Polycab India share price declines 3% after huge block deal; Check the details

Alex Smith

4 weeks ago

Synopsis: Polycab India plunged sharply after a large block deal took place, valued at around Rs 590 crore. About 7.98 lakh shares, or approximately 0.53% of the company, were traded at an average price of Rs 7,387.5.

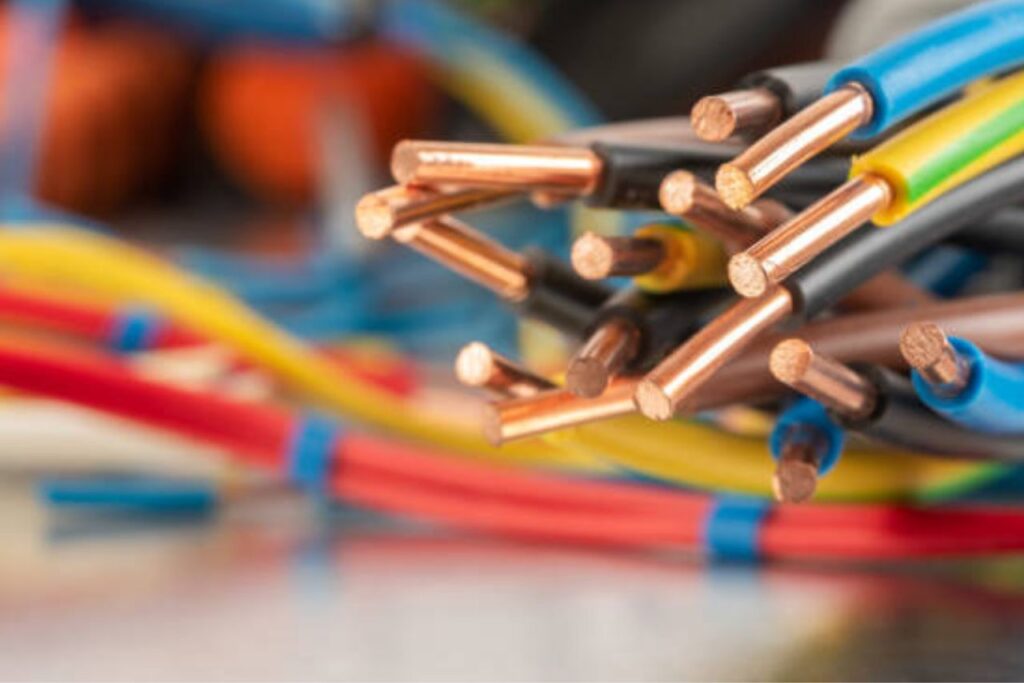

The shares of this leading company, engaged in the manufacturing of cables and wires and other FMEG products, are in focus after a large block deal took place in BSE. In this article, we will delve more into the details of it.

With a market capitalisation of Rs 1,11,920 crore, the shares of Polycab India Ltd reached a day low at Rs 7,342 per share, down 3 percent from its previous day’s closing price of Rs 7,569.55 per share. Over the past five years, the stock has delivered a robust return of 523 percent, outperforming NIFTY 50’s return of 78 percent.

About the deal

Polycab India’s shares fell by nearly 3 percent on Wednesday, after a substantial block deal triggered a round of selling. As part of this deal, nearly 7.98 lakh shares, representing 0.53 percent of the company’s equity, were traded in the deal at an average price of Rs 7,387.5 each, amounting to roughly Rs 590 crore. Though the buyers and sellers have not yet known, the block deal might involved a domestic mutual fund as the seller.

Financials

The revenue from operations for Polycab India stands at Rs 6,477 crores in Q2 FY26 compared to Q2 FY25 revenue of Rs 5,498 crores, up by 18 per cent YoY. Additionally, on a QoQ basis, it reported a growth of 10 percent from Rs 5,906 crore.

Coming down to its profitability, the company’s net profit stood at Rs 693 crore in Q2 FY26, up from Rs 445 crore in Q2 FY25, which is a growth of 56 percent YoY. Additionally, on a QoQ basis, it reported a net profit of Rs 600 crore, which is a growth of 16 percent.

Coming to its sales mix, Polycab India derived Rs 5,633 crore from Wires & Cables, which saw a 21 percent growth YoY. Its FMEG (Fast-Moving Electrical Goods) also reported a robust 14 percent growth YoY, reaching Rs 443.7 crore. However, its EPC segment declined by 19 percent YoY, reaching Rs 402.4 crore.

Polycab India Limited is a dominant wire and cable manufacturer under the brand name POLYCAB for both domestic and global markets. Its product offerings include power, control, solar, communication, and speciality cables, as well as a range of electrical accessories and appliances like fans, lighting, switches, switchgear, solar solutions, and home appliances.

The company also operates in the EPC segment, providing design and execution services for power distribution and electrification projects, with the backing of a comprehensive distribution network at retail outlets, dealers, and distributors.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Polycab India share price declines 3% after huge block deal; Check the details appeared first on Trade Brains.

Related Articles

Why did KPIT Technologies share crash up to 29% in one month?

Synopsis: KPIT Technologies Limited shares fell nearly 29% in a month amid Europ...

Solar Industries, Caplin Point and 6 other stocks delivering back-to-back EPS growth

Synopsis: Stocks like Solar Industries, Waaree Energies, and Navin Fluorine and...

Will Max Financial share price cross ₹2,000 after announcing robust Q3 results?

Synopsis: Max Financial gains after robust Q3 performance; Jefferies reiterates...

Angel One Vs Groww: Which stockbroker performed better in Q3?

Synopsis: Angel One and Groww delivered contrasting performances in Q3 FY26. Ang...