Revealed: Here’s the Only Canadian Stock I’d Refuse to Sell

Alex Smith

2 hours ago

At times, it can be a pretty bad idea to get overly attached to a single stock in your portfolio, but it’s far better to want to hang onto a particular name for decades at a time than to trade in and out of stocks as many retail investors tend to do. Indeed, owning pieces of companies for the long run isn’t nearly as exciting as getting into a hot stock (or a hard-hot one) with the intent of getting out after a run, taking home a nice gain, preferably over a concise timespan.

Also, just because a price-to-earnings (P/E) ratio on a stock is low does not mean you’re getting a market bargain. Doing the homework is important so you can get a better sense of which cheap-looking stocks are actually undervalued and which expensive-looking names might still have a ton of upside left in the tank. In any case, there’s a lot more to it than looking at low P/E ratios.

And if you chase hard-hit names, you should be willing to take a hit to the chin as an investor because odds are the pain won’t turn to euphoria after a stock has entered your TFSA or RRSP portfolio.

In any case, value traps are real, and they can be difficult to steer clear of if you’re limiting yourself by screening out all other stocks that don’t have P/E ratios below a certain level. Personally, I’m more in favour of chasing decent performers poised to experience strengthening tailwinds. Paying up for quality and growth can be a winning strategy. In any case, one of the cheapest stocks (a name that I’d refuse to sell, even when the tides go out) in my portfolio is actually a respectable gainer on the year.

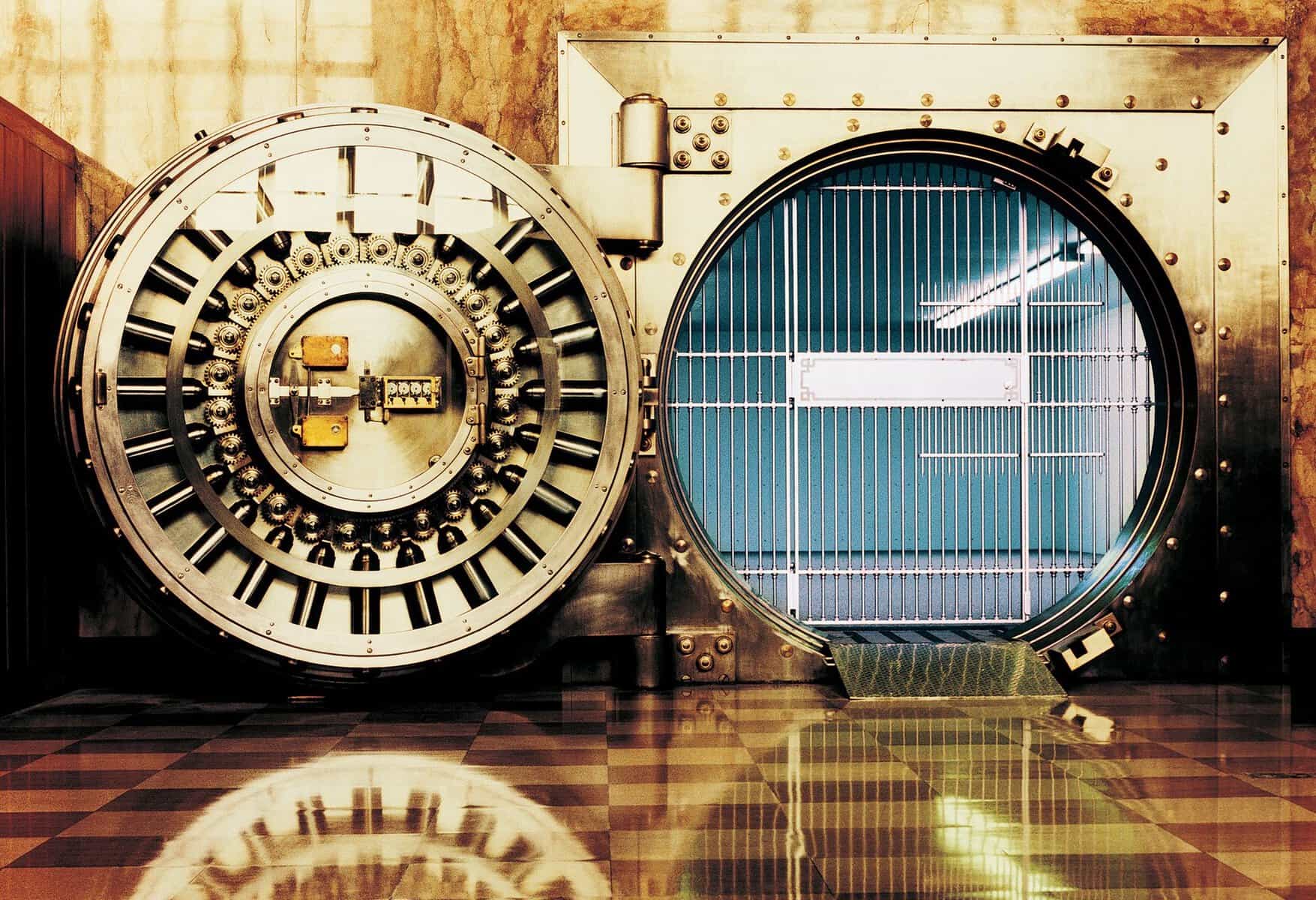

Bank of Montreal: A dividend grower to hold for the long run

Enter shares of Bank of Montreal (TSX:BMO), which looks like a profit-taking candidate after soaring over 37% in the past year or 55% in the last two years. The dividend yield (3.38%) isn’t as large as it once was, and the valuation seems to be getting frothy, at least when you look at the 17.3 times trailing P/E multiple.

That said, I think the path ahead could continue to reward shareholders. Of course, ringing the register might be a good idea if you’re running on a tight budget. But, either way, I see BMO’s growth path south of the border as a reason to pay at a high, even if the yield is on the low end, while the P/E is on the high end.

In short, the bank isn’t just expanding in the U.S.; it’s also seeking to defensify in higher-growth regions (think California). Add the recent closure of low-traffic branches at home into the equation, and it’s clear BMO has an appetite for efficiency gains. As BMO also adapts AI, my bet is that the bank will get a huge efficiency boost in the coming years as automation paves the way for juicier margins.

In short, BMO is pricier than it was a year ago. But it deserves to be, and I think there’s another good year of gains to come.

The post Revealed: Here’s the Only Canadian Stock I’d Refuse to Sell appeared first on The Motley Fool Canada.

Should you invest $1,000 in Bank Of Montreal right now?

Before you buy stock in Bank Of Montreal, consider this:

The Motley Fool Canada team has identified what they believe are the top 10 TSX stocks for 2026⦠and Bank Of Montreal wasnât one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 … if you invested $1,000 in the âeBay of Latin Americaâ at the time of our recommendation, youâd have $21,827.88!*

Now, it’s worth noting Stock Advisor Canada’s total average return is 102%* – a market-crushing outperformance compared to 81%* for the S&P/TSX Composite Index. Don’t miss out on our top 10 stocks, available when you join our mailing list!

Get the 10 stocks instantly #start_btn6 { background: #0e6d04 none repeat scroll 0 0; color: #fff; font-size: 1.2em; font-family: 'Montserrat', sans-serif; font-weight: 600; height: auto; line-height: 1.2em; margin: 30px 0; max-width: 350px; text-align: center; width: auto; box-shadow: 0 1px 0 rgba(0, 0, 0, 0.5), 0 1px 0 #fff inset, 0 0 2px rgba(0, 0, 0, 0.2); border-radius: 5px; } #start_btn6 a { color: #fff; display: block; padding: 20px; padding-right:1em; padding-left:1em; } #start_btn6 a:hover { background: #FFE300 none repeat scroll 0 0; color: #000; } @media (max-width: 480px) { div#start_btn6 { font-size:1.1em; max-width: 320px;} } margin_bottom_5 { margin-bottom:5px; } margin_top_10 { margin-top:10px; }* Returns as of January 15th, 2026

More reading

- The 3 Best Canadian Stocks to Buy With $1,000 Right Now

- 1 Single Stock That Iâd Hold Forever in a TFSA

- 3 Blue-Chip Dividend Stocks for Canadian Investors

- 4 Dividend Stocks to Double Up on Right Now

- Your First Canadian Stocks: How New Investors Can Start Strong in 2026

Fool contributor Joey Frenette has positions in Bank Of Montreal. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Related Articles

A Safe 4.5% Yield? Here’s What I’d Look for

A 4.5% yield sounds great, but Chemtrade’s real appeal is the cash coverage behi...

The Dividend Stock I’d Buy for RRSP Season

RRSP season is a good time to look for tax-sheltered income, but LIF’s dividend...

How to Turn the 2026 TFSA Contribution Into $150,000 (or More)

Want to turn $7,000 into $150,000 or more? Look for these types of stocks, put t...

A Perfect TFSA Stock: A 6.5% Yield With Constant Paycheques

I love this TSX oil & gas royalty as a high-yield passive income stock. The...