, is volatility. The bank has pointed to a bitcoin-to-gold volatility ratio around 1.5, unusually low by historical standards and argues that gold’s surge since October alongside rising gold volatility has improved bitcoin’s relative appeal over the long run.

“The large outperformance of gold vs. bitcoin since last October coupled with the sharp rise in gold volatility has led to bitcoin looking even more attractive compared to gold over the long term,” the analysts wrote.

JPMorgan’s stance effectively splits the tape into two timeframes: a messy adjustment process if bitcoin remains below mining breakevens, and a longer-duration bet that institutional inflows and regulatory progress in the US can reprice the asset’s role versus gold as 2026 unfolds.

At press time, BTC traded at $66,229.

Related Articles

Trump Media Files For Cronos, Bitcoin‑Ether ETFs With Staking Focus

Companies linked to President Donald Trump are expanding their presence in the c...

Cardano Founder Hoskinson Warns Of 90-180 Days Of Pain Ahead: Here’s Why

Cardano founder Charles Hoskinson says the crypto market is headed for “90–180 d...

Bitcoin’s Market Structure May Be Changing — This Metric Explains Why

Bitcoin’s market cycles have long been shaped by shifting liquidity, investor be...

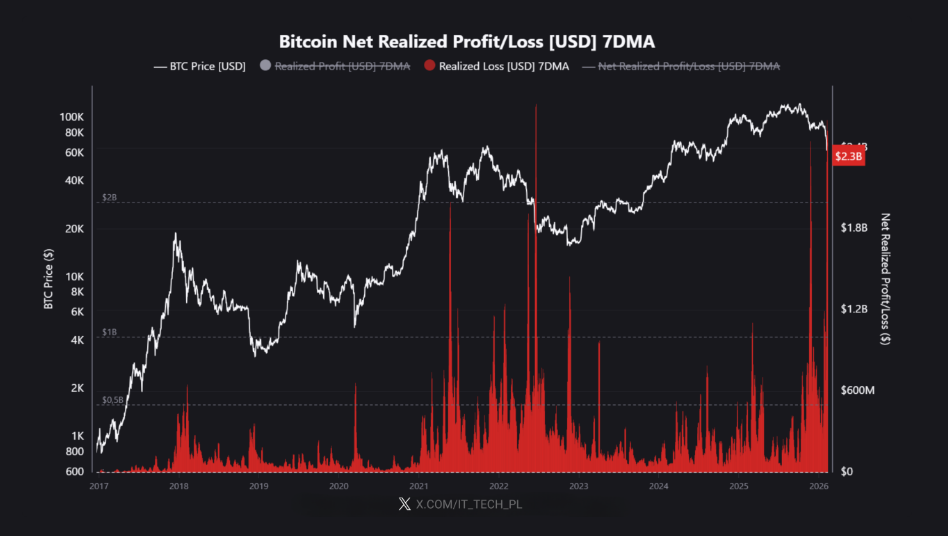

Bitcoin’s $2.3 Billion Wipeout Marks Harshest Crash In 4 Years: Analysts

The recent slide of Bitcoin has punched a hole in short-term holders’ wallets an...