Money Keeps Leaving: Bitcoin ETFs Shed $1.72 Billion In Just 5 Sessions

Alex Smith

2 weeks ago

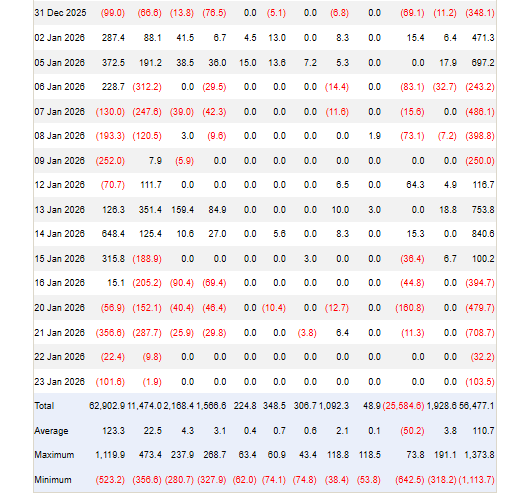

US-based spot Bitcoin exchange-traded funds pulled funds for a fifth straight trading day, and the totals added up quickly. According to Farside data, about $103.5 million left on Friday, bringing the five-day sum to roughly $1.72 billion.

Bitcoin was trading near $89,160 at the time of these reports — still well below the $100,000 mark it last reached on November 13. This movement has sent a clear signal: many investors are stepping back right now.

ETF Flows And Who Is Selling

Reports note that ETF flows are often on the radar as a quick read on investor mood, but the picture is not always simple. Large outflows can reflect institutional rebalancing or tactical moves by funds, not only mass retail selling.

The US market had a four-day trading week because of Martin Luther King Jr. Day on Monday, which may have concentrated trades into fewer sessions and amplified the numbers. Still, losing more than a billion dollars in a few days will get attention.

Market Mood And Metals

The wider mood has soured. The Crypto Fear & Greed Index registered an Extreme Fear score of 25, and sentiment trackers have been flashing caution. Reports say Santiment believes retail traders are pulling back while attention drifts toward more traditional assets.

Meanwhile, metals have been strong. Reports disclose that with gold trading near $5,000 and silver approaching $100, some market players feel Bitcoin has been left out of a rally that lifted metals, which has weighed on confidence in the crypto market.

Bitcoin Price ActionBitcoin has struggled to find a steady rhythm over the past week. Prices slipped below the $89,000 to $90,000 range as traders reacted to fresh geopolitical tension and renewed trade worries, before stabilizing as nerves eased.

This was driven higher after some soft political indicators around tariff threats, only to substantiate the idea that markets rarely react to conflict but rather to changes in tone and expectations.

Signals That Could MatterThese movements illustrate how Bitcoin behaves more like a risk asset rather than an asset shelter, falling in tandem with equities when unexpected financial shocks hit the globe, before rebounding when the fever subsides to gather fresh buyers.

Current price patterns indicate caution, where traders are weighing short-term political risks against medium- and long-term macro patterns, as well as institutional interests.

There are some quieter indications that the rout could be losing steam. To this effect, there are assertions suggesting that supply distribution on-chain and social chatter can be circumstantial evidence showing there is less selling pressure.

Featured image from Money; Shutterstock, chart from TradingView

Related Articles

How Much Would You Have If You Put $500 In Bitcoin In 2014 Vs. XRP?

XRP and Bitcoin (BTC) were pitted against each other in a recent analysis, with...

Why Bitcoin Can’t Be Explained By A Single Economic Cycle

Bitcoin’s price is often framed as the result of one dominant factor, whether it...

Ethereum Whale Selloff Continues As Supply Share Drops Under 75%

On-chain data shows the Ethereum wallets with more than 1,000 ETH have reduced t...

Analyst Wans XRP Price Could Crash Below $1 If Bitcoin Reaches This Level

Crypto analyst TARA has predicted that the XRP price could still crash below the...