US Spot XRP ETF Inflows Hit A One-Month High: Here Are The Numbers

Alex Smith

1 month ago

US spot XRP exchange-traded funds (ETFs) logged their strongest day of net inflows in more than a month on Jan. 5, as XRP rallied sharply and trading activity accelerated across both the token and the ETF wrapper.

SoSoValue data shows the ETF complex pulled in $46.1 million in net new money on Jan. 5, the seventh-largest inflow day since launch and the biggest since Dec. 3, when daily net inflows reached $50.27 million. The same dataset shows cumulative net inflows rising to $1.23 billion, while total net assets climbed to $1.65 billion, alongside $72.15 million in total value traded.

US Spot XRP ETF Snapshot

The move coincided with a broad jump in XRP itself. The cryptocurrency rose more than 11% over the past 24 hours to around $2.40, lifting its market capitalization above $144.3 billion. Spot trading volume reached $7.32 billion, up 144% over the same period, according to CoinMarketCap data.

Flow leadership on Jan. 5 was distributed across all issuers rather than concentrated in a single product. According to SoSoValue’s market-data table, Bitwise’s XRP product led with $16.61 million in daily net inflows, while Franklin’s XRPZ brought in $12.59 million, Grayscale’s GXRP added $9.89 million, and 21Shares’ TOXR posted $7.01 million.

Measured by total net assets, the issuer leaderboard remained led by Canary’s XRPC at $407.01 million as of Jan. 5, giving it the largest footprint in the US spot XRP ETF cohort despite posting $0.00 in net inflows on the day.

21Shares’ TOXR follows with $324.39 million, narrowly ahead of Bitwise’s XRP at $322.85 million. Franklin’s XRPZ ranked fourth at $298.38 million, while Grayscale’s GXRP was close behind at $294.35 million, showing how tightly clustered the mid-pack has become even as XRPC maintains a clear lead at the top.

While the inflow tally was the headline, secondary metrics suggested the day was not simply a passive allocation event. Several products printed sizable on-venue value traded, including XRPZ at $27.98 million and Bitwise’s XRP at $23.06 million, pointing to active participation rather than slow, incremental creation activity.

Notably, Jan. 5’s $46.1 million haul was notable, but it was still only the seventh-largest single-day inflow since the US spot XRP ETF cohort launched. The biggest subscription days were clustered earlier in the product’s life, when headline inflows regularly printed above current levels, making Monday’s figure less about a new peak and more about a clear re-acceleration after a quieter stretch through late December, and the strongest day since Dec. 3’s $50.27 million.

At press time, XRP traded at $2.33.

Related Articles

3 Major Cardano Announcements Just Landed: The Breakdown

Three Cardano ecosystem announcements landed onstage at Consensus Hong Kong yest...

Denmark’s Largest Bank Adds Bitcoin, Ethereum ETPs, But Warns Of ‘High Risk’

Danske Bank has started offering Bitcoin and Ethereum ETPs to customers for the...

BlockFills Freezes Client Funds — Is Another Crypto Crisis Unfolding?

BlockFills, a Chicago‑based cryptocurrency trading and lending firm that caters...

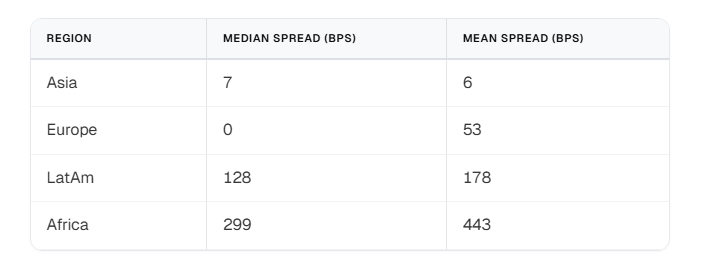

Stablecoins See Largest Conversion Spreads In Africa, Research Shows

Africa’s promise of cheaper remittances via stablecoins is clashing with reality...