Top Stocks to Buy After GST Rate Cut in India – Auto, Cement, Retail & More

3 months ago1. The Deadline Has Been Extended — Again

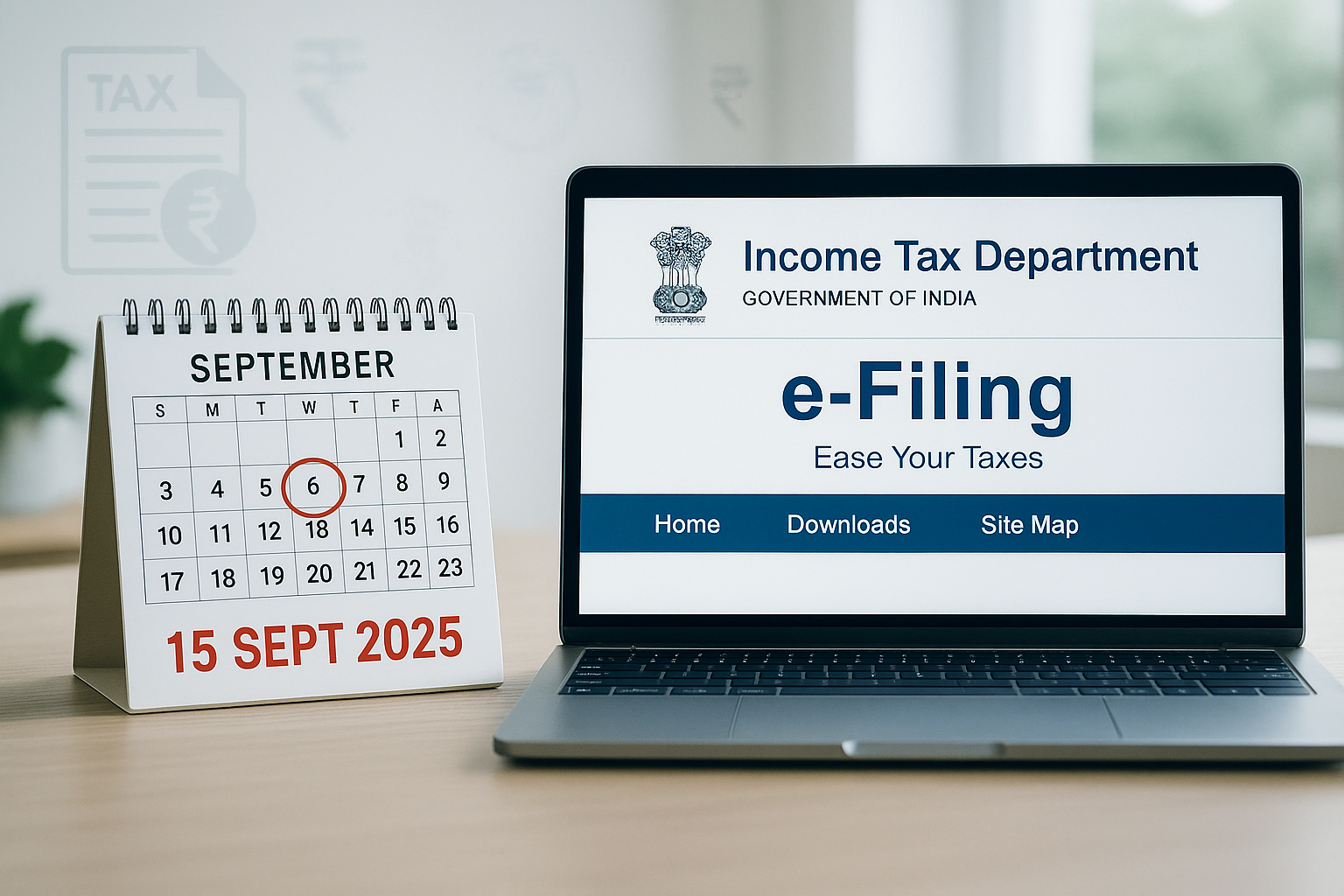

The Central Board of Direct Taxes (CBDT) has extended the due date for filing Income Tax Returns (ITR) for the Financial Year 2024–25 (Assessment Year 2025–26).

-

New deadline for non-audit taxpayers (individuals, HUFs, entities using ITR-1 to ITR-4): 15th September 2025 — previously set for 31st July 2025.

-

This was announced via Circular No. 06/2025, dated 27 May 2025.

2. Who Does This Apply To? What about Audit Cases?

-

The 15 September deadline applies to non-audit cases—meaning taxpayers who do not require tax audits under Section 44AB. This includes:

-

Salaried individuals

-

Pensioners

-

Non-Resident Indians (NRIs)

-

Hindu Undivided Families (HUFs)

-

Small businesses filing using ITR-1 through ITR-4

-

-

If your accounts require an audit (such as businesses under Section 44AB), your due date to file ITR is 31st October 2025.

3. Why Was the Deadline Extended?

Several reasons prompted CBDT to push the deadline:

-

Changes to ITR forms and utilities required updates to the filing system.

-

Delay in release of updated tax forms and technical tools.

-

Ensuring smooth taxpayer experience amid system readiness concerns.

4. Any Plans to Extend Further?

-

As of now, the government has not announced any further extension. Finance Ministry has issued reminders urging taxpayers to file before 15th September

-

Tax professionals and bodies continue to request additional time—some suggesting deadlines like 30th September for non-audit cases and 15th December for audit cases—but no formal extension has been granted yet.

5. Penalties, Interest & Other Consequences

If you miss the 15 September deadline, here’s what you face:

-

Section 234F penalty:

-

Up to ₹1,000 if total income ≤ ₹5 lakh

-

Up to ₹5,000 if income exceeds ₹5 lakh

-

-

Interest under Section 234A: On tax due, calculated from the original due date.

-

Delayed refunds: Processing can be significantly delayed.

-

Belated Return Window: You can still file a belated ITR until 31st December 2025, but with the above penalties and interest applied.

6. Quick Summary Table

| Category | Original Deadline | Extended Deadline | For Audit Cases | Last Date for Belated Filing |

| Non-Audit Taxpayers | 31 July 2025 | 15 September 2025 | — | 31 December 2025 |

| Audit Cases | — | 31 October 2025 | If audit required | 31 December 2025 |

7. What Should You Do Now?

-

Don’t wait for any further extension—untimely filings incur penalties & delays.

-

Compile your documents:

-

Form 16 / 16A

-

Form 26AS (TDS statements)

-

Interest certificates, bank statements, investment proofs (Section 80, capital gains, etc.)

-

-

Choose the correct ITR form based on your income type and status.

-

Use the official Income Tax e-filing portal to file — or consult a CA if needed.

-

Verify your return promptly (e-verification via Aadhaar OTP, EVC, or sending signed ITR-V).

Final Word

15 September 2025 is your final call to submit your ITR if you're in the non-audit category (ITR-1 to ITR-4). After that, expect penalties, interest, slower refunds, and loss of compliance benefits. If your accounts need auditing, make sure to meet the 31 October 2025 deadline.

1

1

2

2

3

3

4

4

5

5

Leave a Reply