Novig Raises $75M, Positions CFTC-Regulated Exchange as Future of Sports Betting

Alex Smith

2 hours ago

Sports prediction market platform Novig has raised $75 million in Series B funding led by crypto investment firm Pantera Capital, a move that comes as the company pushes toward federal regulatory approval that could allow nationwide operation under financial market oversight rather than state sportsbook licensing or sweepstakes-style operating models.

“Our mission is to democratize and financialize sports markets, and we’re proud of the fact that Novig users are 10 times more likely to win than on traditional sportsbooks,” Novig CEO Jacob Fortinsky said in a news release announcing the funding. “We chose to partner with the best crypto venture firms in the world to further accelerate our plans to make Novig the most efficient and liquid sports prediction market in the world.”

“Others are using prediction market technology to financialize new markets with unproven demand,” Fortinsky added. “We leverage it to fix broken markets where demand already exists.”

The round also included Multicoin Capital, Makers Fund, and Edge Equity, plus returning investors Forerunner, Perceptive Ventures, and NFX. Novig says total capital raised since launch now exceeds $105 million.

Forbes reported the Series B funding valued Novig at roughly $500 million post-money.

Regulatory filing puts Ludlow Exchange at the center of Novig’s expansion plan

Novig’s funding news comes on the heels of a regulatory development that could matter more than the capital itself. As DeFi Rate previously reported, a Novig-linked entity, Ludlow Exchange, recently entered the Commodity Futures Trading Commission (CFTC) portal with an application to become an approved Designated Contract Market, a federal exchange designation that would allow Novig to list event contracts for trading nationwide under CFTC regulation.

“We have submitted our application to the CFTC and are diligently working to make the transition to be available to Americans in every single state,” Fortinsky wrote in a lengthy X post announcing the funding round.

— Jacob Fortinsky (@j__fort) February 18, 2026

Fortinsky has indicated the company hopes that approval could come relatively quickly. He told the Sports Business Journal that Novig plans to phase out its sweepstakes offering and transition to a fully CFTC-regulated prediction market within roughly six months, pending approval. That timeline remains uncertain, but it signals growing confidence inside the company that prediction markets tied to sports events may eventually secure clearer federal footing.

Investors cast sportsbooks as flawed, back exchange-style alternative

Some investors framed their backing of Novig in part as a critique of current sportsbook market structure, arguing prediction markets offer a more efficient alternative.

Pantera has invested widely across the crypto sector, including exchanges like Coinbase, blockchain networks such as Solana, and decentralized finance projects. How that crypto focus ultimately fits with a sports prediction market platform like Novig remains unclear.

Pantera investor Mason Nystrom framed the Novig investment around sports betting market structure.

“Prediction markets have gone mainstream. But we should be honest about why,” Nystrom wrote on X. “Sports betting accounts for the vast majority of prediction market volume, upwards of 90% on some major platforms.”

— Mason Nystrom (@masonnystrom) February 18, 2026

Nystrom argued traditional sportsbooks represent flawed market design.

“All of this effectively amounts to a bad market structure with a heavy tax on participation,” he wrote, adding that prediction markets offer “a peer-to-peer marketplace with global liquidity,” “better odds,” and “a market without exploitative vigs.”

NovigPantera’s involvement, along with backing from other crypto-focused investors like Multicoin Capital, reflects venture interest in exchange-style betting models that more closely resemble financial markets than traditional sportsbooks. Multicoin investment partner Shayon Sengupta echoed that assessment.

“An exchange is, from first principles, a strictly superior market mechanism for sports betting,” Sengupta wrote. “Allowing multiple market makers to face a given taker produces deeper liquidity and tighter spreads across tens of thousands of markets than a single counterparty model.”

An exchange is, from first principles, a strictly superior market mechanism for sports betting. Allowing multiple market makers to face a given taker produces deeper liquidity and tighter spreads across tens of thousands of markets than a single counterparty model (the structure… https://t.co/HW1B9ZELp0

— shayon (@shayonsengupta) February 18, 2026

Prediction markets mark latest regulatory pivot for Novig

Novig’s move into federally-regulated prediction markets would mark another strategic pivot for the company. Novig initially explored operating as a state-licensed, real-money sports betting exchange before switching to a sweepstakes-style model that allowed broader U.S. access without traditional sportsbook licensing. The Ludlow Exchange filing now signals a third phase, as the company seeks a nationwide framework that could offer more regulatory clarity and scalability than either earlier approach.

Like its investors, Novig has framed the federal prediction market push as more than a regulatory workaround, positioning it instead as a structural improvement to sports betting itself. In his announcement post on X, Fortinsky argued that sports prediction markets can better align pricing, liquidity, and incentives than sportsbook models, which typically rely on fixed odds and bookmaker spreads.

“We believe we’re at the beginning of a much larger paradigm shift,” he wrote. “Sports betting and financial markets are converging, and prediction markets are evolving into true trading platforms shaped by the same principles that power modern exchanges: transparency, efficiency, liquidity, and fairness. That’s exactly what the next generation of traders expect, and exactly what Novig was built to deliver from day one.

Fortinsky touts exchange model as scrutiny of sports markets continues

DeFi Rate has reached out to Novig seeking clarification on whether the exchange would expand beyond sports markets into other prediction categories. This story will be updated if the company responds.

A sports-heavy focus carries some risk. Prediction markets tied to sports events have already drawn scrutiny from regulators and gaming stakeholders in several states, raising the possibility that even federally-regulated platforms could face localized restrictions in certain jurisdictions.

Despite those unresolved regulatory questions, Fortinsky argued in his X post announcing the funding that prediction markets offer a better experience for bettors and traders than traditional sportsbooks.

“At Novig, we believe the future of sports betting is trader-first, trusted, and transparent,” Fortinsky wrote. “We believe markets — not casinos — should set prices. And we believe sports prediction markets should be as fair and efficient as any modern financial exchange.”

“Whether you love sports betting or hate it, it’s here to stay. It’s legal, nationwide, and culturally embedded,” he added. “The question isn’t whether the market will exist; it’s whether it will finally work for the people who participate in it.”

The post Novig Raises $75M, Positions CFTC-Regulated Exchange as Future of Sports Betting appeared first on DeFi Rate.

Related Articles

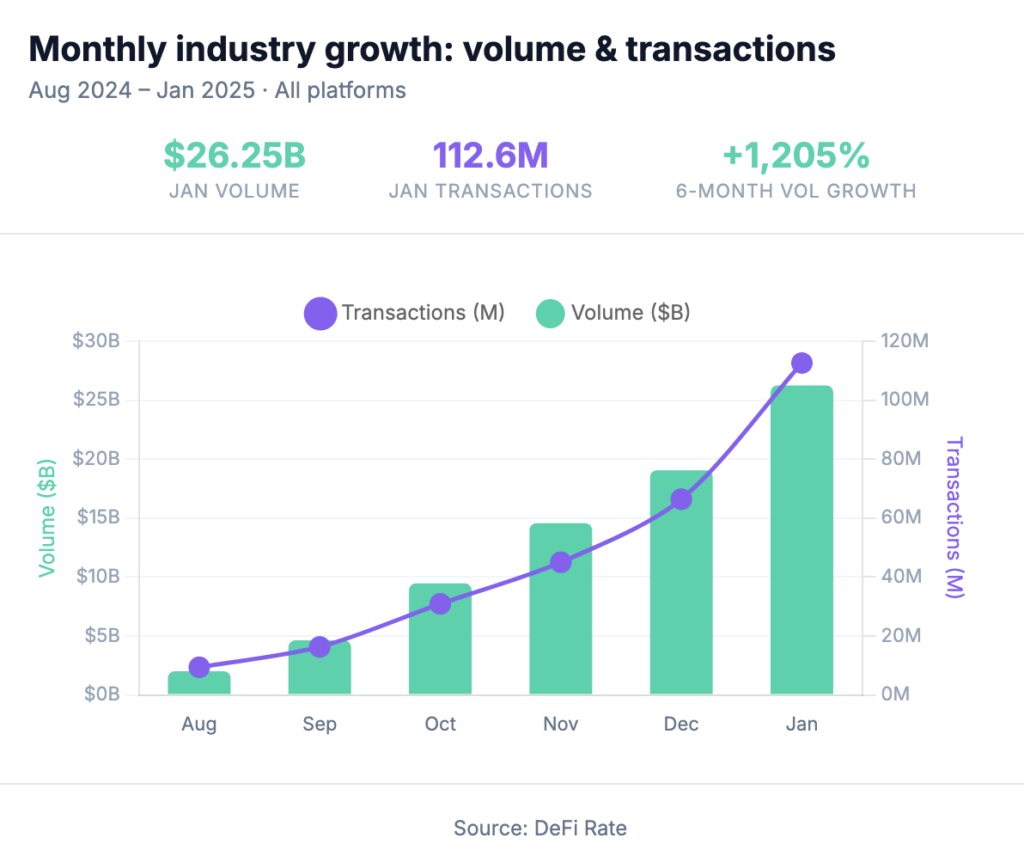

Prediction Markets Cool to $5.3B After Super Bowl Surge as 6-Month Growth Hits 13x

Weekly volume fell 14.8% to $5.3B after Super Bowl Sunday’s $1.34B spike, yet in...

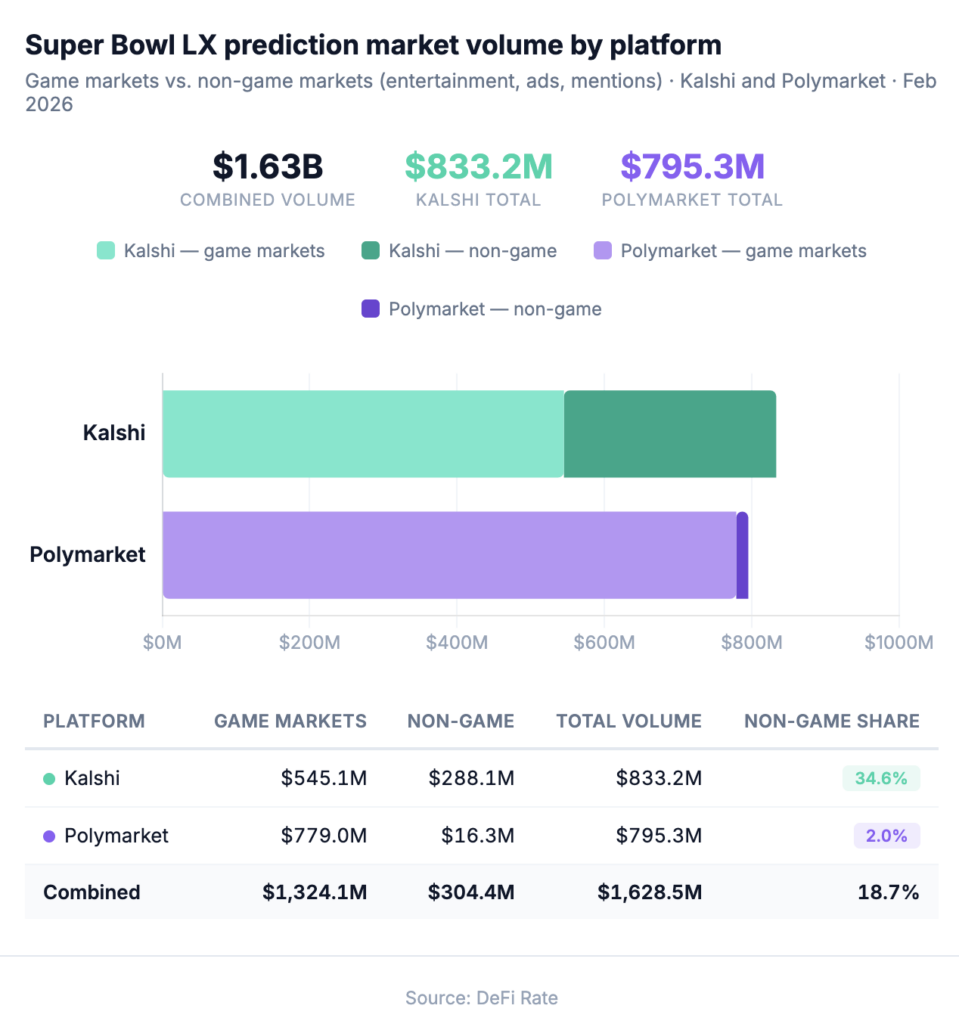

$1.63B in Super Bowl Prediction Market Volume, $304M on Culture: Full Data Breakdown

We tracked $1.63B in Super Bowl prediction market volume across 68+ markets and...

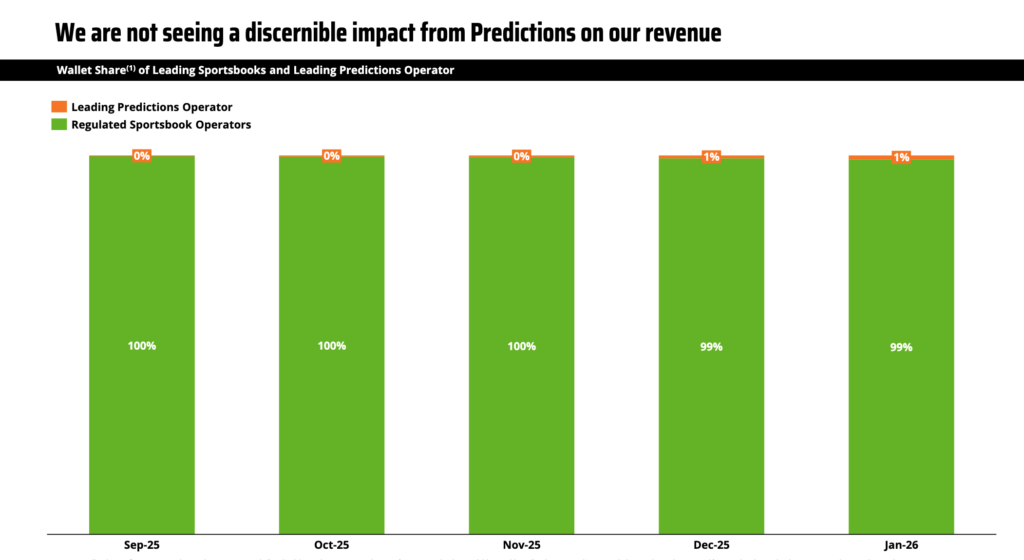

DraftKings Stock Drops 15% on Earnings Miss, Doubles Down on Prediction Markets

In Q4 2025 earnings call, DraftKings CEO confirmed plans to invest heavily in ne...

Rebuilding sUSD

A new path for Synthetix's stablecoinsUSD is the synthetic asset that power...