XRP Projected To Reach $8 By 2026: Standard Chartered Identifies Two Major Catalysts

Alex Smith

1 month ago

Despite a mixed performance throughout 2025, XRP has emerged as one of the standout performers in the cryptocurrency market. Currently trading slightly below $1.90, the fifth-largest cryptocurrency has retraced nearly 50% from its all-time highs achieved in July.

Nevertheless, Standard Chartered is optimistic about XRP’s future, forecasting a significant upward trend driven by anticipated inflows into spot exchange-traded funds (ETFs) and increased regulatory clarity.

Spot XRP ETFs Could Drive $4-$8 Billion In Inflows

The bank predicts that the launch of spot XRP ETFs could bring in between $4 billion and $8 billion into XRP throughout 2026. Should these inflows materialize, the resulting demand—coupled with XRP’s relatively limited supply—could catalyze a sharp increase in the coin’s price.

Analyst Geoffrey Kendrick has laid out an ambitious roadmap for XRP’s future, anticipating prices of $8.00 in 2026, and potentially reaching $12.50 by 2028.

To put this into perspective, XRP’s current circulating supply is approximately 57 billion coins. Even modest inflows of a few billion dollars could create a meaningful supply shock in the market.

So far, XRP ETFs have gathered around $1.25 billion. To reach the $8 target, it would require annual flows to hit the range of $5 billion to $10 billion, similar to the initial enthusiasm surrounding Bitcoin ETFs.

Regulatory Resolution As Key Catalyst

A parallel factor influencing XRP’s potential rise is the resolution of regulatory uncertainty surrounding the cryptocurrency. The US Securities and Exchange Commission’s (SEC) long-standing lawsuit against Ripple Labs has significantly impacted XRP’s narrative.

Yet, in August 2025, the SEC withdrew its appeal, resulting in Ripple agreeing to a $125 million settlement and affirming that XRP sales on secondary markets are not classified as securities transactions.

This resolution eliminates a substantial legal burden and is seen by Standard Chartered as a catalyst for increased adoption. With legal uncertainties removed, capital that had been sidelined could finally enter the market.

However, for XRP to achieve a price of $8 by 2026, favorable economic conditions, including low interest rates and a risk-on attitude among investors, would be critical. Should macroeconomic challenges escalate, investors may shy away from altcoins.

Featured image from DALL-E, chart from TradingView.com

Related Articles

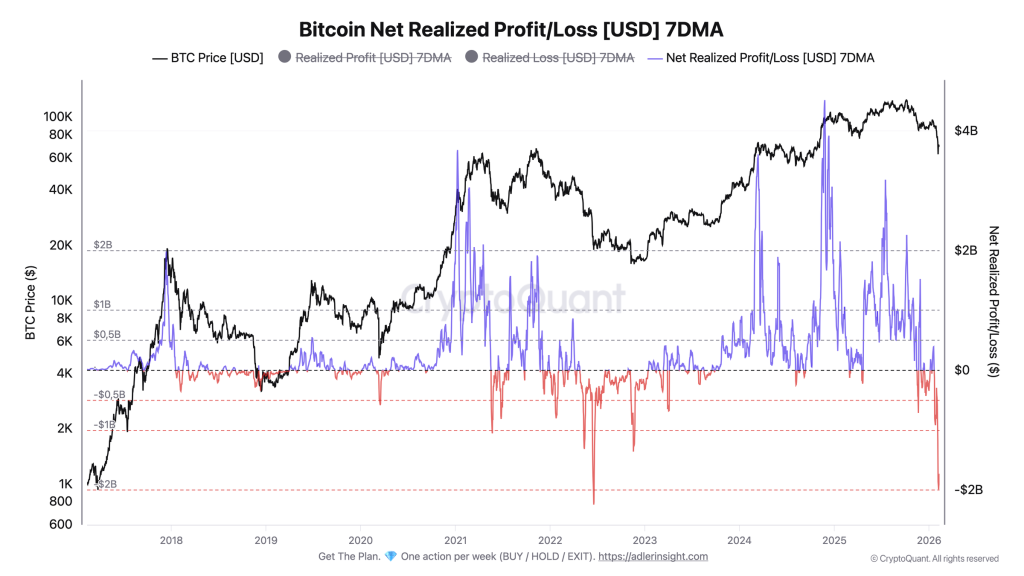

Bitcoin Flashes Luna-Level Capitulation Signal at $67K, Not $19K

Bitcoin is printing on-chain loss-taking on a scale last seen during the Luna/US...

Bitcoin Realized Losses Hit Luna Crash Levels — But Price Context Points To A Different Market Phase

Bitcoin is facing renewed selling pressure after losing the key $70,000 level, a...

XRP Slips 4% Amid Policy Uncertainty, but Analysts Say a Major Move Is Brewing

XRP’s price has drifted lower this week, slipping roughly 4.5% and trading below...

Dogecoin (DOGE) Stumbles Lower, Market Awaits Trend Shift Signal

Dogecoin corrected some gains and traded below $0.0950 against the US Dollar. DO...