XRP Forecast Turns Explosive As Canadian Experts Highlight Massive FinTech Utility

Alex Smith

1 month ago

The latest analysis circulating is that the Canadian fintech analysts are becoming increasingly bullish on XRP, pointing to a surge in real-world utility that could reshape the digital payments landscape. The financial institutions have continued to adopt blockchain-based settlement systems. This growing utility has led several Canadian researchers to issue an explosive new forecast.

How XRP’s Real-world Utility Is Expanding Faster Than Market Valuations

Canada’s fintech landscape is shifting, and XRP is rapidly emerging as one of its most influential digital assets. According to a video shared by crypto analyst Skipper_xrp, a Canadian news article highlighted that XRP could become the most compelling fintech play in the entire crypto sector and that it could reach as high as $2,000 by 2027.

It is worth noting that XRP is no longer just a speculative asset in Canada. It’s now being viewed by Canadian analysts and market observers as a tangible fintech tool powering real change in cross-border payment, with a clear path to becoming a cornerstone of modern finance by 2027. The article also predicts that XRP could become the strongest fintech play in crypto.

Skipper_xrp added that RACO, which is known as the beloved raccoon-themed token, has quickly become one of the most talked-about projects and is making a splash on the XRP Ledger. While RACO is gaining traction as more users adopt it for transactions, it is emerging as a standout choice within the XRPL ecosystem. Furthermore, the RACO tokens are now officially available for community members to get early access and be part of the project’s growth.

Why The Financial Institutions Can Now Offer XRP Access With Confidence

In a major regulatory breakthrough of the Ripple Ledger, analyst Skipper_xrp has also stated that the US Office of the Comptroller of the Currency (OCC) has confirmed that the national banks are now legally permitted to conduct riskless principal transactions in crypto-assets. This riskless principal activity will open the door for the token to be used in these regulated operations and give banks a compliant way to facilitate XRP-based trades and payments.

Furthermore, with the OCC’s confirmation, US national banks can now act as intermediaries for XRP transactions in a fully regulated manner without taking any market risk. This makes it easier for institutional and retail clients to access and use XRP through trusted, regulated financial institutions.

According to Skipper_xrp, this ruling provides regulatory clarity and gives XRP a competitive edge in the US market, making it the perfect asset for banks to integrate into their service offerings. Such a move could power increased adoption and liquidity for the asset.

Related Articles

XRP ‘Looks Different’ This Cycle, Targets No. 2 Spot: Crypto Analyst

Crypto Insight UK director Will Taylor argued in a new video that XRP is “tradin...

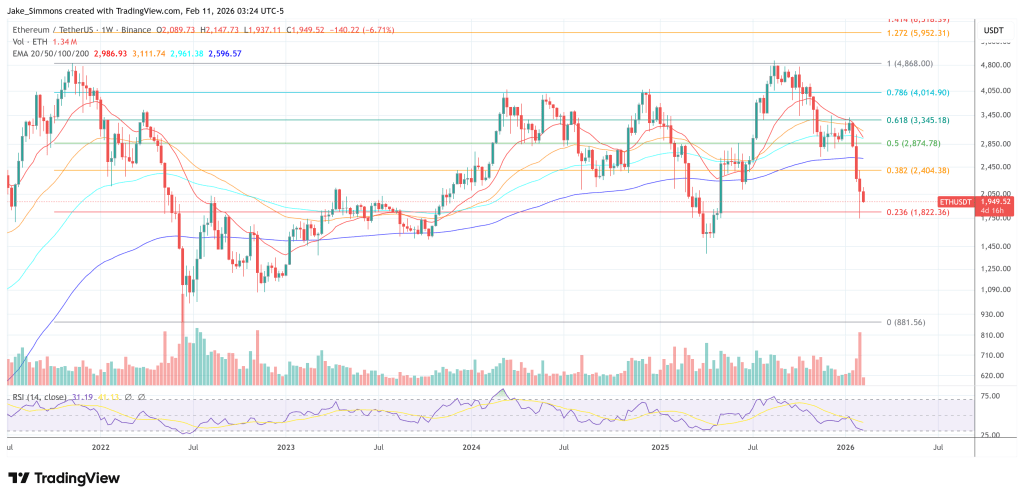

Ethereum ETF ‘Diamond Hands’ Face Their Harshest Test At $2,000

Ethereum ETF investors are sitting on a far uglier entry point than their bitcoi...

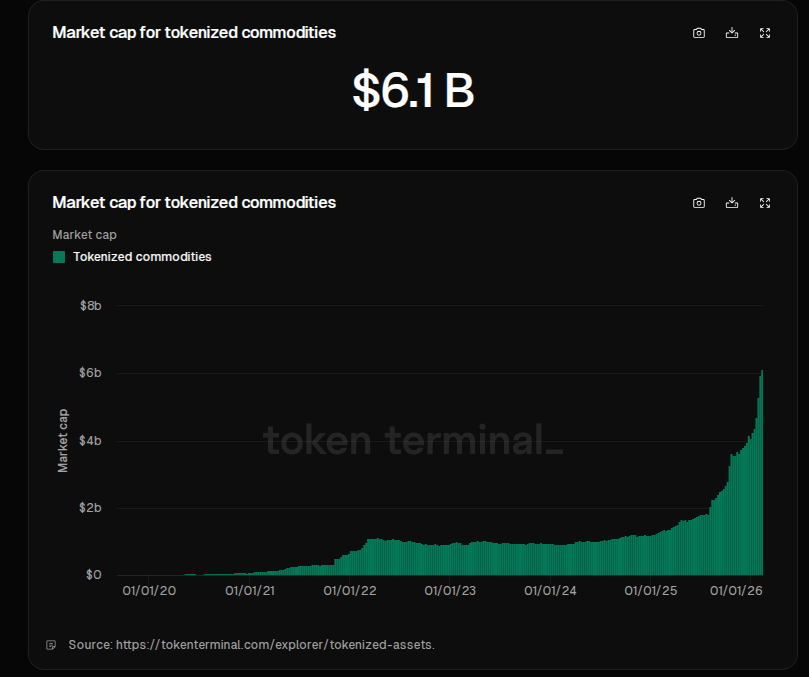

Blockchain Meets Gold: Tokenized Commodities Hit $6 Billion

Markets have put more gold on blockchains, And the shift has been rapid. Reports...

XRP Positioned For Major Structure Shift As Price Tests Critical Level

After recovering from last week’s lows, XRP has been moving sideways, hovering b...