Pundit Reveals The Biggest Enemy Of XRP Investors As Price Struggles At $2

Alex Smith

4 weeks ago

Many XRP investors continue to adopt a wait-and-see approach, as the price has struggled to break above its current consolidation zone near the $2 level. Although XRP experienced a brief rally from around $1.90 to over $2 in January 2026, the upward momentum appears to have stalled at that point. A crypto analyst has shared insights into why XRP may be failing to sustain a breakout, noting that the biggest enemy of XRP investors is not price action.

XRP Investors Face Biggest Enemy Beyond Price

Market analyst Cryptollica has pointed to “time,” rather than price, as the biggest enemy of XRP investors, as the token continues to consolidate near the $2 mark. In a detailed analysis shared on X, he connected XRP’s current consolidation to a recurring historical pattern visible on the two-week price chart.

Cryptollica explained that XRP is moving through a phase labeled “Part 3” on the chart, designed to shake out holders experiencing boredom. In the past, this stage usually followed Part 4, when price expansion became visible and widely noticed. The chart maps a structure from the 2014 to 2017 cycle, in which Parts 1, 2, and 3 played out before a sharp rally followed. The same structural sequence is overlaid on the 2021 to 2026 period, with Parts 1 and 2 already completed and Part 3 currently unfolding.

XRP’s price action on the chart shows it is moving sideways slightly above the $2 region after reclaiming the $1.95 area, which is a key breakout level. The consolidation is occurring above a rising long-term trendline, suggesting the overall uptrend is still holding, even if momentum is slow.

Cryptollica also noted that the weekly Relative Strength Index (RSI) has reset, shown in the lower part of the chart, where momentum has eased but not collapsed. He sees this reset as a necessary step that clears the way for XRP’s next move, and not a sign of weakness. The chart further highlights that previous cycles rewarded patience once this consolidation phase ended, reinforcing the analyst’s belief that time is the biggest enemy of holders.

Analyst Says XRP Is Approaching Price Discovery

In a follow-up post, Cryptollica described his XRP price chart, which divides the cryptocurrency’s cycles into parts, as a precise algorithm. He called Part 1 a multi-year accumulation phase and Part 2, the first impulse and liquidity grab. As mentioned earlier, both phases have been completed in this cycle, according to the analyst.

With XRP now in Part 3, the shakeout stage to test long-term holders, Cryptollica explains that once this is completed, the cryptocurrency is on its way to a vertical price discovery, which marks Part 4. He highlighted the reliability of this decade-long fractal, suggesting that XRP’s spring is currently loaded and ready for a potential expansion phase.

Related Articles

LayerZero (ZRO) Soars 40% Amid Zero Blockchain Debut, Major Institutional Backing

ZRO, the native token of the omnichain interpretability protocol LayerZero, has...

Bitcoin Social Sentiment Stays Bearish Even As Price Recovers From $60,000 Drop

Data shows the social media sentiment around Bitcoin has remained deeply bearish...

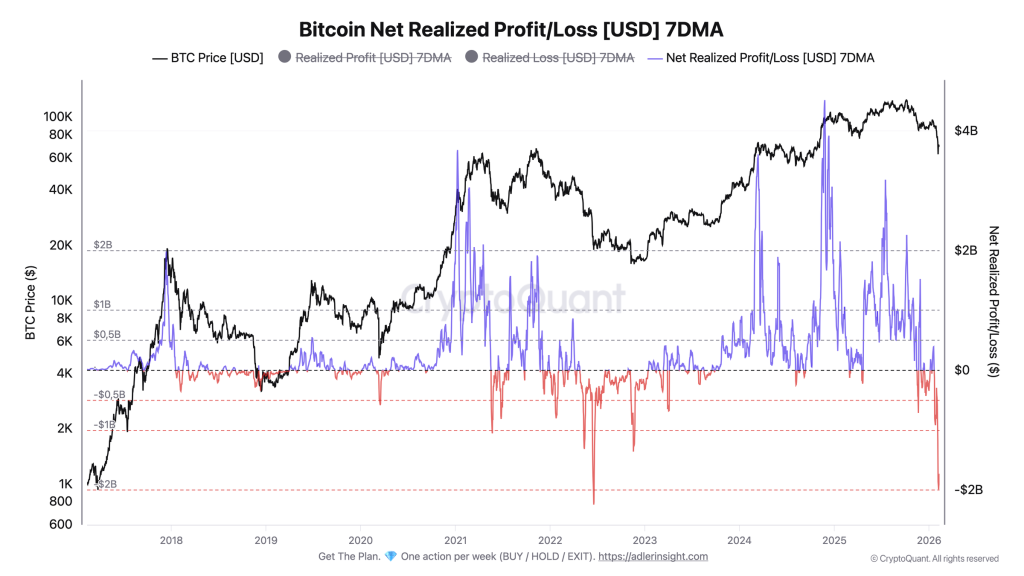

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...

Bitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Bitcoin is facing renewed selling pressure after losing the key $70,000 level, a...