Mainnet is Where the Heart is

Alex Smith

5 months ago

Synthetix is done with L2s.

With Arbitrum and Base gone, we’re now shutting down Optimism as a final farewell. By September, all remaining Synthetix functionality on Optimism will cease to exist. This marks the final step in our broader transition away from Layer 2 deployments, as we refocus all resources and development toward Synthetix Mainnet, the high-performance perp exchange built on Ethereum.

If you are currently an SNX staker on Optimism in the 420 pool, you may remain staked, and enjoy the benefits of the Debt Jubilee. We salute our Optimism stakers and ask that you turn off the lights on your way out.

What’s Happening

Synthetix will deprecate all remaining products on Optimism in three phases:

- August 18: Perps will enter close-only mode.

- August 25: All open perps positions will be force-closed, and margin will be airdropped to user wallets in sUSD. Users with contract or multisig wallets must open a support ticket on the Synthetix Support Page to reclaim funds. Open the dialog box in the bottom right of the page to begin the process.

- August 31: All other Synthetix functionality on Optimism will be deprecated.

For the simplest experience, please exit your positions soon and bridge sUSD to Ethereum Mainnet in preparation for the next phase of Synthetix on Ethereum.

What You Should Do

Perps TradersIf you’re trading perps on Optimism, you should close your positions and withdraw before August 25. Traders who don’t close their positions will have their positions force-closed, and receive any remaining margin balance directly to their wallets. If you’re using a multisig or smart contract wallet, you will not receive an airdrop of your margin. Please open a ticket on the Synthetix Support Page.

We encourage traders to bridge any remaining sUSD margin to Ethereum Mainnet. Once on Mainnet, sUSD can be staked, added to Curve liquidity pools, or deposited in the SLP early deposit vault to continue earning.

SNX or sUSD HoldersIf you’re an SNX or sUSD holder on Optimism but not actively staking in the 420 Pool, bridge your tokens back to Mainnet using Superbridge:

https://superbridge.app/?fromChainId=10&toChainId=1

You can choose the native 7-day route with no slippage, or fast bridging with some slippage, depending on liquidity.

Once on Mainnet, you can:

- Stake SNX with no lockup to earn protocol rewards (~37% APR)

- Stake sUSD in the 420 pool to earn yield (~44% APR, locked until April 2026)

- Deposit sUSD in the SLP Early Deposit Vault for exclusive perks (coming in August)

- Provide liquidity in the sUSD/sUSDe Curve pool to earn rewards

- Hold sUSD in your Infinex account to earn yield and a chance to win prizes.

If you’re using Infinex, no action is required. Your sUSD will be automatically bridged to Mainnet on your behalf, and rewards will continue.

420 Stakers on Optimism420 stakers do not need to take any action at this time. Ensure you have the required sUSD staked to complete your Debt Jubilee.

Join the Community

All future development is focused on Ethereum Mainnet. Synthetix Mainnet offers a faster, simpler, and more secure perps trading experience. We invite you to make the move with us.

Join the conversation: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Follow on X: x.com/synthetix

Related Articles

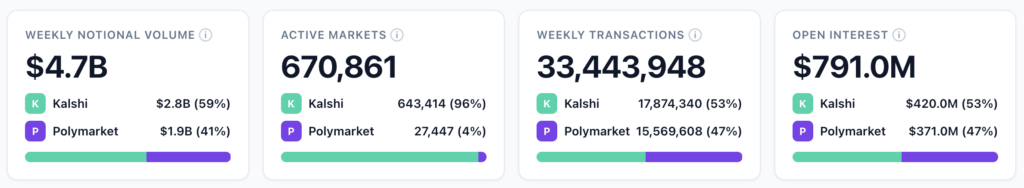

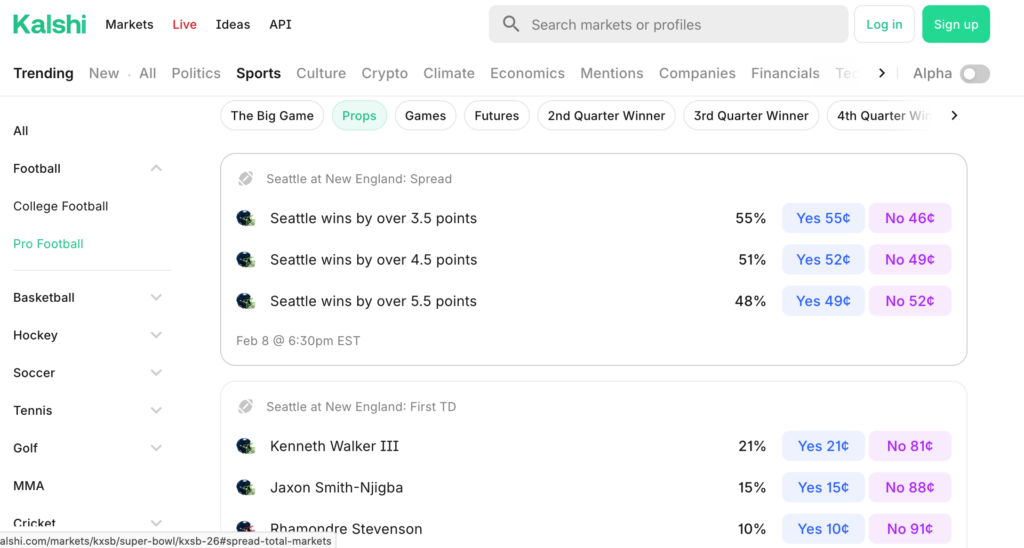

Super Bowl Fuels Kalshi to Record $2.8B Week as Prediction Markets Hold Near $6.3B

Kalshi hit a record $2.80B week with the Super Bowl surge as Polymarket slipped...

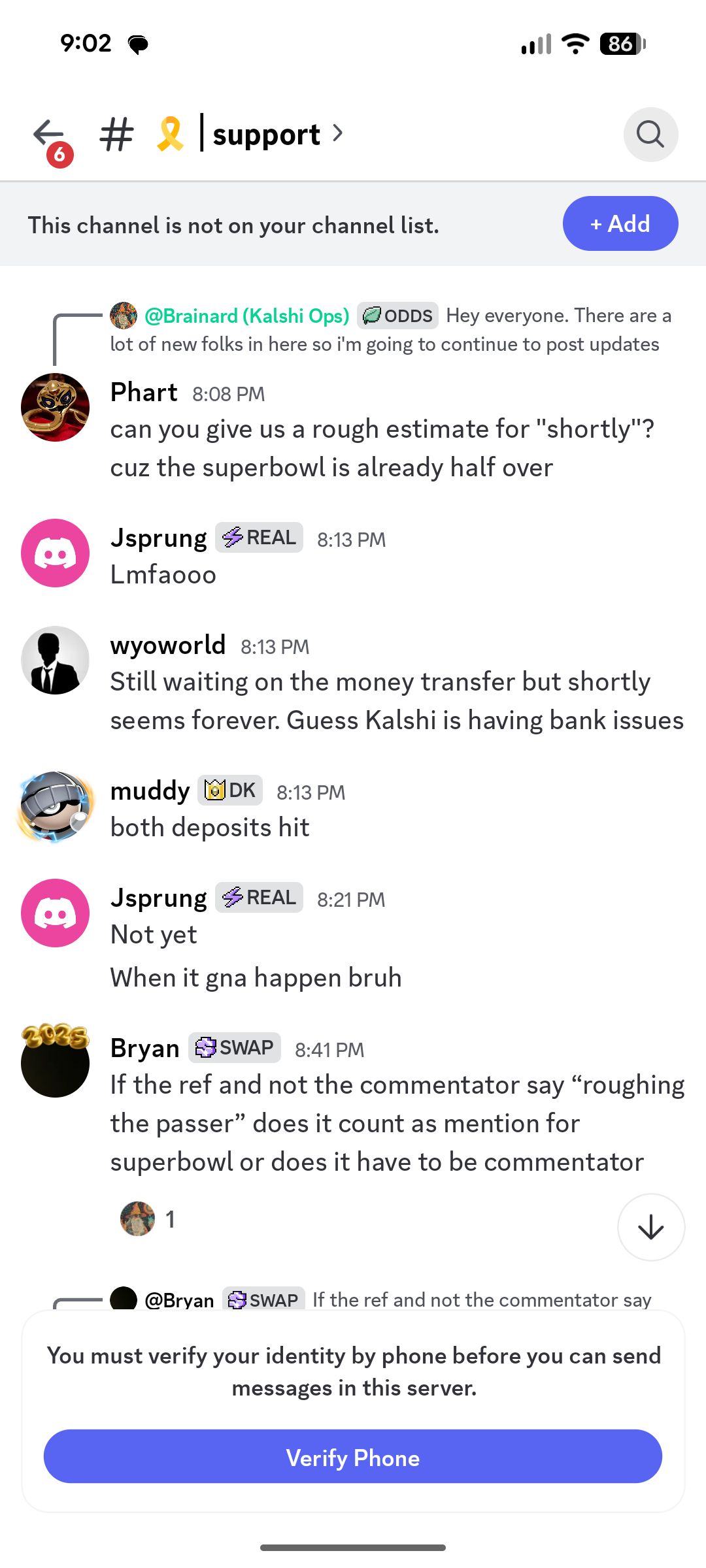

Kalshi Experiences Significant Point of Failure During Super Bowl

Kalshi’s payment infrastructure became a significant point of failure toni...

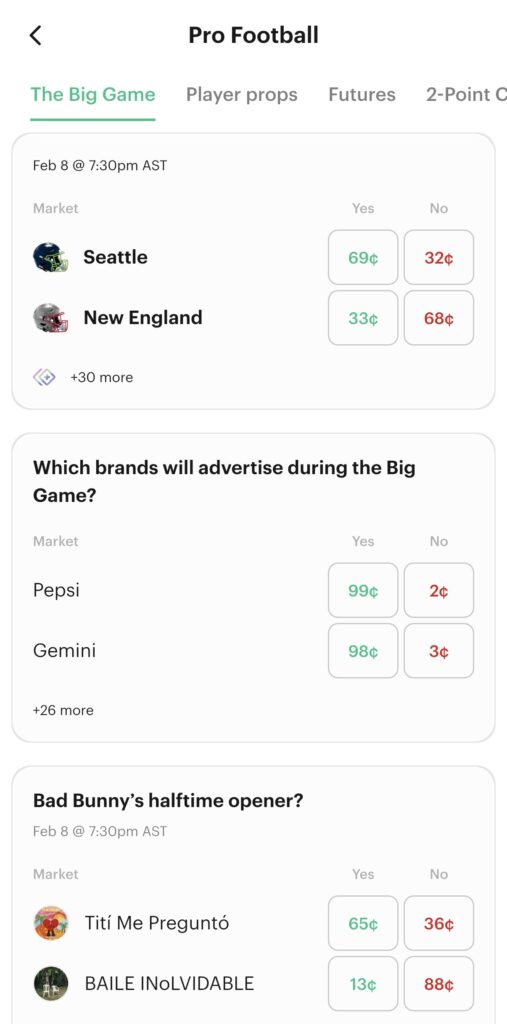

How to Bet on Super Bowl LX in California: Best Prediction Market Apps Compared

California has no legal sports betting, but 12+ prediction market apps offer leg...

Super Bowl Betting 2026 at Prediction Markets: All States Including California & Texas

Prediction markets are letting more people than ever put money on Super Bowl out...