Volume Report: Kalshi, Polymarket Post Record Volume Driven by Sports

Alex Smith

4 weeks ago

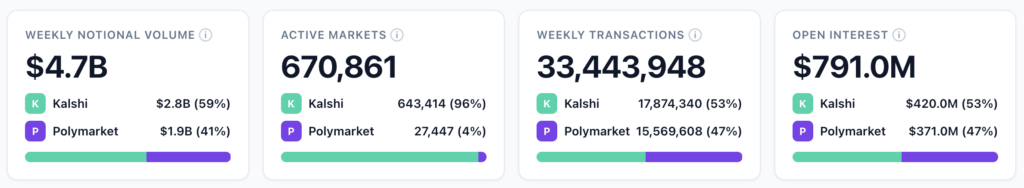

In the first full week of the new year, Kalshi and Polymarket both posted yet another weekly notional volume record, largely driven by a busy week of primetime football, with Kalshi maintaining its recent lead over Polymarket.

Weekly notional trading volume across major prediction markets totaled approximately $5.23 billion in the week ending Jan. 11, relatively flat (down just 1.6%) week over week from the late-December/early-January holiday peak of $5.32 billion.

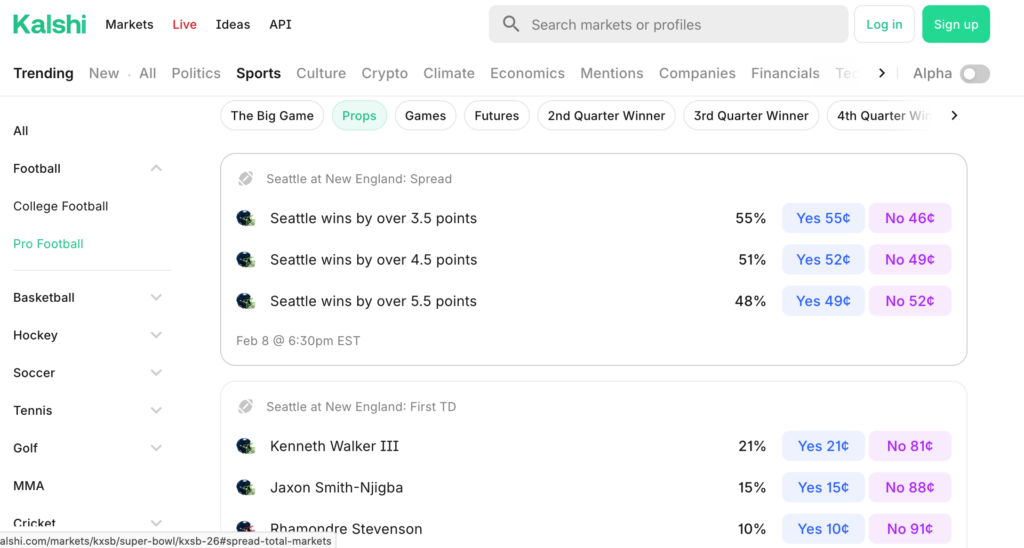

Kalshi’s lead remains category-driven, meaning market share will likely fluctuate largely based on the sports calendar. Sports trading accounted for a whopping 91.1% of Kalshi’s volume (and 39.9% of Polymarket’s) last week. NFL playoffs will mean fewer games each successive week, with each being primetime and driving significantly higher volume than single regular-season games. Expect the overall sports volume to peak with Super Bowl betting (Feb. 8), and pick back up for March Madness in mid-March.

For the week of Jan. 5-11:

- Kalshi notional volume: ~$2.01 billion (+1.7% WoW)

- Polymarket notional volume: ~$1.50 billion (+4.1% WoW)

- Opinion notional volume: ~$1.60 billion (-11.7% WoW)

The data, originating from Dune Data Dashboards and tracked by DeFiRate.com, includes top on-chain platforms as well as the leading CFTC-regulated exchange, Kalshi. Note that not all prediction platforms are currently tracked by Dune.

Major platforms by the numbers (Week ending Jan. 11)

Below is a comparison of the weekly notional volume and transactions across the platforms Dune is tracking.

PlatformNotional Volume ($)WoW ChangeTransactionsWoW ChangeKalshi$2,012,006,5571.7%11,083,63116.6%Opinion$1,597,197,928−11.7%683,346−61.7%Polymarket$1,503,807,6924.1%11,403,09326.8%PredictIt$108,892,16151.8%110,95068.1%Limitless$8,967,549−19.7%154,102−40.8%Myriad$1,845,727−33.8%166,75650.2%Total$5,232,717,614−1.6%23,601,8783.6%Compared with the prior week, Kalshi and Polymarket both notched small increases to post their best respective weeks to date. However, they both showed much larger WoW increases in transactions, indicating an overall trend toward smaller average trade sizes.

- Polymarket: ~11.4 million (+16.6%)

- Kalshi: ~11.1 million (+26.8%)

Polymarket’s lower average trade size (volume per transaction) could reflect, in part, the greater popularity of short-term, fast-settling crypto markets which make up a significant portion of Polymarket’s trading activity and volume.

While Kalshi and Polymarket are showing steady volume patterns, the on-chain platforms are much more volatile from week to week. Opinion, for instance, dropped 11.7% in weekly notional volume, but saw a drop of 61.7% in transactions. The Opinion Labs exchange continues to show a much different pattern compared to its mainstream rivals, with much higher average trades across fewer users overall.

Category data: Sports rule but crypto and politics still strong

The chart below shows market category comparison at Kalshi and Polymarket. Note that the two use slightly different categorical organization, so these aren’t exactly 1:1 comparisons. (For example, Kalshi separates “Mention Markets” into their own category; Polymarket does the same for “Trump Markets.”)

Kalshi top categories (Jan. 5-11)

Sports still dominate at Kalshi, to the tune of 91.1% of total notional volume for the past week. This is no surprise considering a weekend full of primetime NFL games (wildcard weekend) and the college football playoffs semi-final games this past week.

Polymarket top categories (Jan. 5-11)

Polymarket’s volume is far more diversified, with sports, crypto, and politics all clearing meaningful double-digit shares. The standalone “Trump” category alone rivals entire verticals on other platforms. The same category is reflected within “politics” on Kalshi, a category that is clearly more dominant in Polymarket’s overall category mix.

Sports markets rule U.S. prediction markets at least for now

Kalshi’s market share dominance at this point is likely cyclical, based on the sports calendar. But that’s not to say the platform’s other trading categories won’t grow significantly in the coming months, especially as midterm election season ramps up.

Both Kalshi and Polymarket are also likely to continue to show long-term growth across trading topics as prediction markets become embedded even further into mainstream consciousness and news/politics reporting.

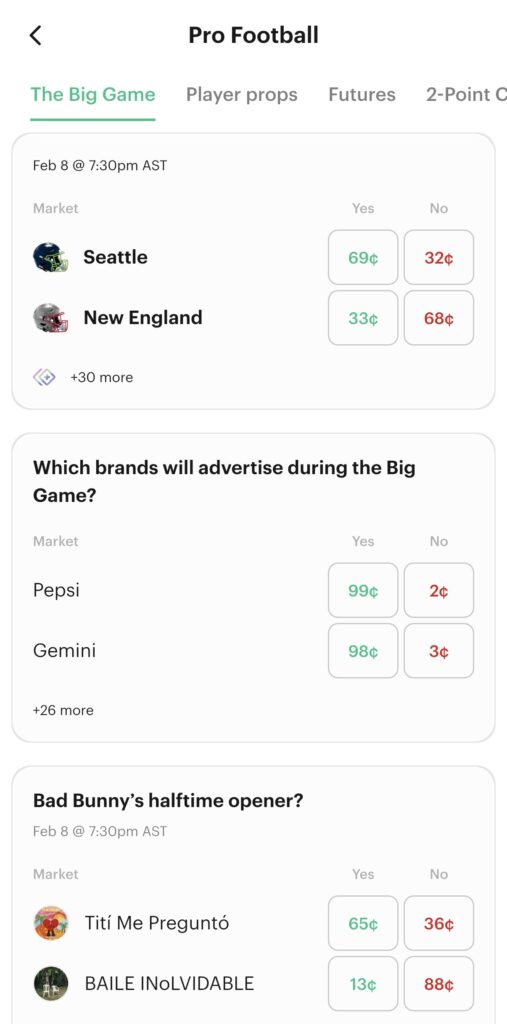

For now, however, volume data trends clearly signal disproportionate reliance on sports markets, particularly among U.S.-based CFTC-regulated exchanges. That includes Polymarket US, which still only offers sports markets, though the site promises “more polymarkets coming soon.”

The post Volume Report: Kalshi, Polymarket Post Record Volume Driven by Sports appeared first on DeFi Rate.

Related Articles

Super Bowl Fuels Kalshi to Record $2.8B Week as Prediction Markets Hold Near $6.3B

Kalshi hit a record $2.80B week with the Super Bowl surge as Polymarket slipped...

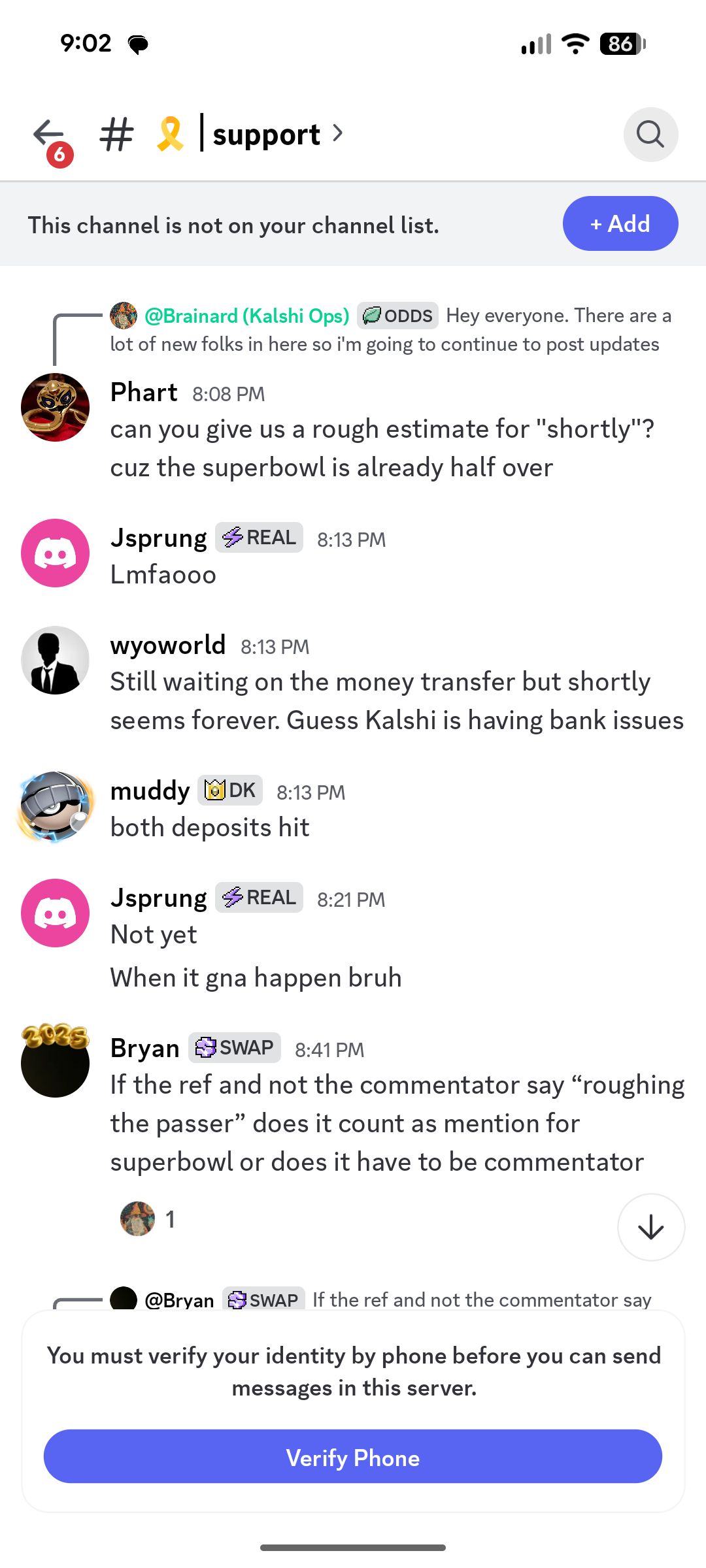

Kalshi Experiences Significant Point of Failure During Super Bowl

Kalshi’s payment infrastructure became a significant point of failure toni...

How to Bet on Super Bowl LX in California: Best Prediction Market Apps Compared

California has no legal sports betting, but 12+ prediction market apps offer leg...

Super Bowl Betting 2026 at Prediction Markets: All States Including California & Texas

Prediction markets are letting more people than ever put money on Super Bowl out...