Trump DOJ Threatens Fed Chair Powell But Markets Forecast Stability

Alex Smith

3 weeks ago

Federal Reserve Chair Jerome H. Powell broke the news on Sunday night that President Donald Trump’s Department of Justice had served the Federal Reserve with grand jury subpoenas while threatening a criminal indictment.

“This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings,” said Powell. “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Powell’s message insinuated that President Trump wanted the rates to go lower, likely in hopes of spurring growth and investment during the lagging economy. The 2025 government shutdown delayed the release of the October and November jobs reports. When it finally arrived in mid-December, U.S. payrolls showed they only rose 64,000 in November after losing 105,000 jobs in October. December’s job report brought mixed but overall positive implications, increasing confidence in interest rates remaining steady, at least for now.

The various developments have sparked odds movement and trading activity across prediction markets, as traders interpreted what to make of Trump’s actions, Powell’s words and the latest economic data.

Powell out as Fed Chair and related markets move

The “Powell out as Fed Chair” market, which opened on Kalshi on Oct. 30, has already generated over $8.3 million in trading volume. While this market was relatively slow to react, the odds for “Before May 2026” more than doubled from 6.3% to 14.1% on Jan. 12, but is currently trading around 9% (9¢) as of Jan. 14.

A Kalshi market that asks “Jerome Powell out as Fed Governor before August 2026?” has also shown volatility since Powell’s public announcement, which included the statement:

“Public service sometimes requires standing firm in the face of threats. I will continue to do the job the Senate confirmed me to do, with integrity and a commitment to serving the American people.”

The odds of Powell leaving his Fed Governor position early (by the end of July) dropped from 83.4% on Sunday evening down to 48.6% on Monday before trading at around 61% on Wednesday.

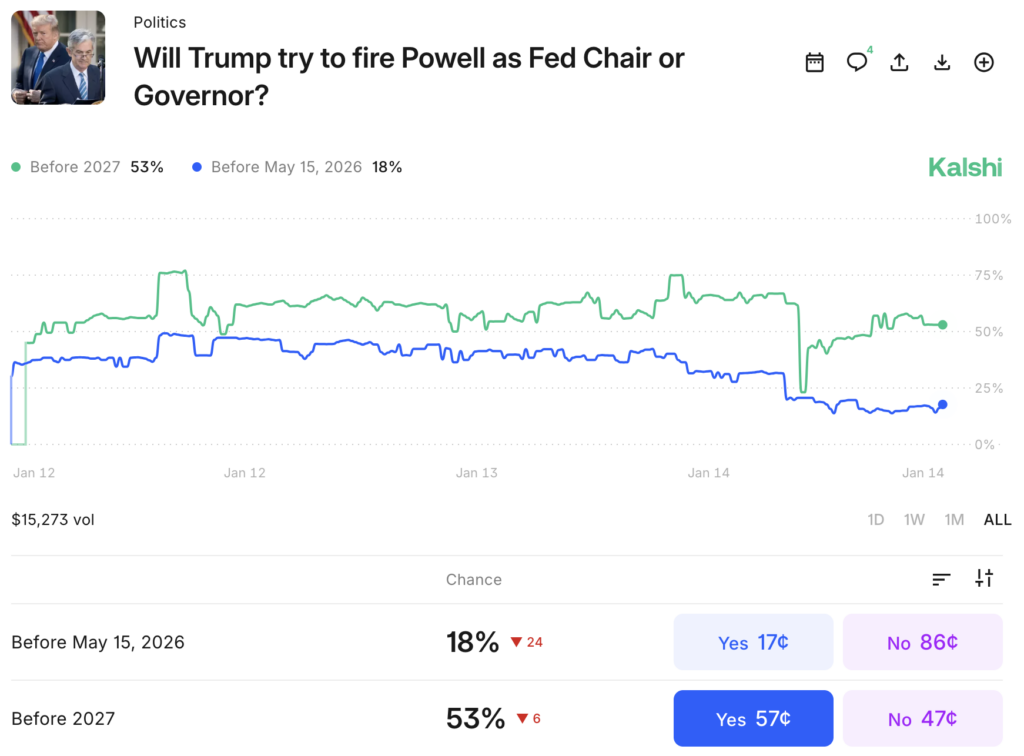

A new Kalshi market that opened on Jan. 12 asks “Will Trump try to fire Powell as Fed Chair or Governor?” With only around $15,000 traded so far, the odds for “Before 2027” are around 53% (57¢) with an 18% (17¢) for before May 15.

Another newer market with low volume so far asks if Trump will sue Powell before his term ends. Those odds spiked to 55% just after Powell’s statement but have slid to around 16% over the last few days.

Polymarket global traders also think there’s a small chance that Powell will be federally charged by June 30, with current odds at 12% (the market has nearly $93,000 volume). Another Polymarket question with notable volume is “What will Powell say during January Press Conference?” with odds at 84% for him to say the word “Inflation” between 40 and 49 times.

Next fed chair odds steady

Markets on who will be Trump’s nominee as the next fed chair with Powell’s chairman term set to end in May 2026 have been active over the past several months. At present, traders still see it as primarily a two-horse race between Kevin Warsh, a financier and former member of the Federal Reserve Board of Governors, and Kevin Hassett, the Director of the National Economic Council.

Warsh is currently the frontrunner with average odds of 40%, while Hassett is not far behind at odds of 36.5%.

Jobs report a mixed bag

Towards the end of 2025, the Federal Reserve cut interest rates by a quarter of a point, down to 3.5% from 3.75%. Many in the prediction market space banked on the move, despite a slowing market and a cloudy employment forecast.

However, CNBC reported at the start of January that nonfarm payrolls rose a seasonally adjusted 50,000 for the month, which was “lower than the downwardly revised 56,000 in November and short of the Dow Jones estimate for 73,000.” Unemployment dropped to 4.4%, better than the forecasted 4.5% and down from a four-year high of 4.6% in November.

Economists called the jobs report a “mixed bag,” with the U.S. experiencing what Heather Long, chief economist at Navy Federal Credit Union, called “a jobless boom where growth is strong, but hiring is not.”

No rate cut projected for January

Prediction markets also anticipate the fed rate to remain the same in January, with markets now pricing near-certainty on a pause rather than a cut. Major prediction exchanges are currently pricing odds for January’s fed decision as follows (averages):

- Maintain rate (no cut): 95.3%

- 25 basis points decrease: 4.6%

- 25 basis points increase: 0.2%

- More than 25 bps increase: 0.5%

- More than 25 bps decrease: 0.4%

Markets remain cautiously optimistic

Days after Powell shared the news of a threat of criminal indictment, CNN reported that Treasury Secretary Scott Bessent is “unhappy” with the decision to investigate the Fed Reserve’s chair. Bessent is reportedly concerned that the investigation will negatively impact the market, and that firing Powell could cause “volatility.”

Volatility is certainly happening across many fed-related prediction markets, while confidence in fed rates remaining the same in January remains high.

However, the markets have taken these threats with a grain of salt. On the Monday after Powell’s announcement, for example, the Dow Jones closed higher by 86 points, after falling 500 points earlier in the day. And prediction markets are currently expecting Powell to stay put as chair through the end of his term, forecasting just a 9% chance of him exiting before May.

The post Trump DOJ Threatens Fed Chair Powell But Markets Forecast Stability appeared first on DeFi Rate.

Related Articles

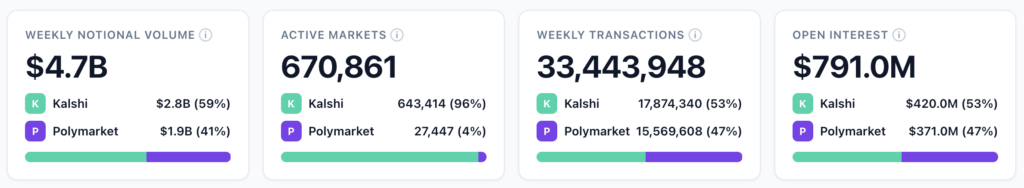

Super Bowl Fuels Kalshi to Record $2.8B Week as Prediction Markets Hold Near $6.3B

Kalshi hit a record $2.80B week with the Super Bowl surge as Polymarket slipped...

Kalshi Experiences Significant Point of Failure During Super Bowl

Kalshi’s payment infrastructure became a significant point of failure toni...

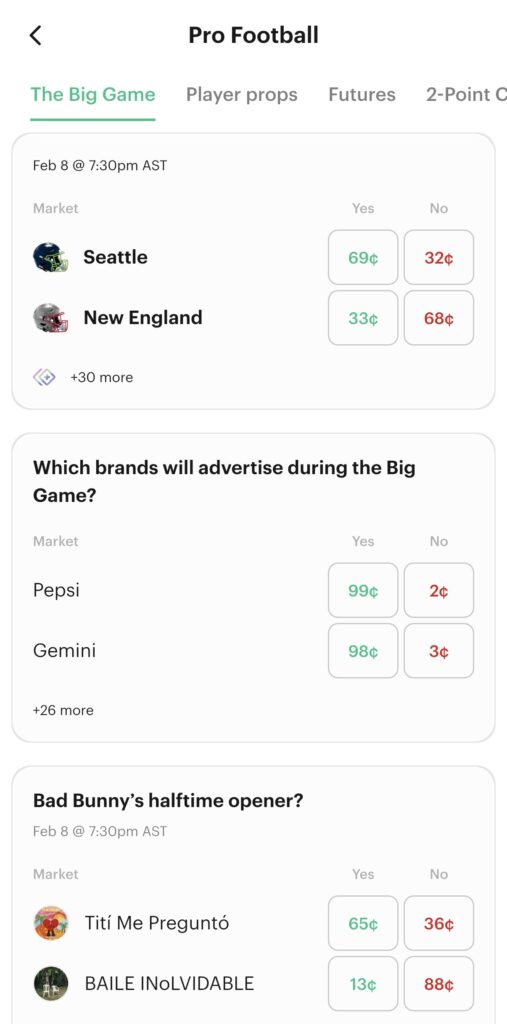

How to Bet on Super Bowl LX in California: Best Prediction Market Apps Compared

California has no legal sports betting, but 12+ prediction market apps offer leg...

Super Bowl Betting 2026 at Prediction Markets: All States Including California & Texas

Prediction markets are letting more people than ever put money on Super Bowl out...