Senate GOP Drops New Crypto Bill Draft As Odds of Passing Stagnate

Alex Smith

2 weeks ago

The Senate Agriculture Committee released on Wednesday an updated draft of the crypto market structure bill, which builds on the CLARITY Act passed by the House and referred to the Senate in July 2025. The bill seeks to establish a U.S. regulatory framework for digital assets and define clear roles for the Security Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) in regulating digital securities and commodities.

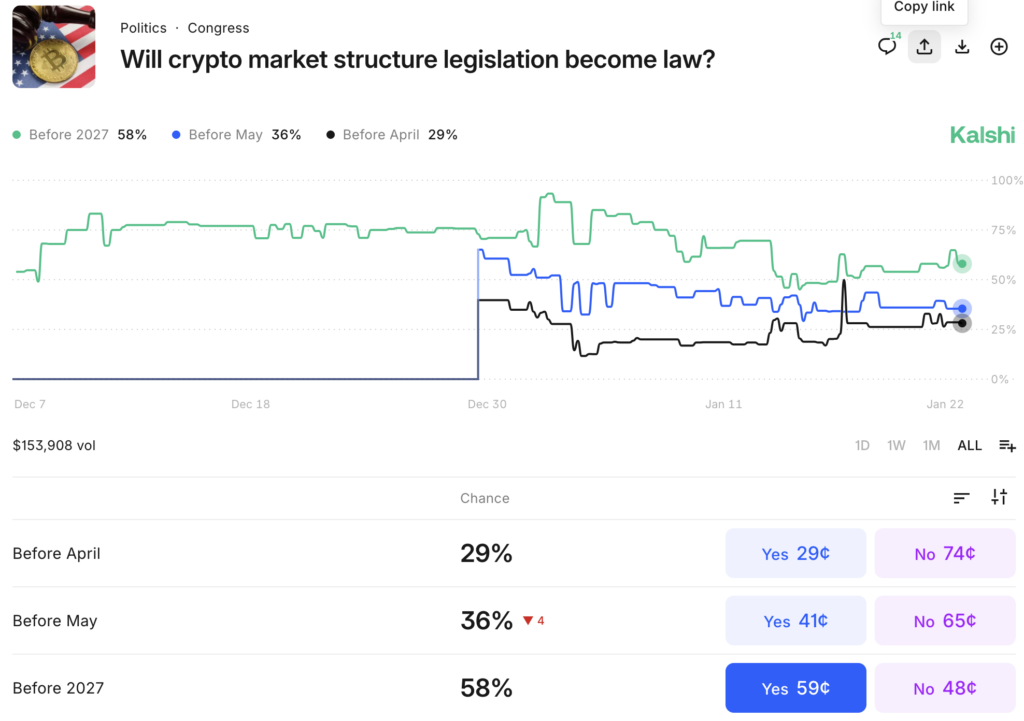

The landmark crypto bill has a 59% chance of passing before the end of 2026, according to current prediction market projections. The odds were around 70% on Jan. 13, but promptly began dropping as key crypto support waned and doubt crept in. Unlike the previous version, the new draft comes only from Republicans only, but that should not dampen the bill’s potential for bipartisan support, according to Patrick Witt, the Executive Director of the President’s Council of Advisors for Digital Assets.

The newly released Senate Ag market structure bill is a quality bipartisan product that deserves the support of the entire committee at Tuesday’s markup.

— Patrick Witt (@patrickjwitt) January 22, 2026

The text is +80% similar to House CLARITY—a bill that got the support of 17/24 Democrats in the Ag committee and nearly 40%…

Senate Agriculture Committee Chairman John Boozman (R-AR) said in the release announcement:

“I appreciate Senator Booker and his staff for working with us and providing thoughtful additions as we advance consumer protections and provide new authority to the CFTC. While differences remain on fundamental policy issues, this bill builds on our bipartisan discussion draft while incorporating input from stakeholders and represents months of work. Although it’s unfortunate that we couldn’t reach an agreement, I am grateful for the collaboration that has made this legislation better. It’s time we move this bill, and I look forward to the markup next week.”

So, what will the bill actually mean for the future of crypto, DeFi and event trading? That part is still to be determined, and currently lies in the hands of Senate members and key stakeholders across crypto and finance. While a new markup meeting is scheduled for Jan. 27, many hurdles remain as urgency ramps up among DeFi enthusiasts.

How Republican-only version impacts crypto bill’s odds

The bill was originally developed through bipartisan negotiations between Boozman and Senator Cory Booker (D-NJ). The bipartisan draft version reflected months of negotiations, incorporating agreed-upon policies and unresolved issues marked in brackets. The markup session for the previous draft was canceled last week when key stakeholder Coinbase CEO Brian Armstrong said his company “can’t support the bill as written.”

The bill went back to the drawing room, and Senate committee republicans emerged with a new partisan draft. Boozman said in Wednesday’s news release that the two sides couldn’t bridge “fundamental policy issues.”

The Senate requires 60 votes to overcome a filibuster and advance legislation to a floor vote. With Republicans holding a slim majority, a Republican-only bill could face a harder path to becoming law. However, the odds for a bill passing by the end of the year remain just better than a coinflip, with some fluctuation — to be expected considering an apparent lack of consensus on the bill text. Next week’s markup and responses could bring more market confidence in one direction or the other.

Adding to the complication of getting a bill to the finish line is the fact that the crypto market structure bill is being handled by two separate Senate committees, Banking (overseeing SEC jurisdiction) and Agriculture (overseeing CFTC jurisdiction). After each Committee completes its markup of their portions, the two drafts will need to be merged into a single bill before a unified version can move to the Senate floor for a vote.

The Senate Banking Committee has its own draft bill language to mark up, covering issues related to securities law under the Banking Committee’s jurisdiction. The committee’s chair Tim Scott said on X following the pause on the last markup, “Everyone remains at the table working in good faith.”

I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith.

— Senator Tim Scott (@SenatorTimScott) January 15, 2026

As we take a brief pause before moving to a markup, this market structure bill reflects months of…

Stablecoin yield sticking point

A major sticking point so far between the central banks and crypto sector has been the treatment of stablecoin yield in the bill, which falls under the Senate Banking committee’s portion of the Clarity Act bill language. Armstrong took issue with the previous draft version, saying there were “Draft amendments that would kill rewards on stablecoins, allowing banks to ban their competition.”

Meanwhile, other crypto-centric Kraken, a16z, and Ripple continued to support moving forward on the bill. White House AI & Crypto Czar David Sacks didn’t mince words when he told CNBC he wants a bill to move forward.

“I’m in favor of facilitating a compromise so we can get a bill on the President’s desk,” said Sacks.

Traditional banks see authorized stablecoin yield as an existential threat to their industry. But Sacks pointed out that the already-passed GENIUS Act already includes yield for stablecoins.

“I think the banks have to recognize that yield is already a feature of the GENIUS Act that passed and was signed into law in August,” said Sacks. “…I understand their point of view, but again, if there’s no deal, then they’re going to lose on this issue.”

Urgency to pass crypto market structure bill

With so many individuals and organizations with a lot at stake, industries and stakeholders remain divided on support. But there is palpable urgency among the majority of crypto stakeholders, and understandably so, considering the size of the unregulated crypto industry combined with the current pro-crypto administration.

As Patrick Witt said on X after the last markup delay:

“Do we take advantage of the opportunity to pass a bill now, with a pro-crypto President, control of Congress, excellent regulators at the SEC and CFTC to write the rules, and a healthy industry? Or do we fumble the ball and allow Dems to write punitive legislation in the wake of a future financial crisis à la Dodd-Frank?

“You might not love every part of the CLARITY Act, but I can guarantee you’ll hate a future Dem version even more. Let’s keep working to improve the product, recognizing that compromises will need to be made in order to get 60 votes in the Senate, but let’s not let perfect be the enemy of the good.”

Compromise will clearly be key for getting a bill through, but powerful forces could certainly prevent it from passing this year. Will the banks — or when will the banks — get behind a version of the Clarity Act, might be the real question. For now, let’s take a look at what is in the revised version of the Senate Agriculture Committee draft released this week.

Key components of the current Clarity Act bill draft

Based on the full bill text from the Senate Agriculture Committee, there are a number of key components, some of which are more contentious than others.

1. Who gets to regulate crypto (CFTC gets the big role)

The bill gives the CFTC “exclusive jurisdiction” over digital commodity spot markets, meaning Bitcoin, Ethereum, and other crypto that qualify as “digital commodities” would be regulated by the CFTC, not the SEC. This is a massive shift from the current regulatory gray zone.

2. What counts as a “digital commodity”

The bill defines a digital commodity as “any fungible digital asset that can be exclusively possessed and transferred, person to person, without necessary reliance on an intermediary, and is recorded on a blockchain.”

What’s excluded:

- Securities (still SEC territory)

- Permitted payment stablecoins (covered separately under GENIUS Act)

- Bank deposits

- Commodities derivatives

- Pooled investment vehicles (like crypto ETFs)

- NFTs and collectibles (unless mass-minted and traded speculatively)

Notably included: The bill explicitly includes “meme coins”—defined as “a digital asset inspired by an internet meme, character, current event, or trend for which the promoter seeks to attract an enthusiastic online community to purchase and engage in trading of the digital asset primarily for speculative purposes.”

3. New registration requirements for crypto businesses

The bill creates three new registration categories:

- Digital commodity exchanges – Trading platforms offering spot markets in digital commodities

- Digital commodity brokers – Entities that solicit or accept orders from retail customers

- Digital commodity dealers – Entities that buy/sell directly with retail customers off-exchange

These entities must register with the CFTC within 90 days of the registration process being established.

4. DeFi gets special treatment

The bill carves out protections for truly decentralized systems:

A “decentralized finance trading protocol” is defined as a blockchain system where:

- Transactions execute via automated, predetermined algorithms

- No one maintains custody or control of user assets

- No single person or group can materially alter the system’s functionality

- No one can unilaterally restrict or censor users

The key protection: If a protocol meets this definition, it’s exempt from the exchange registration requirements.

5. Customer protection requirements

Exchanges must:

- Segregate customer funds (cannot commingle with company money)

- Hold customer crypto with a “qualified digital asset custodian”

- Disclose information about listed tokens including source code, transaction history, tokenomics, trading volume, and material risks

- Maintain financial resources exceeding one year of operating costs plus all customer obligations

6. Prohibition on self-dealing (with exceptions)

Exchanges and their affiliates generally cannot trade against their own customers. However, exceptions exist for:

- Transactions at customer direction

- Liquidity provision (with policies to limit this to reasonably expected demand)

- Risk-hedging activities

7. Listing standards for tokens

To list a token, exchanges must verify that:

- The digital commodity is “not readily susceptible to manipulation”

- Required disclosures have been filed with the SEC (or equivalent public information exists)

- Information about the token is “correct, current, and available to the public”

Next steps for crypto bill legislation

If the current bill passes, it would generally take effect 18 months after enactment. An expedited registration process must be established within 180 days and registered entities get a “provisional status” period to come into full compliance. But before that, the bill will need to get through the following steps:

- January 27: Senate Agriculture Committee markup vote

- Parallel track: The Senate Banking Committee still needs to mark up its portion (covering SEC jurisdiction issues including stablecoin yield)

- Reconciliation: The two committee bills must be merged

- Senate floor vote: Requires 60 votes unless Republicans use reconciliation (unlikely for this legislation)

- House reconciliation: Must be harmonized with the House-passed CLARITY Act

While the Clarity Act’s passage still has several hurdles to cross, its chances will hinge on garnering enough support to get a palatable version to the Senate floor, and get the necessary votes there. You can bet that prediction market traders are watching closely, and trading along as developments unfold.

The post Senate GOP Drops New Crypto Bill Draft As Odds of Passing Stagnate appeared first on DeFi Rate.

Related Articles

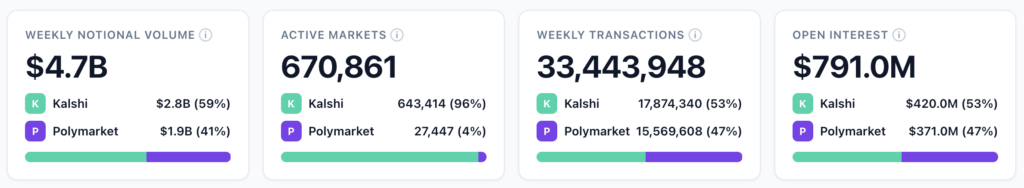

Super Bowl Fuels Kalshi to Record $2.8B Week as Prediction Markets Hold Near $6.3B

Kalshi hit a record $2.80B week with the Super Bowl surge as Polymarket slipped...

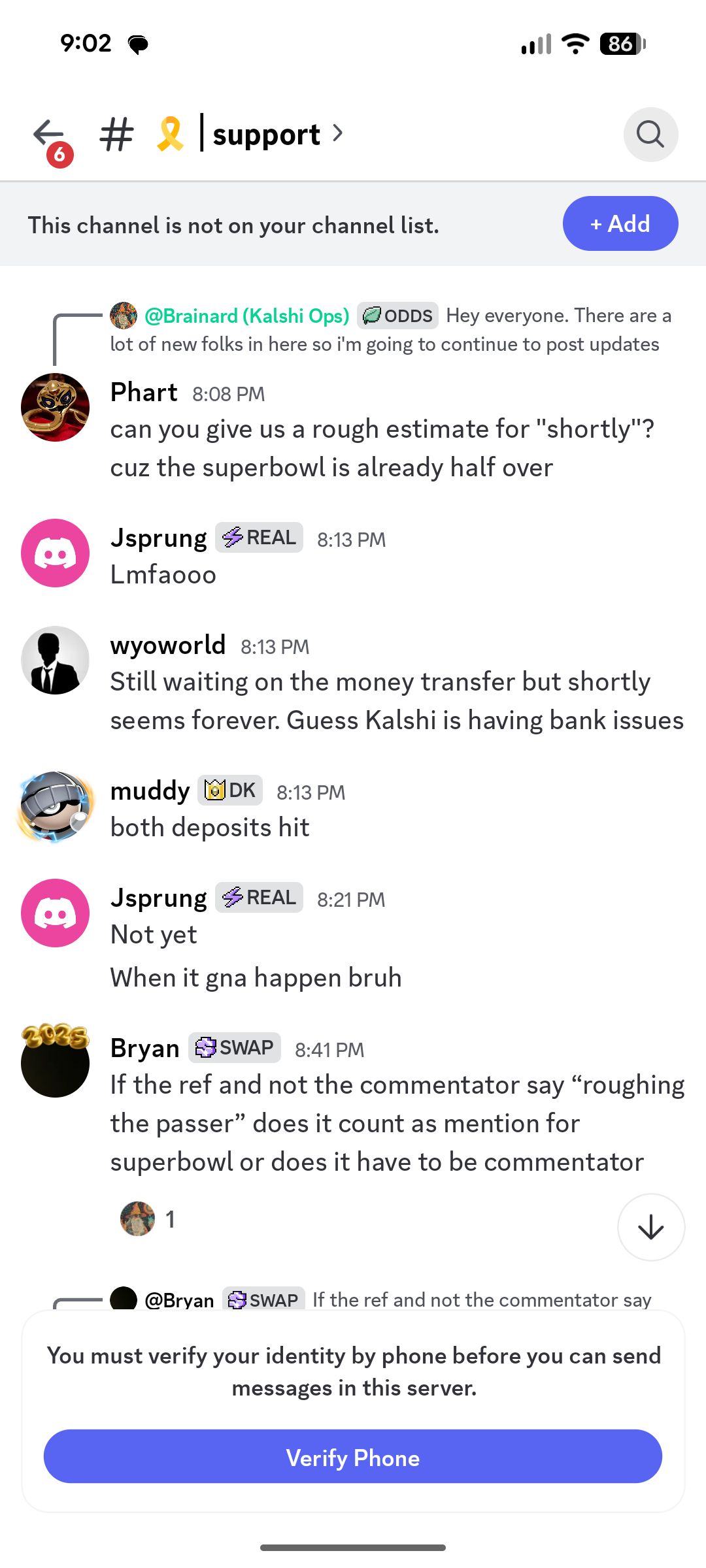

Kalshi Experiences Significant Point of Failure During Super Bowl

Kalshi’s payment infrastructure became a significant point of failure toni...

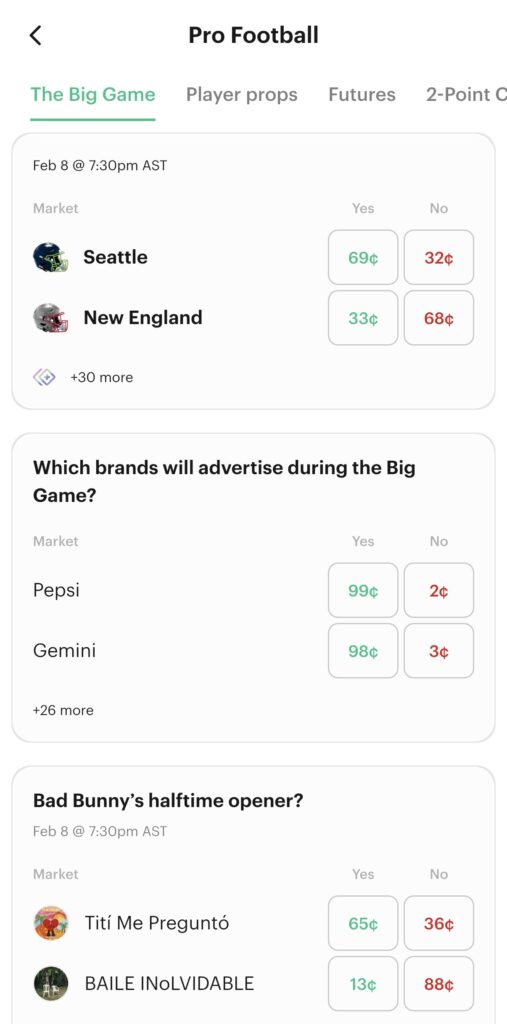

How to Bet on Super Bowl LX in California: Best Prediction Market Apps Compared

California has no legal sports betting, but 12+ prediction market apps offer leg...

Super Bowl Betting 2026 at Prediction Markets: All States Including California & Texas

Prediction markets are letting more people than ever put money on Super Bowl out...