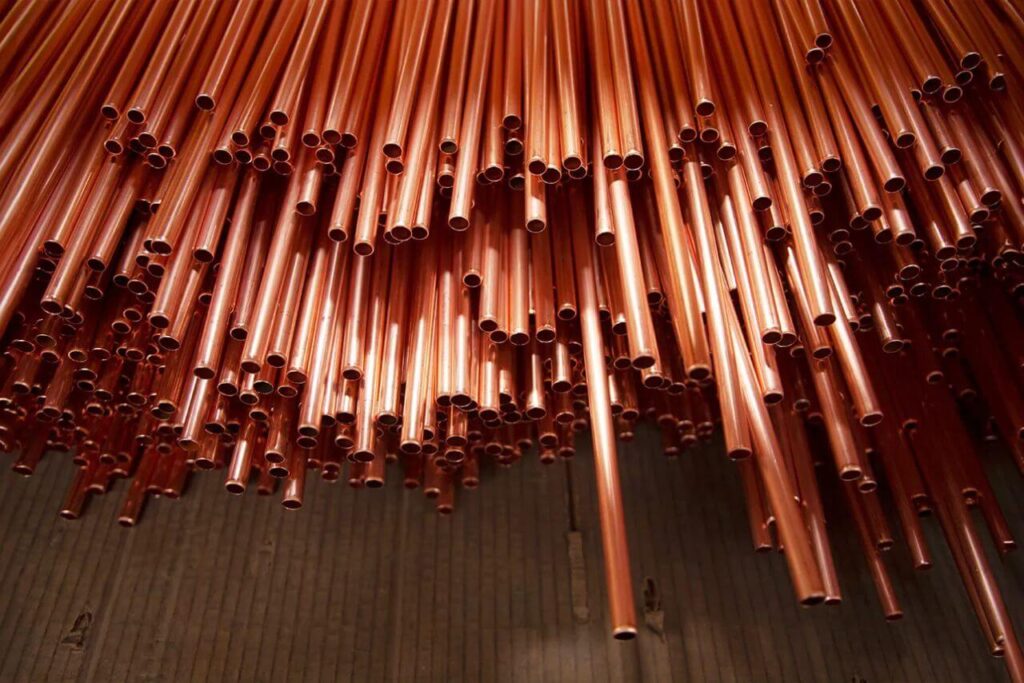

Stock in Focus After Securing PLI Approval for Manufacturing Copper Tubes; Check Details

Alex Smith

1 week ago

Synopsis: Kiri Industries shares rose 2% as its subsidiary Indo Asia Copper Limited (IACL) has received approval under the PLI Scheme for producing copper tubes for air conditioners, and issued a Letter of Intent for a hybrid wind-solar power project in Gujarat.

The shares of the Small-Cap company specialising in the manufacturing and exporting of a wide range of dyes, dye intermediates, and basic chemicals, are in focus upon securing an upon securing an Production Linked Incentive (PLI) approval for White Goods Manufacturing.

With a market capitalization of Rs. 2,797.95 Crores on Thursday, the shares of Kiri Industries Limited rose upto 1.8 percent, reaching a high of Rs. 484.60 from its opening price of Rs. 475.70.

What Happened

Kiri Industries Limited’s subsidiary Indo Asia Copper Limited (“IACL”) has received approval under the Production Linked Incentive (PLI) Scheme for White Goods (Air Conditioners and LED Lights) from IFCI Limited on behalf of DPIIT, Ministry of Commerce & Industry.

The approval covers Air Conditioners – High Value Intermediaries, with eligible products being Copper Tubes (Plain and/or Grooved), under the Normal Investment category, with a committed investment of Rs. 258.97 Crore.

Incentives under the Scheme, up to 4% of net sales, are subject to meeting prescribed investment and sales thresholds and verification by the competent authority. IACL will comply with all applicable Scheme conditions and statutory requirements within the prescribed timelines.

Along with it, the company has also issued a Letter of Intent (LOI) for the installation of a Hybrid Power Project at the Kamlapur site in Rajkot, Gujarat. The project, involving IB Vogt Solar India Private Limited and Four-Square Green Energy Private Limited, will combine 9.45 MW of wind and 8 MW of solar capacity. The total estimated cost is ~Rs. 101 crores, with commissioning expected within 10 months.

The project aims to optimize energy costs for the Company’s manufacturing facilities and contribute to sustainability by reducing the carbon footprint. It also aligns with the Company’s Environmental, Social, and Governance (ESG) objectives.

Financials & Others

The company’s revenue rose by 23.38 percent from Rs. 173 crore in September 2024 to Rs. 213 crore in September 2025. Meanwhile, the Net profit declined from Rs. 80 crore to Rs. 20 crore during the same period.

The company has a decent return on capital employed (ROCE) of 10.5% and a return on equity (ROE) of 8.56%, indicating solid profitability. With a debt-to-equity ratio of 0.37, the company maintains a relatively low level of leverage. Additionally, the stock is trading at 0.88 times its book value, suggesting it is undervalued relative to its net assets.

Kiri Industries Ltd (KIL), established in 1998 in Ahmedabad, is a leading, fully integrated manufacturer and exporter of a wide range of dyes, dye intermediates, and basic chemicals in India. With a strong presence in the textile industry, it operates state-of-the-art manufacturing facilities in Gujarat, offering products like reactive, acid, and direct dyes.

KIL to offer Internationally recognized quality products and services, and is an accredited and certified Key Business Partner with the world’s top Dyestuff majors across Asia-Pacific, the EU and the Americas.

Disclaimer: The views and investment tips expressed by investment experts/broking houses/rating agencies on tradebrains.in are their own, and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must therefore exercise due caution while investing or trading in stocks. Trade Brains Technologies Private Limited or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing.

The post Stock in Focus After Securing PLI Approval for Manufacturing Copper Tubes; Check Details appeared first on Trade Brains.

Related Articles

Minda Corp: Can Exports, EV Components & Acquisitions Drive Massive Revenue Growth?

Synopsis: Auto ancillary firm with a market cap of Rs. 14,179 cr, targets Rs. 17...

Tata Motors CV Vs Ashok Leyland: How did these commercial vehicle companies perform in Q3?

SYNOPSIS: Commercial vehicle demand strengthened in Q3 FY26, supporting revenue...

Nikhil Kamath Portfolio: How Did Nazara Tech and 2 Other Stocks Perform in Q3?

Synopsis: Nikhil Kamath’s Q3 portfolio comprises three key listed holdings, Naza...

Stock To Buy: CDMO Stock With 40% Upside and Strong Growth Momentum

Synopsis:- ICICI Direct maintains a Buy with ₹1,310 target, implying 38% upside....